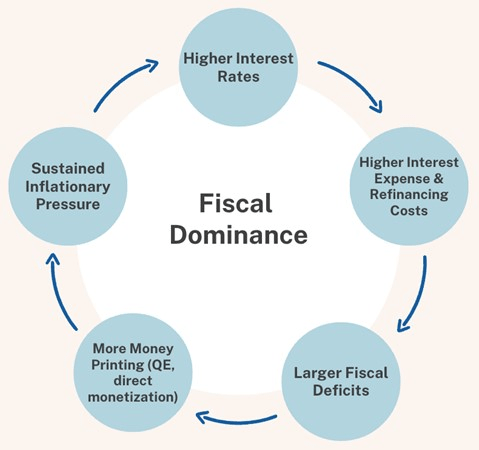

Lyn Alden just released an absolute masterpiece of a newsletter on Fiscal Dominance and the impact it will continue to have on the economy and financial markets moving forward. She walks through:

- What fiscal dominance is and how we got here

- Why government spending is now more important than bank/private sector lending

- Why central bank tools become ineffective at combating inflation in this new environment

- Why DOGE will fail to reach its goals on cutting government spending

- Why the stock market, not labor markets, have become the dominant driver of tax revenues

- What to own/invest in to navigate the through the years ahead

___________________________

A phenomenal Q&A with Russell Napier, market strategist and historian, discussing how the global economy and financial markets will look in the months and years ahead.

___________________________

Forget about making a New Year’s resolution. Have you tried imagining your deathbed? It’s called a Premortem. It’s a habit that began for Ron as a response to the death of his parents in the 1990s. His mother was at peace with herself when she died, he says. But his father was “racked with regret and remorse” about decisions he made and the opportunities he missed. What he took away from their experiences was the last lesson that his parents would teach him—and the most profound of them all. Don’t wait until the end to decide if you are proud of your life. Do it before it’s too late. Do it while you can still do something about it. To him, there is nothing macabre or even remotely depressing about ruminating on death. In fact, he finds it to be oddly inspiring.

______________________________

There’s one particular, very achievable commitment in mind that will help you become happier and improve your health and effectiveness: This year, start getting up early.

- Our brain exhibits greater functional connectivity in the mornings. This, we might assume, facilitates better performance of complex tasks.

- It tends to enable the achievement of other popular goals. The goal-directed brain regions—such as the hippocampus and orbitofrontal cortex—work better at this time than later in the day.

- One habit that is easier to adopt first thing in the morning is exercise. Clear data exist to show that when people intend to exercise early in the day, they are significantly less likely to experience “intention failure” than if they plan to exercise later.

- People who get up early enjoy a more positive mood throughout the day compared with those who rise late.

______________________________

All the major Wall Street brokerage and bank strategists failed to anticipate how well the market would do in 2024. Only part of the problem is that they are bad at predictions; the bigger issue is that they do it all. It’s kinda like Phrenology, the pseudoscience feeling bumps on people’s skull to predict their personality traits. It’s not that there are better or worse phrenologists, but rather, why was anyone doing phrenology? Think about how variable the future is. Random events can and will completely derail the best laid plans we may make. Even the most well-ordered, thoughtful forecasts turn to mush when randomness strikes. And randomness is served up daily.

____________________________________

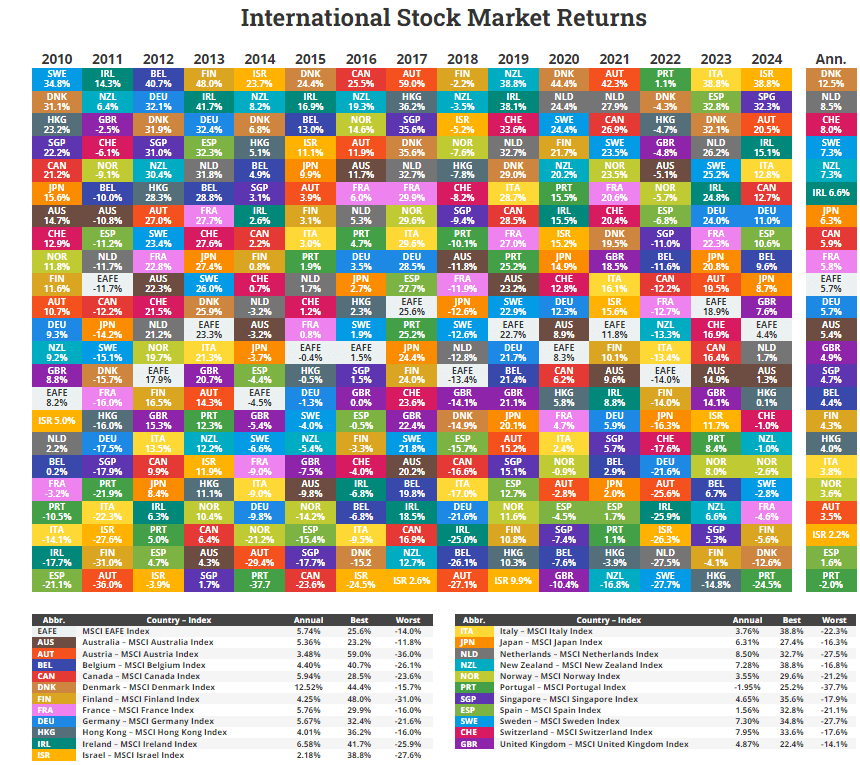

It’s a big world out there. The U.S. makes up a little less than half of the global market cap. By avoiding international stock markets, you cut out half of the investment opportunities. Why limit yourself?

The chart below breaks down the annual performance of developed international stock markets. Each country’s performance seems to bounce around at random year after year, but over the long term those returns smooth out. While it’s difficult to pick the best performing country every year, a diversified global portfolio offers the benefits of international stock market performance which in turn lowers risk.

________________________________

Zooming out to all asset classes, U.S. stocks crushed everything in 2024, as they have for the last 15 years: