Daniel Kahneman spent his life studying behavioral economics, cognitive biases and learning why people make irrational decisions. He won the Nobel prize for his research and wrote the most influential book ever on the topic titled “Thinking, Fast & Slow.” At age 90, his closest friends and family were shocked and upset when they received an email from him saying that he would be ending his life through assisted suicide, even though he was still in relatively good health. From his email:

“I am still active, enjoying many things in life (except the daily news) and will die a happy man. But my kidneys are on their last legs, the frequency of mental lapses is increasing, and I am ninety years old. It is time to go.

Not surprisingly, some of those who love me would have preferred for me to wait until it is obvious that my life is not worth extending. But I made my decision precisely because I wanted to avoid that state, so it had to appear premature. I am grateful to the few with whom I shared early, who all reluctantly came round to support me.

I discovered after making the decision that I am not afraid of not existing, and that I think of death as going to sleep and not waking up. The last period has truly not been hard, except for witnessing the pain I caused others. So if you were inclined to be sorry for me, don’t be.“

Kahneman knew the psychological importance of happy endings. In repeated experiments, he had demonstrated what he called the peak-end rule: Whether we remember an experience as pleasurable or painful doesn’t depend on how long it felt good or bad, but rather on the peak and ending intensity of those emotions. It is the case that in following this carefully thought-out plan, Danny was able to create a happy ending to a 90-year life, in keeping with his peak-end rule. He could not have achieved this if he had let nature take its course.

_____________________________

One reason why the younger generation doesn’t like to drink is because every moment of their lives is either being filmed or only seconds away from the next picture that will be shared online. “I think that a lot of times we’re so consumed with how other people are looking at us that we don’t even want to risk being considered messy,” said Sofie Ruiz, a sophomore at Texas Christian University. This fear of being perceived as “messy” is fueled by the popularity of the “clean girl” aesthetic. A “clean girl” is often associated with healthy habits like yoga, pilates, green smoothies, and journaling—definitely not heavy drinking. The epitome of the popular girl is now one who projects an image of a balanced, healthy, and often sober lifestyle. This ideal is heavily promoted on social media, influencing what is seen as desirable and aspirational. College campuses also have school-specific social media apps, such as Yik Yak, where a drunken night out can get posted by peers with lasting and embarrassing consequences, said Ruiz. With social media comes permanent and wide-reaching evidence, and students are choosing not to be seen in a certain way in perpetuity.

The reputation repercussions can run deep. Ruiz has a friend who attends a university with its own dedicated Instagram account. Students can send in anything, and it will likely be posted. A female student was kicked out of her sorority for being drunkenly featured on the page. “We grew up a lot hearing the concerns of a digital footprint. People don’t want to risk their future on stuff like that,” said Ruiz. “Guys don’t have as much to be scared about, I think. Because even if they do something embarrassing and it gets posted, they, by history, most likely will not get the same repercussions as a girl might. As a girl, you don’t want to be hungover, you don’t want to feel sick, which also goes into the clean girl aesthetic thing.” “I think that if social media wasn’t a component, it would definitely be a lot different,” she said. The opposite is true with marijuana. Ruiz said that cannabis’s popularity may stem from its perceived social acceptability: “You’re kind of at less of a risk to embarrass yourself because if you’re high, you’re normally just going to chill out. Whereas when you’re drunk, you don’t really have control over your actions.”

_________________________________

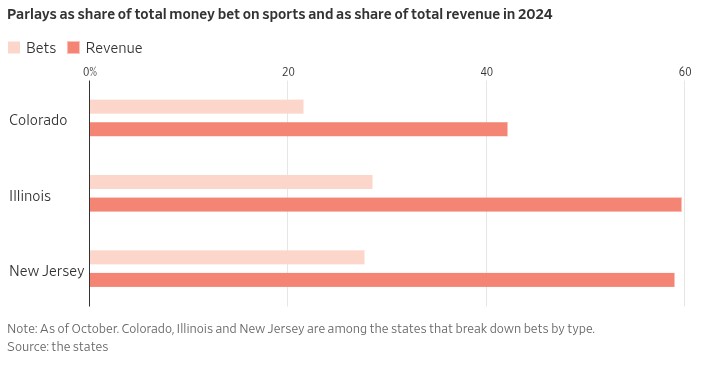

Are there financial determinants of great-power decline and fall? “Ferguson’s Law,” which states that any great power that spends more on debt servicing than on defense risks ceasing to be a great power. The paper identifies the “Ferguson limit,” or the point at which interest payments exceed defense spending, as the tipping point after

which the centripetal forces of the aggregate debt burden tend to pull apart the geopolitical grip of a great power.

This is because the debt burden draws scarce resources towards itself, reducing the amount available for national security, and leaving the power increasingly vulnerable to military challenge. Looking at historical case studies that are analogous to the situation of the modern United States as the dominant global power, it is very rare but not unprecedented for a great power to return to the right side of the Ferguson limit. The United States began violating Ferguson’s Law for the first time in nearly a century in 2024.

________________________________

Don’t let your kids get on motorcycles, if possible.

_____________________________________

Atlanta-based Chick-fil-A is on the vanguard of fast-food drive-through science, regularly dispatching specialist teams to its more than 3,000 restaurants to study the minutiae of parking-lot traffic patterns and how employees hand off orders. In years past, some Chick-fil-A operators would climb onto restaurant roofs to study traffic flows. These days, the chain sends out traffic-analysis teams that use drones to capture aerial footage, which team members splice with video from kitchens and drive-through windows to create roughly hourlong videos for store owners. The insights are reshaping Chick-fil-A’s restaurants. One opened outside Atlanta last August with no dining room but four drive-throughs that can serve some 700 cars an hour. A second-floor kitchen prepares food that is delivered to the cars below via a system akin to a dumbwaiter.

_____________________________