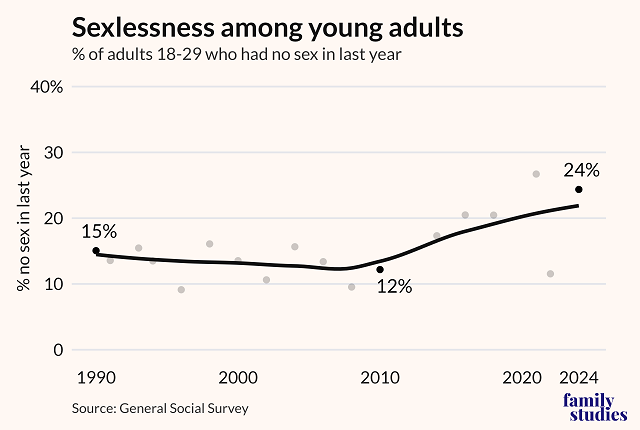

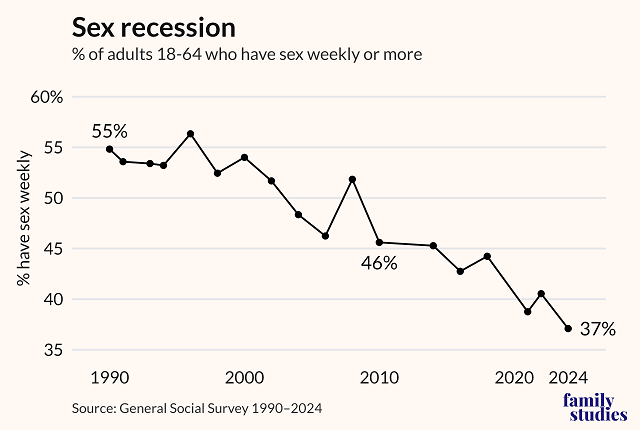

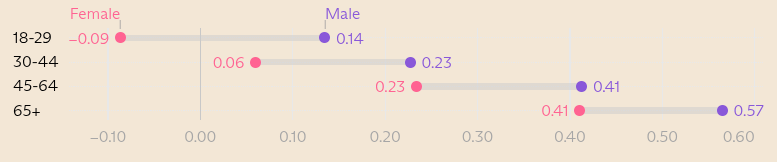

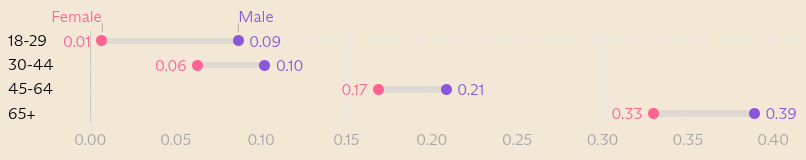

With 23,000 responses to survey questions distributed over more than 4,500 respondents, we found there is a youth loneliness crisis, not just a male loneliness crisis like many believe. Younger people — both male and female — are increasingly paralyzed by anxiety and fear, and they are finding it harder and harder to socialize.

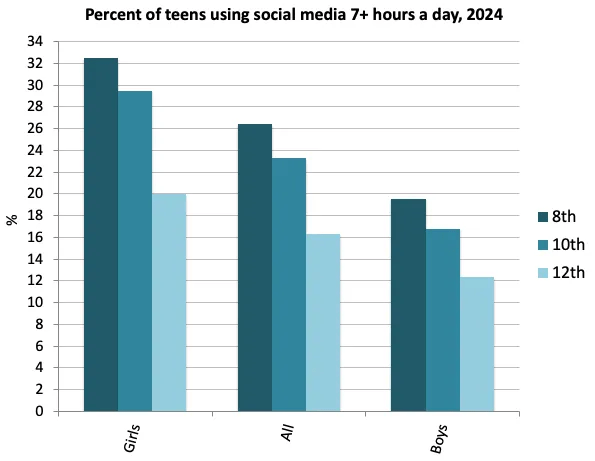

In fact, when you look at the data, the “antisocial crisis” is actually most pronounced among young women, who experience the highest rates of social isolation.

It’s true that young men are facing a loneliness crisis, but it’s part of a broader loneliness crisis that young people are facing in general, and the numbers suggest that young women might actually be hit even harder, even though that story hasn’t gotten nearly as much attention.

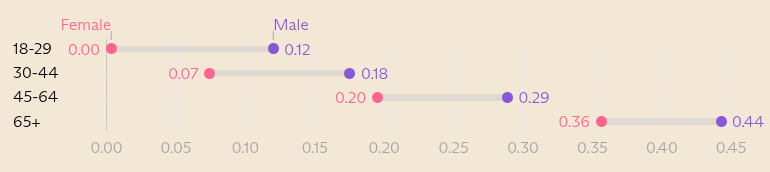

Looking at the results from our study on the questions concerning emotional distress the gender split is striking, but it is age, rather than gender, which marks the determining axis once again.

For instance, young men (18 to 29) are more distressed than almost every other demographic, including women 45 to 64 and women over 65. But young women are hit even harder, and they actually have the worst scores among any age-based gender cohort in our entire dataset.

In another axis of our study, social disengagement, young people once again emerged as the age group most likely to feel lonely, isolated, or conversationally stunted with people they don’t know, and there is a striking gap between the “internet generations” (people under 45) and everyone else.

While both young men and young women suffer from a loneliness and socialization crisis, young women actually seem to be hit significantly harder by it. In particular, they seem to find it much harder to make new friends or converse with strangers, especially when it comes to the opposite gender — and they’re much more likely to be introverted and alienated.

The results of this study lined up quite well with the existing research on this topic. A study conducted by Public Opinion Strategies found that young women are the cohort of Americans most likely to feel lonely and left out. And it doesn’t seem to be limited to just America — a study done by the United Kingdom’s Campaign to End Loneliness found that women and young people were two of the cohorts most affected by loneliness.

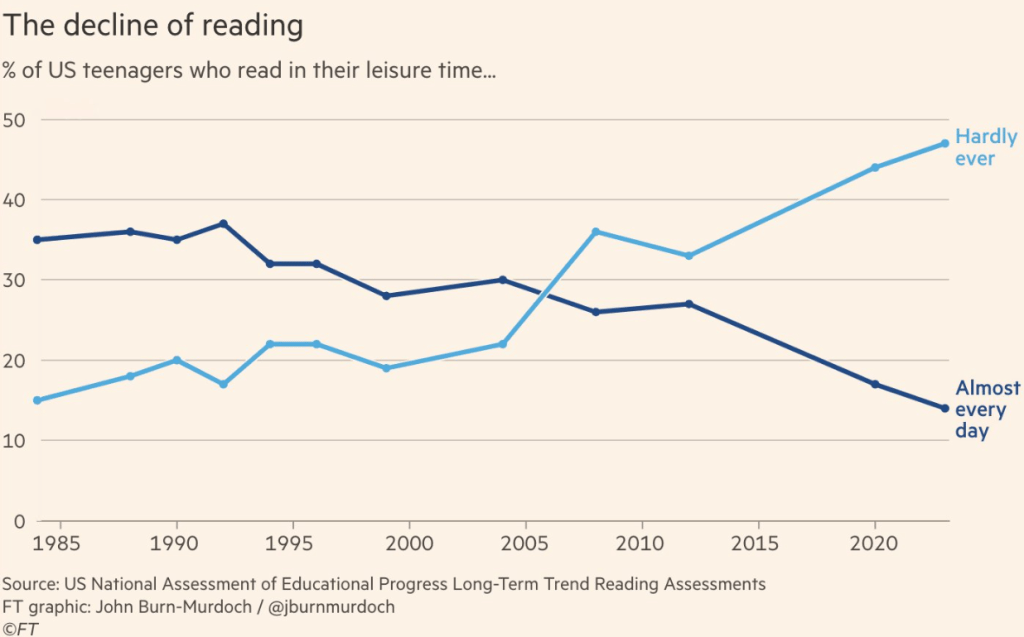

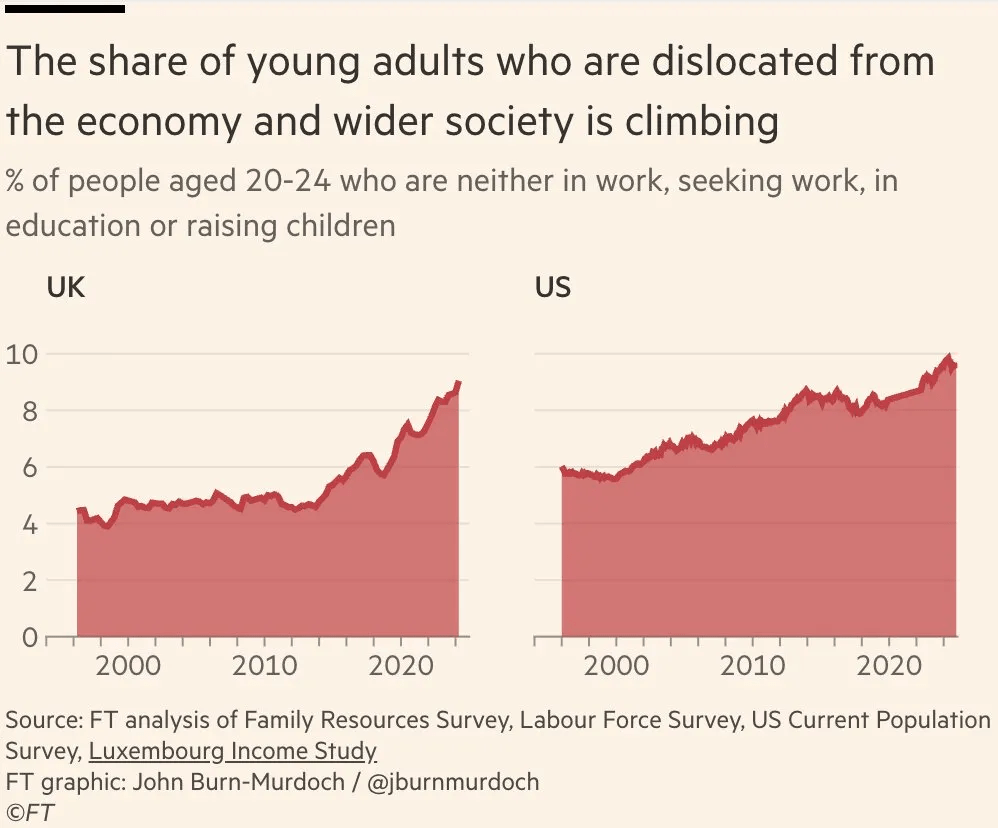

Young people are spending less and less time socializing with each other. The American Time Use Survey estimated a nearly 50% decline in face-to-face interactions among teenagers over the last two decades.

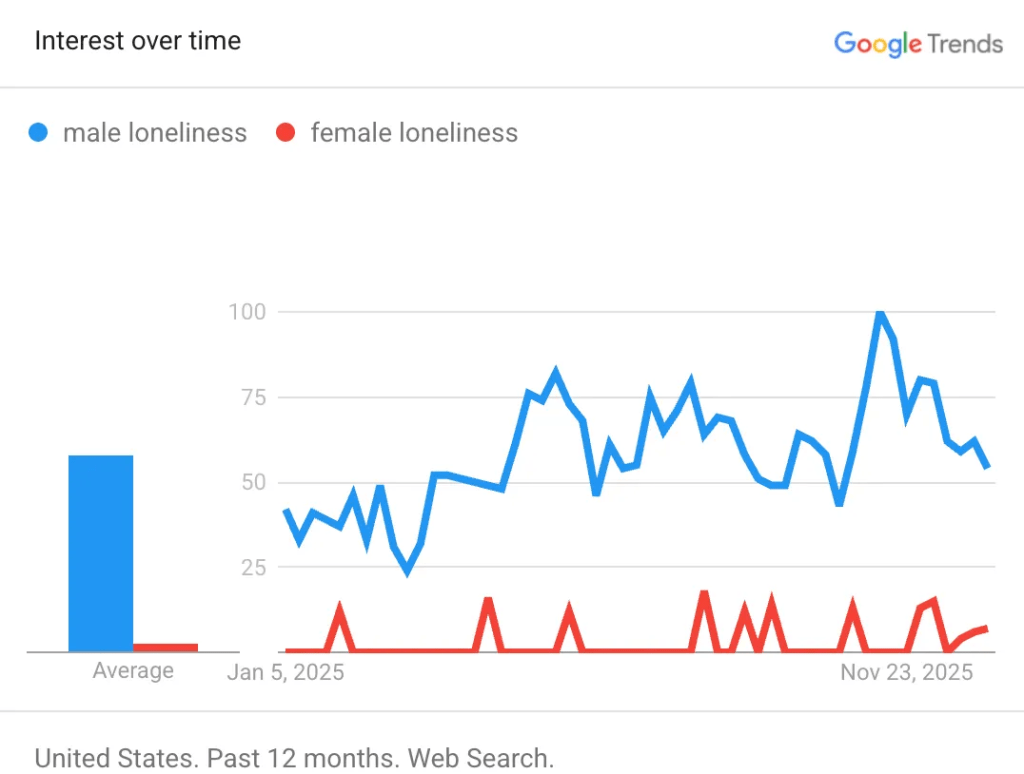

Time that used to be spent with friends is now spent online. When it comes to the “female loneliness crisis,” I’m not even convinced that most people know it exists. You can find column after column on the male loneliness epidemic. But when it comes to the female loneliness epidemic? Crickets.

_____________________________

Growing up, I spent every French school holiday in the U.S. with my dad — the more career-driven of my parents (which tracks, since my mom is Belgian and my dad is a pure-bred American from Michigan). So I grew up with both models: French and American.

I don’t think most French people think about purpose the way Americans do. What’s your purpose? What are you building? What are you here for?

They’re good questions. But in France, they’re not humming in the background of every conversation. Most people I know don’t define themselves by what they do for a living. And if they work in a corporate setting, there’s often this quiet trust that things will evolve over time. No need to panic about your life path. Just do your job — and enjoy your life. Work is one part of the equation. So is your social life, your hobbies, your weekends away.

In the U.S., the idea of having purpose is everywhere: in books, on podcasts, in LinkedIn bios, even in casual brunch conversations. There’s this constant pressure to align your job with your passion, your calendar with your goals, your time with your values.

But what if your purpose is simply to build a good life? To raise kind children. To cook a little better each year. To read a few excellent books. To notice the seasons. To build meaningful relationships. Isn’t that what people will remember anyway?

In France, there’s no guilt in doing a job because it pays the bills. Or because it gives you your evenings. You can be excellent at what you do and still have no desire to talk about it over dinner — which is very much the case with my French husband, who bans work talk at the table. At first it felt strange. Now I love it. We talk about where we want to go next weekend. What we’re reading. What to cook.

When I moved back to Paris as an adult, I was struck by how much people here were just… living. They weren’t building personal brands. They weren’t trying to optimize themselves into more perfect versions. They worked, they took real holidays, they cooked, they went to the theater. They had long conversations about everything and nothing. And they rarely used the word productive.

What they value instead is curiosity. Culture. Taste. The art of paying attention. Of being present, not just purposeful. That doesn’t mean people are passive. But the energy is different. Life is more about living well or profiter de la vie.

It took me time to unlearn the habit of measuring everything by what it might lead to. What goal it served. What version of myself it might create. I still have ambition, but I no longer believe every moment needs to be part of some upward trajectory. Some days, it’s enough to spend the weekend with my family — visiting an exhibition, taking the kids to a play.

I don’t know that I’ll ever stop caring about meaning. But I’ve stopped needing to declare it. What I want now is to live with intention, even when there’s no obvious reward. To build a life that’s full, not optimized.

____________________________

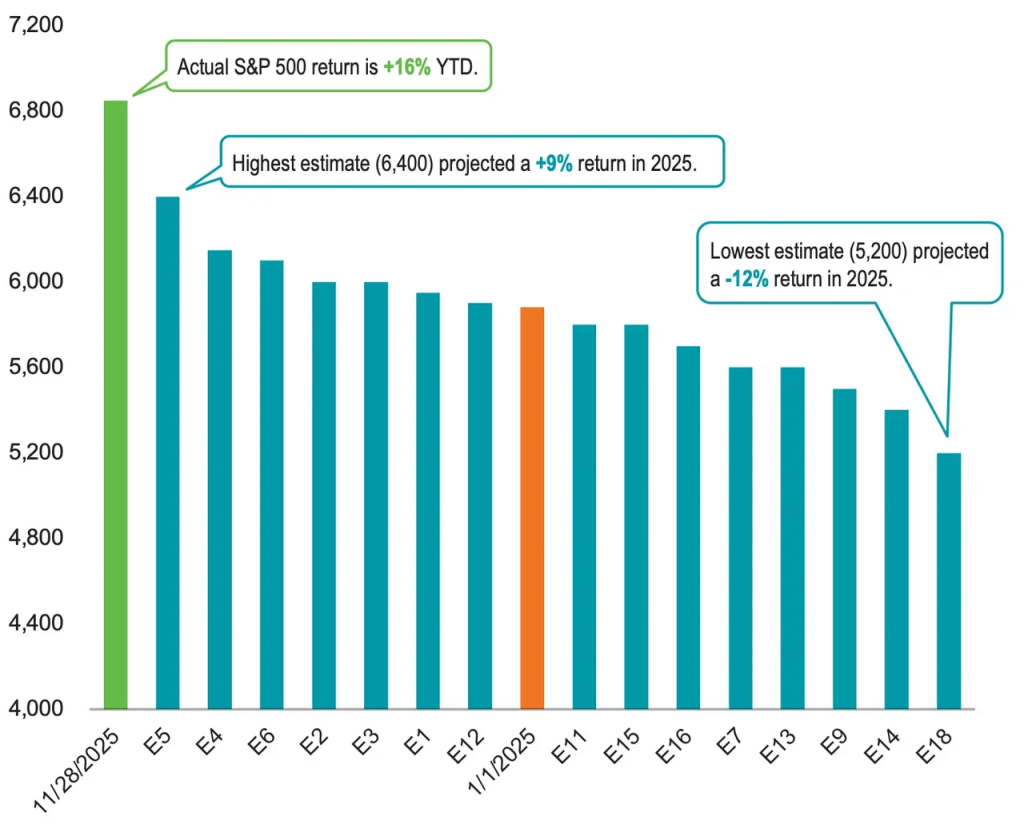

There’s a strange comfort in believing someone out there knows what the market will do next. Don’t fall for it. People who make predictions on the financial markets for a living are about as accurate as a 50/50 coin toss.

By early spring 2025, when President Trump’s tariff wars started, over half of the forecasters were calling for the market to decline. The below graph shows the level of the S&P 500 at the beginning of the year (orange bar), the actual price level at year end (green bar) and the wide range of estimates published in April (blue bars). If you’d been reading all their research reports, you might have started selling.

Maybe you’re thinking “Fine. Experts may be clueless, but vibes are easy to read.” You know all about employment numbers, and inflation, and the usual talking points from CNBC.

Well, here’s a great chart from JP Morgan Asset Management that begs to differ. It looks at S&P 500 performance after peaks and troughs in the University of Michigan’s consumer sentiment survey. Interestingly, the weakest moments in how people are feeling tend to precede strong equity returns while peaks in sentiment do not see as much upside. Turns out that getting out of the market when things feel bad can be a poor investment strategy.

__________________________

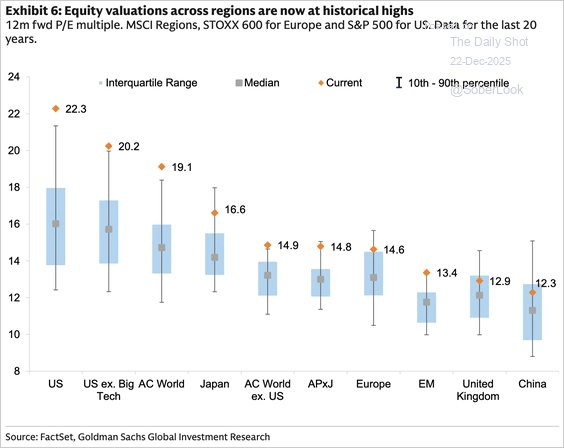

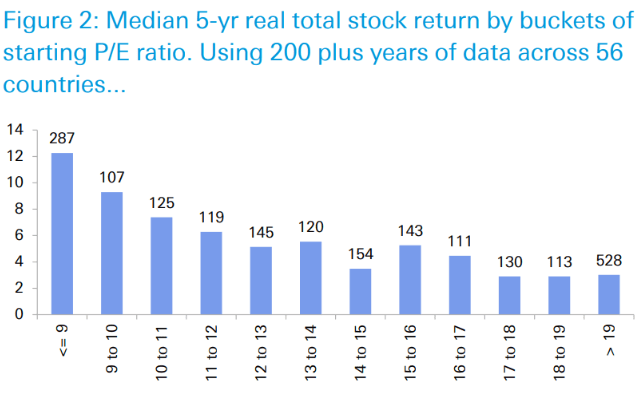

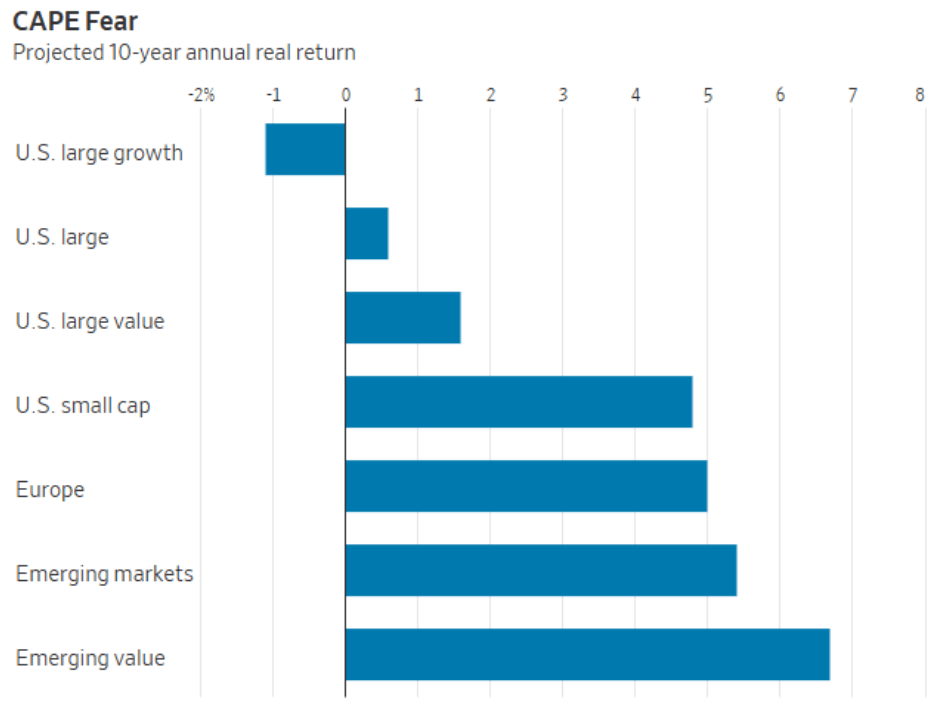

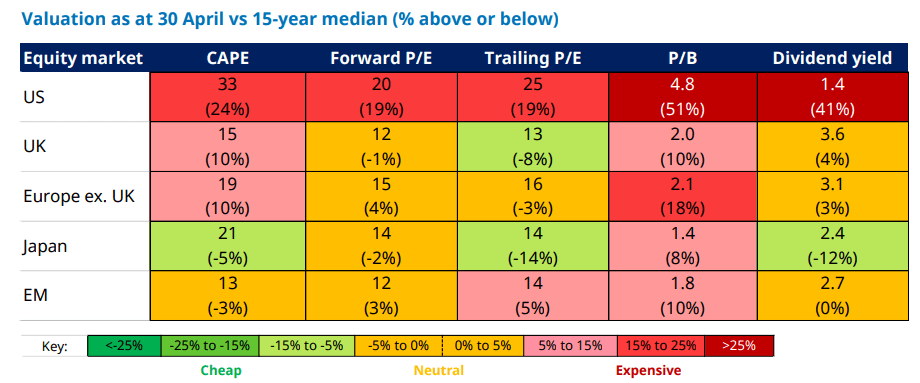

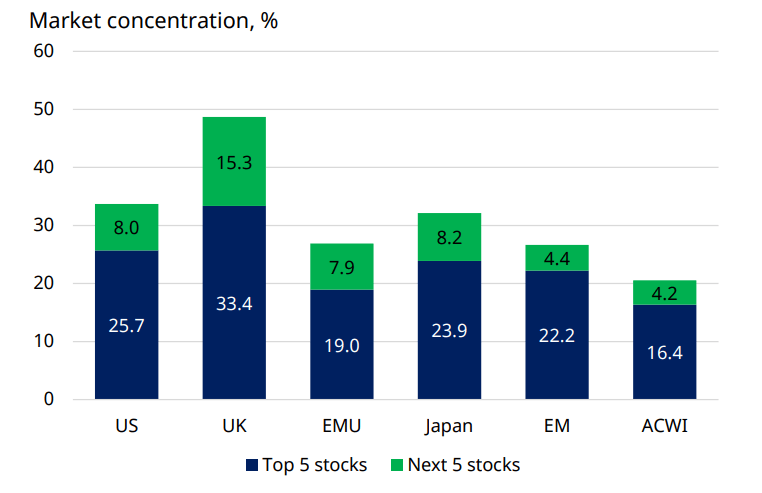

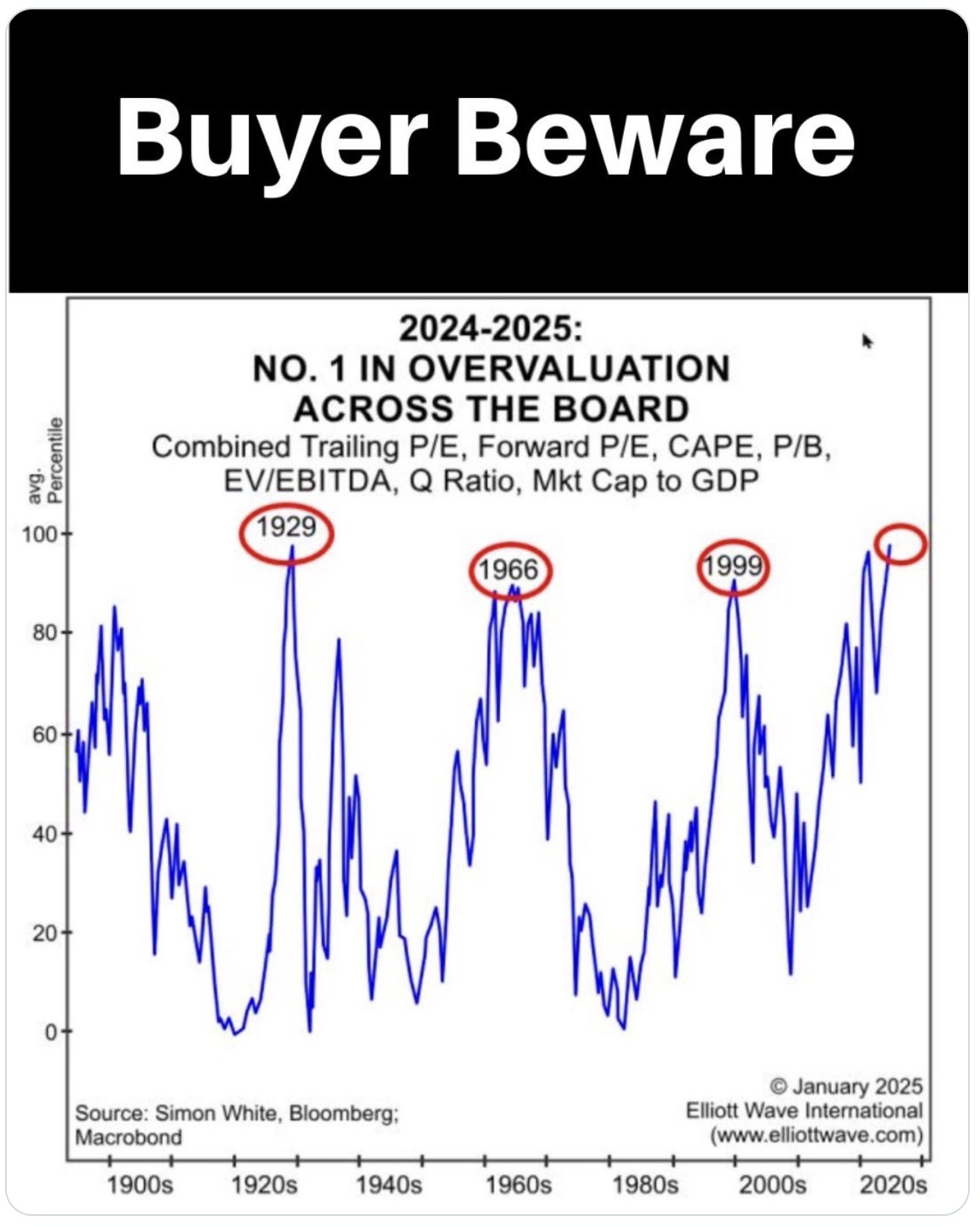

The defining feature of every bubble is the same: a growing inconsistency between the long-term returns that investors expect in their heads – based on extrapolation of the past, and the long-term returns that properly relate prices to likely future cash flows – based on valuations.

Each speculative episode encourages a certain stubbornness – because humans are adaptive creatures, we base our expectations for the future on the experience of the recent past. We respond far less to those things that are painful but distant in our memory than to those things that are rewarding in real-time.

This feature of investor behavior – what Galbraith called “the extreme brevity of the financial memory” – is complicated by the crowd psychology that accompanies speculation. Independence of thought requires one “to resist two compelling forces: one, the powerful personal interest that develops in the euphoric belief, and the other, the seemingly superior financial opinion that is brought to bear on behalf of such belief. As long as they are in, they have a strong pecuniary commitment to the belief in the unique personal intelligence that tells them there will be yet more. Speculation buys up, in a very practical way, the intelligence of those involved.”

A related, and I think equally challenging complication is that, in the short run, market prices will be whatever the consensus of the crowd chooses them to be. Nothing that we can measure affects market prices – whether earnings, GDP, employment, interest rates, monetary policy, or any other factor – except through the expectations and risk-preferences in the heads of investors at any moment in time. As the Buddha said, “With our thoughts we create our world.”

A financial “security” is nothing more than a claim on some stream of cash flows that investors expect to be delivered into their hands in the future. For any stream of future cash flows, and some long-term rate of expected return, we can always calculate the “present value” of the cash flows expected at each point in the future. Likewise, once we have a reasonable estimate of likely future cash flows, then the moment we know the market price, it’s just arithmetic to calculate the expected long-term rate of return on the investment.

Over the short-run, however, nothing prevents investors from imagining whatever long-term rate of return they like, and paying whatever price they wish, even if the two are mathematically incompatible with likely future cash flows. Even then, we can make everything compatible by imagining whatever future cash flows we like. Only time imposes any discipline on those choices, and sometimes time is unforgiving.

Over the short run, all that matters is the return in people’s heads. It’s only over time that the cash flows arrive and reliably teach investors that valuations matter. That’s why Ben Graham wrote “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

_________________________________

Will LLM models run out of data to train on? In its 2025 AI Index Report, Stanford concluded that this is unlikely before 2030. Common Crawl, an open repository of web crawl data frequently used in AI training, is estimated to contain a median of 130 trillion tokens. The indexed web holds approximately 510 trillion tokens, while the entire web contains around 3,100 trillion. Additionally, the total stock of images is estimated at 300 trillion tokens, and video at 1,350 trillion tokens.

Assume that 5 billion people end up using AI by the 2030’s (compared to 6 billion current internet users). Each user consumes about 1.6 mm tokens per day for search, coding assistance, other agents, background

assistants and creative purposes. That would be a LOT of demand vs current levels and assumes a paradigm

shift in how AI is used in daily life. Across all users, that would be 8 quadrillion tokens per day

How much capacity would be needed to handle 8 quadrillion tokens per day? 23 – 92 Gigawatts of active

inference capacity. While there are 125 Gigawatts of data centers around the world, only about 20 Gigawatts are currently estimated to be capable of handling AI workloads.

What is the constraint to grow toward the Gigawatts needed? Energy.