Psychologist and writer Adam Mastroianni has been trying to figure out why adults have so much trouble making friends and Derek Thompson spoke with him to discuss:

Mastroianni: It seems like the takeaway from this research that has been done over the past 10 years or so is that people are way too negative about their own social abilities and the things that are likely to happen when they talk, especially to someone new. So, for instance, they underestimate how pleasant it’s going to be to talk to someone new. But even afterward, when we ask them, hey, how much did you like that person? They say oh, I like them a lot. And when we ask, how much did they like you? Oh, less than that. I ran one study with some friends of mine where we had people talking groups of three and we’re like, okay, how much did you like them? People would say 5 or 6 out of 7. And how much did they like you? People would say 4 or 5 out of 7. On average, people thought they were the least liked person in the conversation, which obviously can’t be true for each person.

Thompson: We are, on the one hand, the social animal. Yet we delude ourselves about the degree to which we’re a fun hang. We’re the social species and we’re the socially anxious species as well.

Mastroianni: Yeah, well, we’re the ones who care about it the most. And so we have the most to lose. And so we worry about it the most in part in the hopes that maybe it makes us better at doing it. The way I think about it is in our evolutionary history, we lived in groups. But how often did we meet someone who we literally had no connection to before? I can’t imagine it was all that often. But today it can happen literally every day. You get on the bus and it’s full of people that aren’t related to you. You don’t know them. They don’t know you. That’s a really weird thing to do.

____________________________________

Morgan Stanley surveyed all stocks trading on U.S. exchanges over a 40-year period, between 1985 and 2024. They found the median stock experienced a decline of 85% at one point or another. Worse yet, more than half of these stocks never fully recouped their losses. The median stock recovered to just 90% of its prior high-water mark. Among those stocks that were able to reclaim their prior highs, it was a long process—about five years, on average.

Those numbers only apply to the median stock, but suppose you had above-average stock-picking skills. How would things have turned out? If you had the foresight to pick the 20 best performing stocks over that 40-year period, at some point they still would have delivered an average agonizing draw-down of 72%.

It’s hard to remember, but Apple dropped 83% at one point. Nike once lost 66%. Even Nvidia, which was the best performing stock over the past 20 years through 2024, lost more than 90% at one point. And most notably, Amazon was once down 95% from its prior high.

Over the long term, share prices tend to move in tandem with corporate profits. When a company’s earnings increase, often its share price does too. The problem is that prices are only sometimes rational. Very often, stock prices disconnect from corporate earnings, and the gap can be significant.

This was first proven empirically Daniel Kahneman and Amos Tversky. In 1974, they published a paper that found investors exhibit an “availability heuristic.” That is, they tend to rely on the information that is most available. That’s a problem because the information that happens to be most available isn’t necessarily the information that’s the most accurate or even relevant. Often, the information that happens to come to mind is the information that’s most vivid. In other words, extreme information or news becomes most memorable, and thus drives decision-making.

___________________________

ChatGPT users may want to think twice before turning to their AI app for therapy or other kinds of emotional support. Sam Altman, OpenAI’s CEO:

“People talk about the most personal sh** in their lives to ChatGPT. People use it — young people, especially, use it — as a therapist, a life coach; having these relationship problems and [asking] ‘what should I do?’ And right now, if you talk to a therapist or a lawyer or a doctor about those problems, there’s legal privilege for it. There’s doctor-patient confidentiality, there’s legal confidentiality, whatever. And we haven’t figured that out yet for when you talk to ChatGPT. This could create a privacy concern for users in the case of a lawsuit, because OpenAI would be legally required to produce those conversations today.“

_________________________________

The average young person is on course to spend 25 years of their life on their phone. Plus more on other screens. Most of them don’t want to live this way, but feel trapped.

____________________________

_____________________________

How Country Music Took Over the Charts: A Statistical Analysis.

The 1990s were a turning point for country’s mainstream acceptance, driven by two mutually reinforcing phenomena:

- Improved Telecommunication Infrastructure: The Telecommunications Act of 1996 enabled American media companies to consolidate regional stations into national networks, facilitating country radio play outside of rural strongholds. Simultaneously, enhanced geographic radio coverage brought consistent access to under-served rural listeners. Together, these infrastructure improvements fostered a virtuous cycle: greater airplay propelled more country songs onto the charts, which in turn drove even more airplay.

- Country Crossover Successes: Country crossovers like Garth Brooks, Shania Twain, and Tim McGraw blended conventional genre staples with accessible pop and rock influences, broadening the format’s appeal beyond its traditional fanbase.

______________________________________

Something unusual—and incredibly fast—is happening with teenagers running the 100-meter around the world. From Japan to the U.K., young speedsters are posting eye-popping times in track’s most prestigious event. What’s driving these turbocharged athletes who aren’t old enough to vote?

One major cause is the relatively recent arrival of super spike shoes, which has helped lower times across the board. But just as significantly, the line between amateur and pro track athletes is fuzzier than ever. Prodigies are accessing better coaching, and they’re able to sign endorsement deals, which adds a financial incentive to improve.

______________________________________

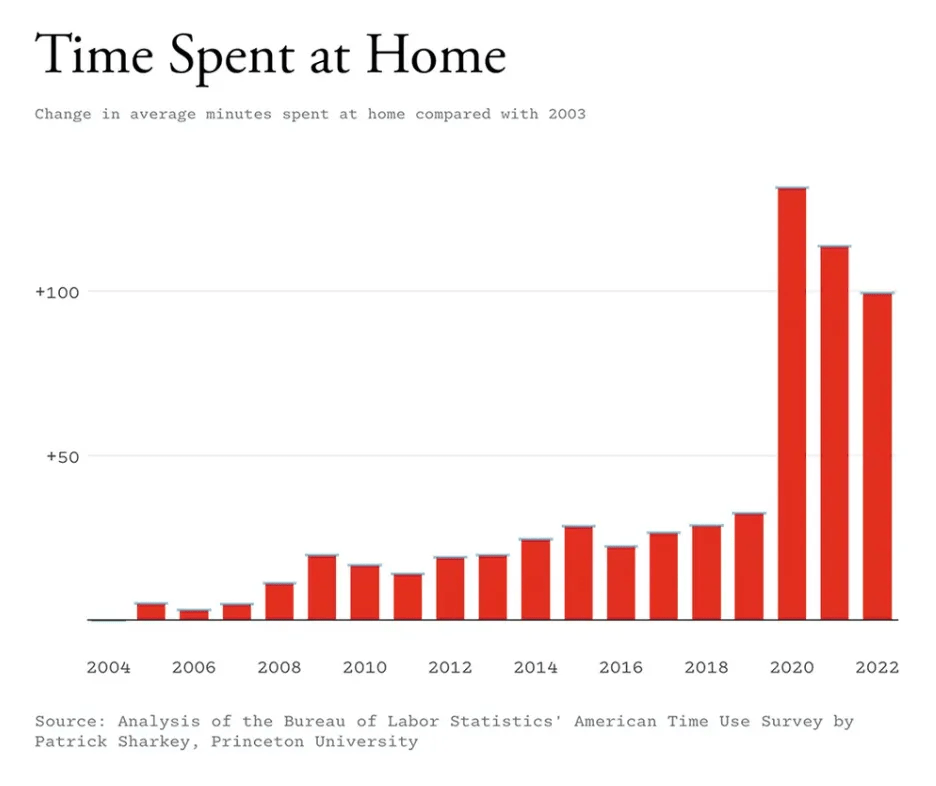

Pretty incredible graph for Americans:

_____________________________

The number of companies listed on U.S. stock exchanges has decreased substantially since its peak in 1996, as it nearly halved to less than 4,700 in 2022. At the same time, the number of U.S. PE-backed

companies grew to over 11,000.

_______________________________

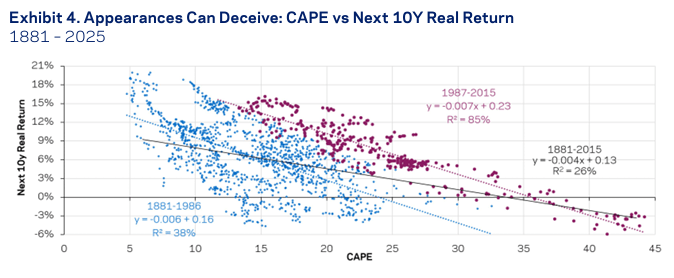

Peter Bernstein liked to say that investors have memory banks: the market returns collectively earned by people of similar age. Experience shapes expectations. The problem is that your memory bank can deceive you in dangerous ways. Your experience of the past is a reasonable guide to the future only if the future turns out to resemble the portion of the past that you’ve lived through. And it often doesn’t. It’s worth looking at a few investing beliefs that your memory bank might hold—and asking whether they’re still valid.

_______________________________

How much longer will emerging markets be undervalued and hated?

________________________________

Nasdaq Price to Earnings valuations are at the very high end of their historical range. That means they are extremely expensive.

______________________________

______________________________

While countries like the United States and India are extremely expensive relative to the rest of the world, the global stock market as a whole has seen its P/E ratio rise dramatically from the early 2010s.

_______________________________

Looking at Enterprise Value (EV) divided by sales, we’re not above the 2000 and 2021 bubble peak for global stocks:

__________________________________