Barry: You’ve covered human behavior and human nature, what led you to say, I wanna write a new book about the art of spending money?

Morgan: I didn’t call this book The Science of Spending Money because I don’t think that exists. Science implies that there is like a, a one size fits all rule for, for you and I, and that’s not the case. I call it the artist spending money because art is subjective. It is often contradictory. It is different from person to person, and that’s really what spending is. So much good ink has been spilled on how to invest, how to grow your career, how to earn more money, but very little on spending money.

Barry: There’s been a lot of academic research: Does money make you happier?

Morgan: What a lot of the research shows is that if you are already a happy person, money can make you happier. But if you are a depressed person – or a miserable person, whatever it might be – that it will not, and it’s easy to just kind of contextualize this into a real person’s life of if you are in a bad marriage and you hate your career and you have a two hour commute and just go on down the list, you’re an alcoholic, you’re obese. If you take that person and you give them more money, will they be happier? The answer is no, of course not, because all of those other aspects of their life are gonna override whatever money can do for them.

But if you also take somebody who’s in a great marriage loves their career, they’re happy, they’re healthy, they sleep eight hours, they have a good set of friends – and you give that person more money, there’s a good chance that they’re gonna use that money to just leverage what they’re already doing. To spend more time with the friends who they already love, to spend more time getting healthier and eating good food.

Barry: One of the interesting things in the academic literature that I recall seeing a few years ago was when they draw these charts of money potentially making people happier, Divorce is a giant red flag. People in the middle of a divorce or people who have recently been divorced, that’s a really challenging road to haul, isn’t it?

Morgan: I think what it comes down to is that having more money is so quantifiable that we use it as a crutch for all of our problems. For example, if I said I would have a better life if I was a 10% better dad. What does that even mean? What does a 10% better Dad mean? There’s no way to quantify it, but if I said I would have a better life if my salary went up by 10%, you can easily quantify that, wrap your head around it. So we chase that and we assume that that’s gonna be the solution to all of our ills. Becoming a better dad might make me a happier, better person, but since it’s impossible to quantify, I just ignore it and pretended that it doesn’t exist.

Barry: You alluded to impressing others. How should people avoid spending money for status and symbolism as opposed to bringing themselves satisfaction and happiness?

Morgan: It is so easy to overestimate how much other people are looking at your stuff, your house, your cars……they’re not paying any attention. They’re busy worrying about themselves and thinking about themselves. And so when you frame it like that – it’s not to say don’t use your money to gain attention – it’s use it to gain attention from the very small core group of people who you want to love you. There’s a great quote from Warren Buffett where he says, “The definition of success in life is when the people who you want to love you do love you.”

Barry: The person driving down the street in the loud Lamborghini or the person around the corner from you with a giant house? You are only seeing one half of the balance sheet. You’re only seeing their assets. Did they pay cash for that or did they go deep into debt in order to buy a house or a car to show off for the neighbors? Talk about that a little bit.

Morgan: Wealth is what you don’t see. Wealth is the cars that you didn’t purchase and the giant house that you didn’t buy. That’s what wealth is. It is money that you didn’t spend that you can now save for either for future consumption or for independence today. I can see your car, I can see your house, I can see your watch and your clothes. I cannot see your bank account or your brokerage statement. So the most important part of wealth – literally in my view, the definition of wealth is invisible to everybody.

Think about physical fitness. You can see somebody’s physique, it’s right there. And so you know who to admire and who to chase. “Oh, that, that person’s in great shape. I should ask them what they do. I should ask them their diet and try to mimic what they do.” But if you see somebody with a mansion or a Ferrari or whatever it is, you don’t know they got that by success. That may be the picture of a leverage. It’s possible they haven’t slept in two weeks because they’re wondering how they’re gonna make their next Ferrari lease payment. And so we have a fake view of who we’re chasing and what we should do, because wealth that we’re chasing is invisible.

_____________________________

The reason why Trump caved on his tariff threats was due to the response of the financial markets. Throughout history they have had the ability to force immediate policy changes from politicians.

Another good example occurred in October 2008:

During the month following Lehman Brothers’ September 2008 implosion, then Federal Reserve Chairman Ben Bernanke testified to the House Committee on the Budget on Monday, October 20, 2008. He reminded members that the Federal Reserve’s charter was to maintain high employment and low inflation. The Fed, he also reminded, was not authorized to manage the stability of the financial system or keep credit markets flowing; it was not the FOMC’s charge to address any of the myriad issues that had endangered the financial system’s functioning.

A fiery speech from someone (maybe Rand Paul?) led to a vote against Bernanke’s funding and authority request. He would not be getting the tools necessary to unfreeze credit and keep the banking system operating.

Sayeth Mr. Market: “Hold My Beer.”

The sell-off began immediately after the vote; over the next five trading days, from recent highs, the S&P 500 fell 13.9%, the Nasdaq was right behind it at 13.5%, and the Russell 2000 crashed 18%. MOSTLY IN ONE WEEK. Congress reconvened and passed both the necessary authority and the dollars that the Fed chairman had requested. By November 4th, all of the losses had been made up and then some.

Don’t fix the credit markets, and put corporate revenue and payrolls at risk? FAFO.

______________________________

Behind a paycheck, the largest source of income for the 1% highest earners in the U.S. isn’t being a partner at an investment bank or launching a one-in-a-million tech startup. It is owning a medium-size regional business. Many of them are distinctly boring and extremely lucrative, like auto dealerships, beverage distributors, grocery stores, dental practices and law firms.

The analysis of anonymized tax data from 2000 through 2022 suggests the importance of such business ownership to the U.S. economy has grown. The share of income that ownership generates has increased to 34.9% in 2022 from 30.3% in 2014 for the top 1% earners. It has increased even more at the topmost levels. The top 0.1% highest-earners saw 43.1% of their income come from such business ownership in 2022, compared with 37.3% in 2014. (The minimum income threshold in 2022 to qualify for the top 0.1% of earners was $2.3 million).

The growth of this growth can be attributed in large part to tax cuts in recent decades for such business owners and low interest rates that have boosted company valuations. The number of such business owners worth $10 million or more, adjusted for inflation, has more than doubled since 2001, to 1.6 million as of 2022. The growth has been in S-corporations and partnerships, where the profits and losses of the business flow through to the owners or partners; the business itself doesn’t pay taxes. The typical medium-size business they studied has annual sales of $20 million and 100 employees.

_____________________________

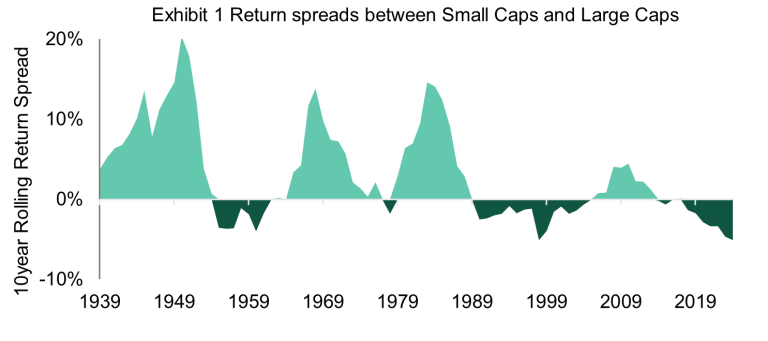

Despite their recent struggles, U.S. small cap stocks aren’t dead — they’re just misunderstood. After eight consecutive years of under-performance relative to U.S. large caps, some investors are ready to write them off entirely, even calling for exclusion from portfolios. History, valuation metrics, and macro conditions suggest a different story – one that points to an approaching comeback, for three key reasons:

- Small-cap underperformance has historical precedent — but cycles turn. We’re in the 12th year of a small-cap lagging cycle, longer than average. Historical data suggests a reversal is near.

- Higher interest rates are reigniting migration. With rates expected to stay elevated, small-cap stocks are more likely to graduate to large caps — boosting overall performance potential.

- Valuation and quality favor small caps. Compared to the weakest segment of large caps, small-cap stocks offer stronger return on assets and more attractive price-to-book ratios, contradicting the view that only low-quality names remain in the space.

_____________________________

The MSCI ACWI index includes large and mid-sized companies from 23 developed countries (like the U.S., UK, Japan) and 24 emerging markets (like China, India, Brazil). It covers about 85% of the available stocks around the world. The number of stocks in the MSCI ACWI that do business globally has risen to 80% (which is why the global stock market did not respond well to the recent tariff announcements).

_____________________________

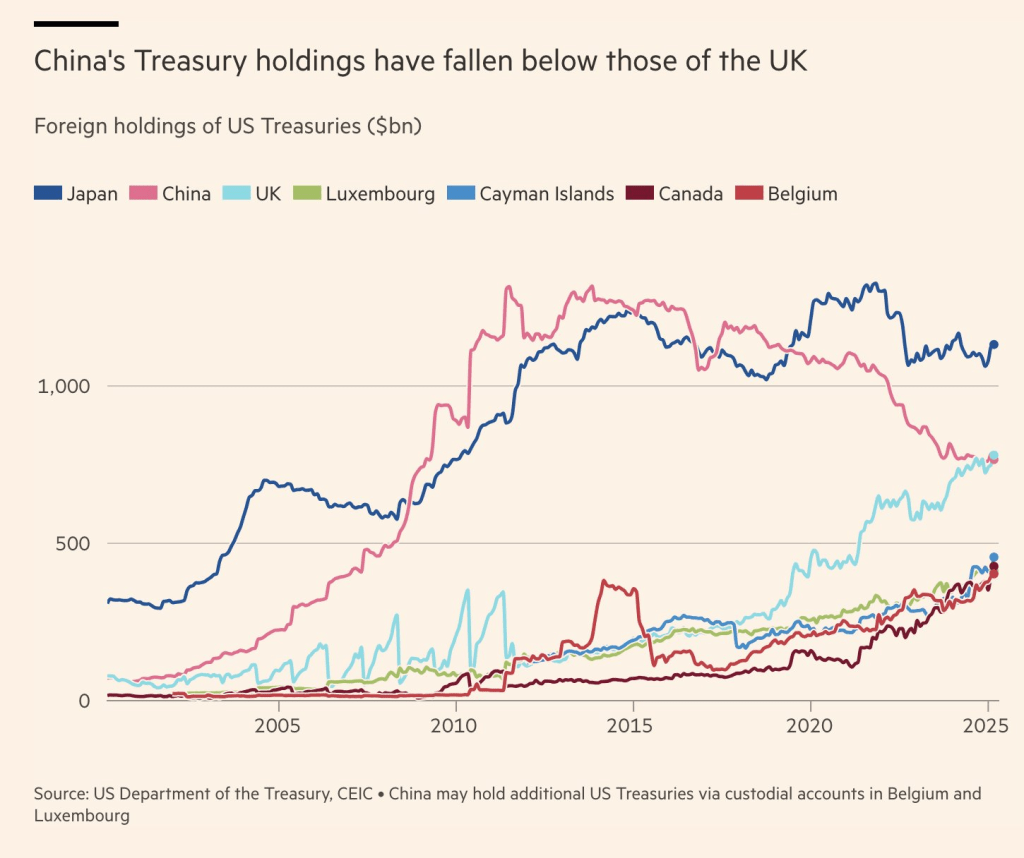

The U.K. has overtaken China as the second largest holder of U.S. treasuries (behind Japan):

___________________________

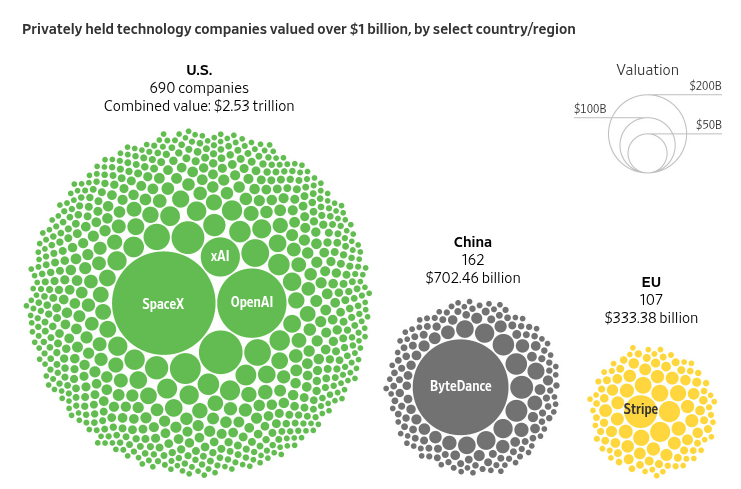

Over the past 50 years, the U.S. has created, from scratch, 241 companies with a market capitalization of more than $10 billion, while Europe has created just 14. A big reason why Europe is now behind can be summed up as a lack of speed. Entrepreneurs complain that everything takes longer in Europe: raising money, complying with local regulations, and hiring and firing workers.

_____________________________

America’s national legislature has the oldest median age compared to dozens of wealthy democracies: