William Vanderbilt was the son of the great Cornelius Vanderbilt. When his father died, Cornelius was the richest person on the planet. Billy took his father’s wealth and almost immediately doubled it with some shrewd business maneuvers (in today’s terms, imagine Elon Musk’s son inheriting $500 billion when he dies and then investing it and quickly doubling it to $1 trillion). Being the richest rich person didn’t make William Vanderbilt any happier:

“The sheer magnitude of his fortune, he told Chauncey Depew, gave him no advantages over men of moderate wealth. “I have my house, my pictures and my horses, and so do they. I can have a steam yacht if I want to, but it would give me no pleasure, and I don’t care for it.” On another occasion he spoke of a neighbor saying, “He isn’t worth a hundredth part as much as I am, but he has more of the real pleasures of life than I have. His house is as comfortable as mine, even if it didn’t cost so much; his team is about as good as mine; his opera box is next to mine; his health is better than mine, and he will probably outlive me. And he can trust his friends.”

Being the richest person in the world brought him, he said, nothing but anxiety.

The founder of MVMT recently sold his company for $100 million at age 29. He recently posted on Reddit how two years after selling his company he’s lonelier than ever and deeply depressed. Money dramatically improves everyone’s lives up until the point they can relax and be content. After that, assuming they are in moderately good health, almost all happiness comes internally.

________________________________

The largest medical A.I. randomized controlled trial yet performed, enrolling >100,000 women undergoing mammography screening, was published today. The use of A.I. led to 29% higher detection of cancer, no increase of false positives, and reduced workload compared with radiologists without A.I.

________________________________

The Drug Industry Is Having Its Own DeepSeek Moment. It isn’t just artificial intelligence—Chinese biotechs are now developing drugs faster and cheaper than their U.S. counterparts. Many top scientists trained in the U.S. have returned to China over the past decade, fueling the emergence of biotech hubs around Shanghai. And just as DeepSeek built a formidable chatbot—allegedly on a lean budget with limited access to semiconductors—Chinese biotech companies are also scrappier, capitalizing on a highly skilled, lower-cost workforce that can move faster. Additionally, companies can conduct clinical trials at a fraction of what they would cost in the U.S., while recent changes in the Chinese regulatory system have streamlined and accelerated the approval process to get a study started.

_____________________________

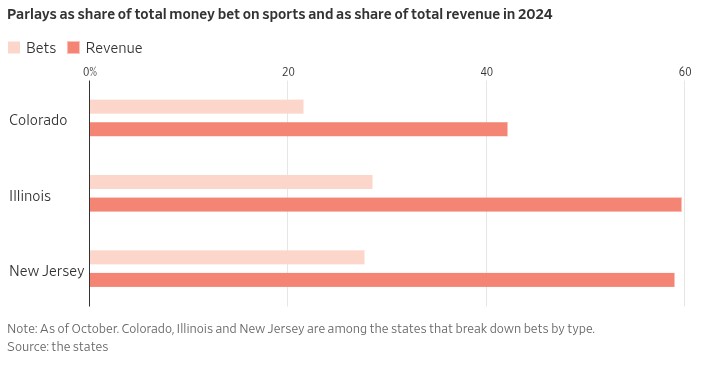

A new study by Stanford University researchers finds that the average online sportsbook customer expects a gain of 0.3 cent for every dollar wagered. In reality, sports bettors lose an average of 7.5 cents per dollar wagered, reflecting widespread overoptimism about financial returns. We found that people more or less understood the amount of money they had lost in the past, but they just thought the future would be better. Parlay bettors do so much worse than single-outcome bettors and are so much more overconfident in their chances that they likely account for most of the excessive optimism in the overall sample.

_______________________________

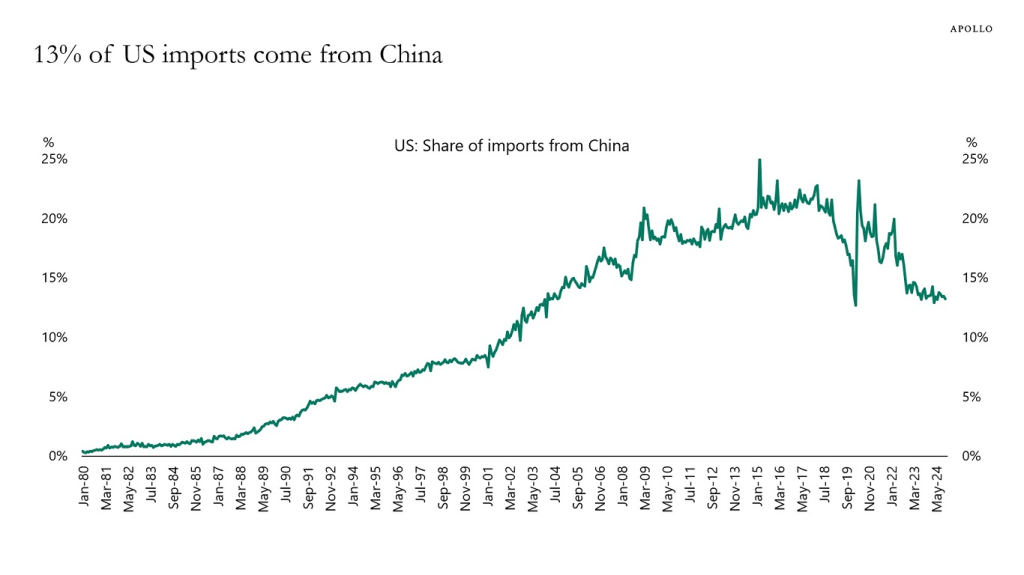

Only 13% of U.S. imports come from China:

_____________________________

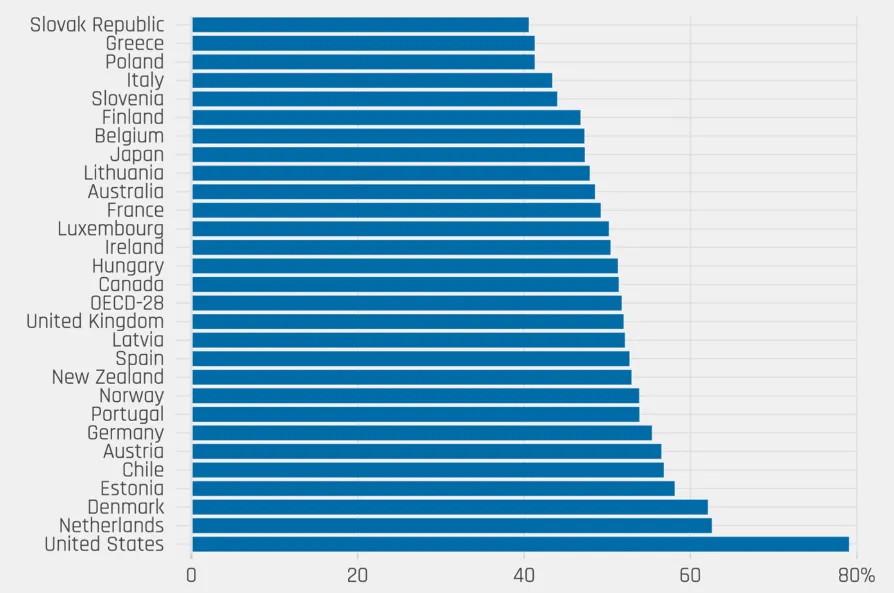

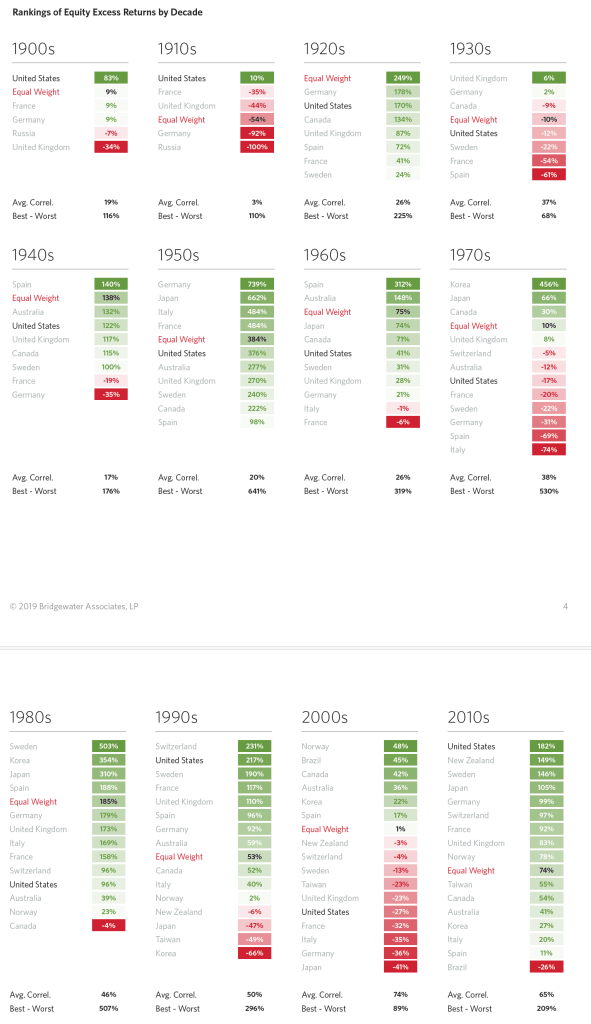

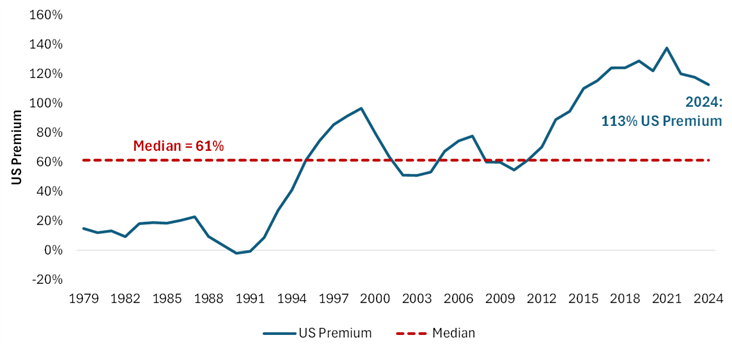

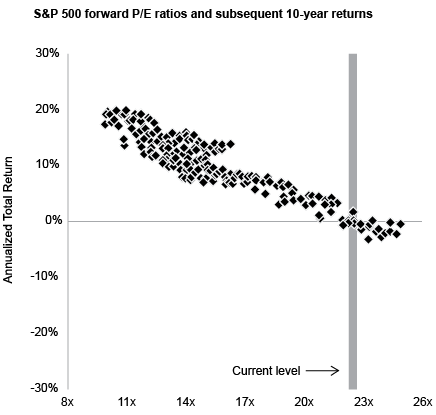

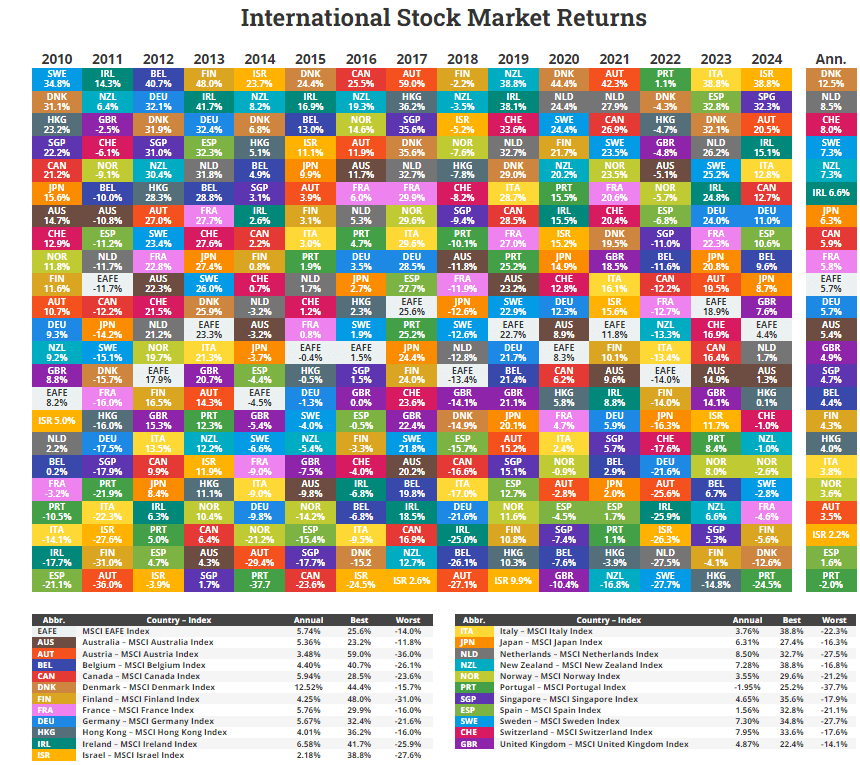

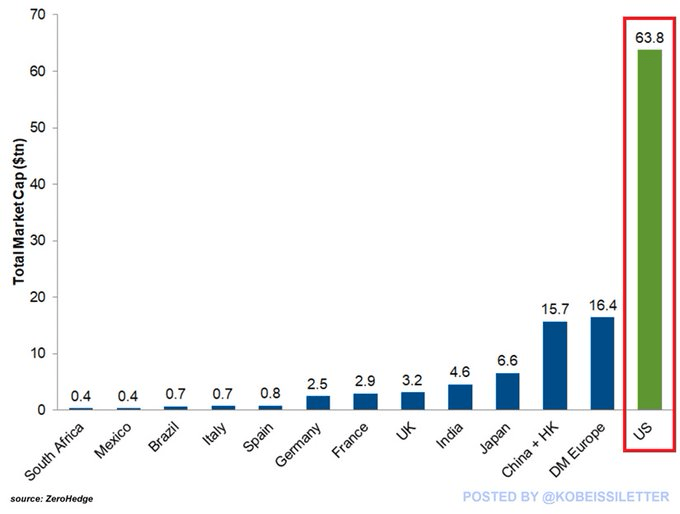

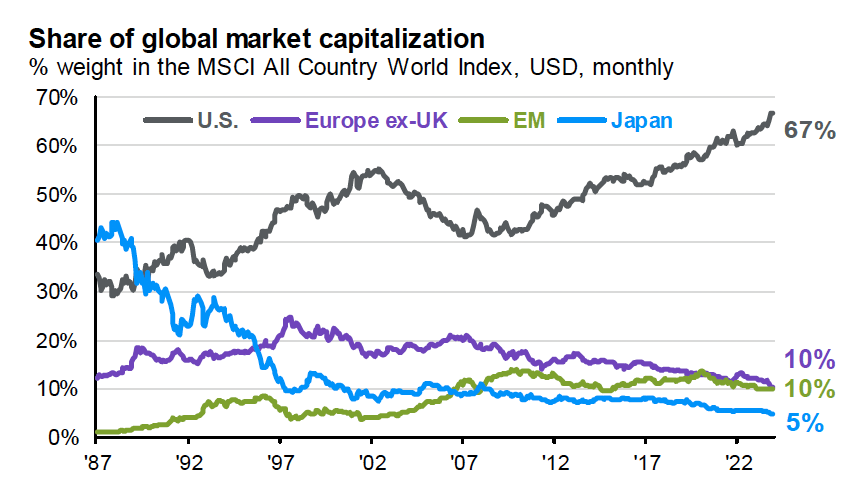

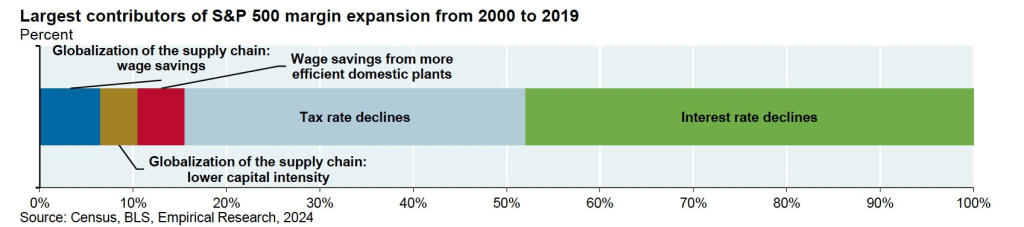

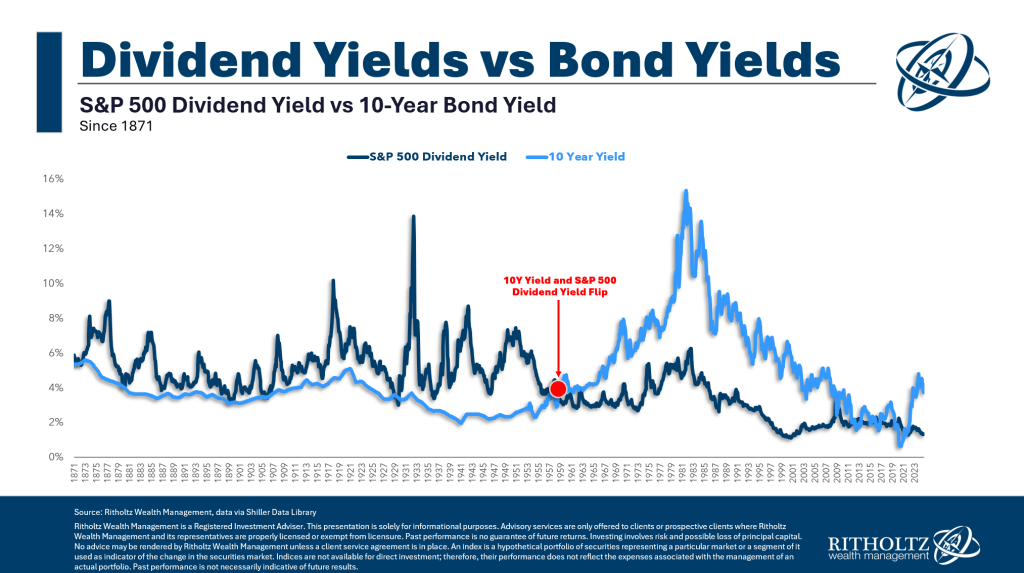

European stocks have under-performed U.S. stocks in 12 of the last 15 years. However, the pedestrian pace of the European economy and markets could be a virtue for investors in the years ahead. Europe suffers from none of the over-building excesses that haunt the Chinese economy. European equity markets have none of the bubbly valuations that pose a threat to U.S. stocks. A starting point of a weak euro and monetary easing, combined with a high savings rate and fiscal capacity has the potential to boost both economic growth and dollar-denominated returns on European equities. Attractive dividend yields can allow European equities play a respectable role in generating income. Moreover, political pressure from within Europe, along with the threat of tariffs from the United States, could motivate bolder action from European policymakers in both deregulation and fiscal stimulus, triggering greater economic momentum. The strongest case for European equities is simply a value case. At the end of January, the MSCI Europe ex-UK had a forward P/E of 14.7 times compared to 21.8 times for the S&P500, a discount that is more than two standard deviations greater than its average over the past 20 years. It also sported a dividend yield of 3.3% compared to 1.3% for the S&P500.

_______________________________

The silver market is heading into a perfect storm. Even in our most conservative case, holding everything but solar demand constant, we’re looking at potential deficits of 100-200 million ounces annually for the next decade. Solar panels now consume one in four ounces of silver mined globally. Even at current solar installation rates – before factoring in any AI-driven surge in energy demand – we’re looking at a supply-demand gap as large as the entire elastic (price-sensitive) portion of silver supply. Solar demand is structurally inelastic – panel manufacturers will buy silver at almost any price because it represents a tiny fraction of total costs but is essential to functionality. The sheer scale of the energy transition dwarfs anything in silver’s industrial history – we’re talking about rebuilding the entire global energy infrastructure.