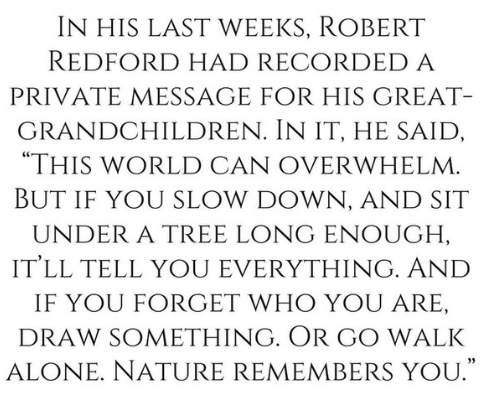

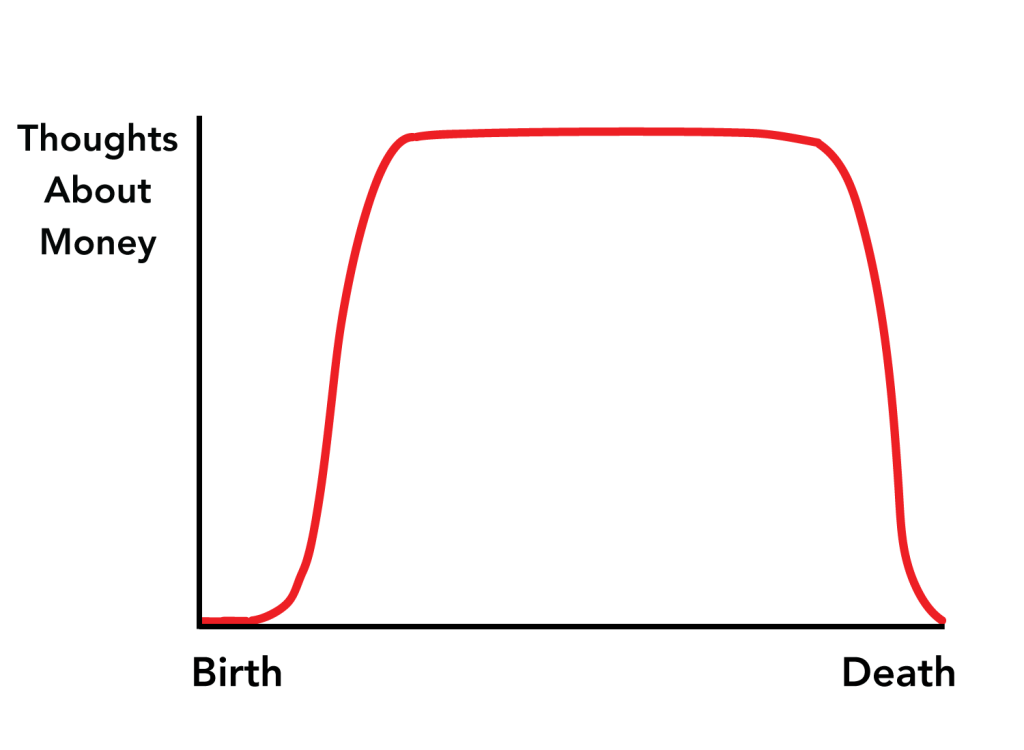

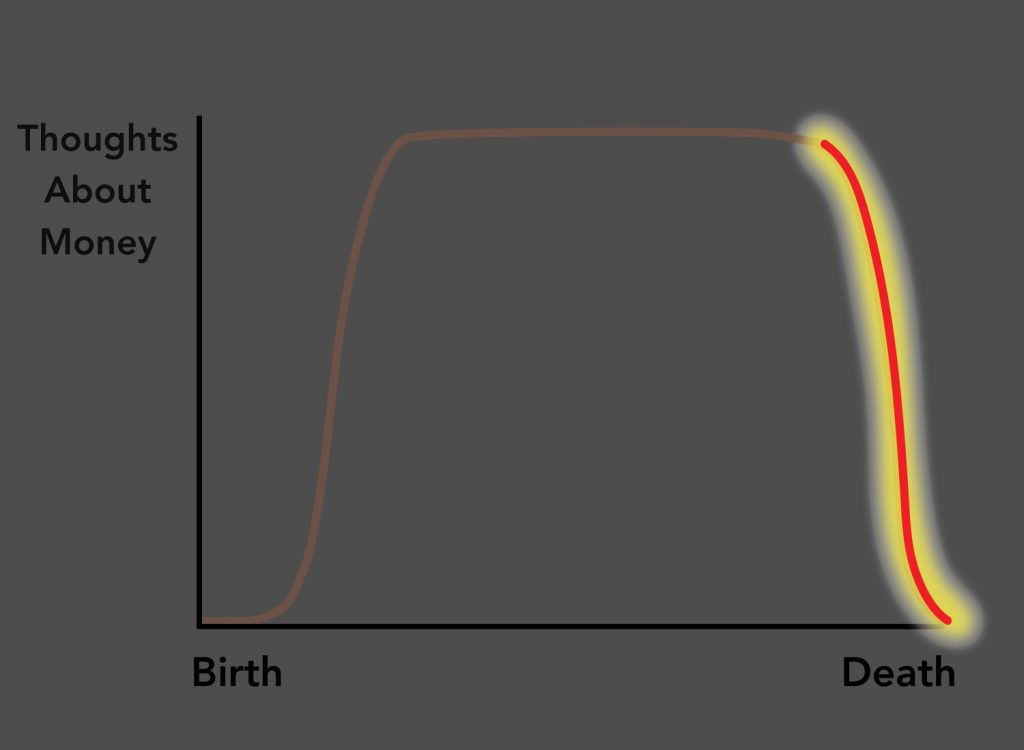

Money is a required pursuit for life, but a pointless pursuit upon death. If I were to illustrate what this tension looks like for your average person, it would look something like this:

That steep descent to zero is what I call The Nothingness of Money. It’s when the pointlessness of money is no longer theoretical; it’s truly understood. This delineation is important.

Everyone knows that your bank account doesn’t go with you upon death. But for most of life, that knowledge is theoretical, meaning that it’s not real enough to influence your day-to-day behavior. The mere awareness of your mortality isn’t enough to cease your pursuit of wealth.

It is only when the finiteness of life is glaringly obvious that things change. For most people, the Nothingness of Money strikes when the finish line is a few yards away. A terminal diagnosis is delivered. An appointment is made at a hospice center. A deathbed is prepared.

In this moment, a pursuit that once seemed all-consuming fades into the background. All that matters are the memories you have, the people you love, and the memories you can still make with them. The use of your finite time to squeeze out an extra dollar is laughable, as no one with a sound mind would expect that of you.

And finally, in this brief section of life, something profound happens. The Nothingness of Money is truly understood.

Wisdom is the co-existence of contradictory truths, and money is the clearest example of this. We must internalize its importance while also recognizing its pointlessness. We must operate within the story of money while also understanding that it’s a fairy tale. The problem is that we often fail to see the illusory nature of this story, and treat it as gospel until it’s too late.

____________________________

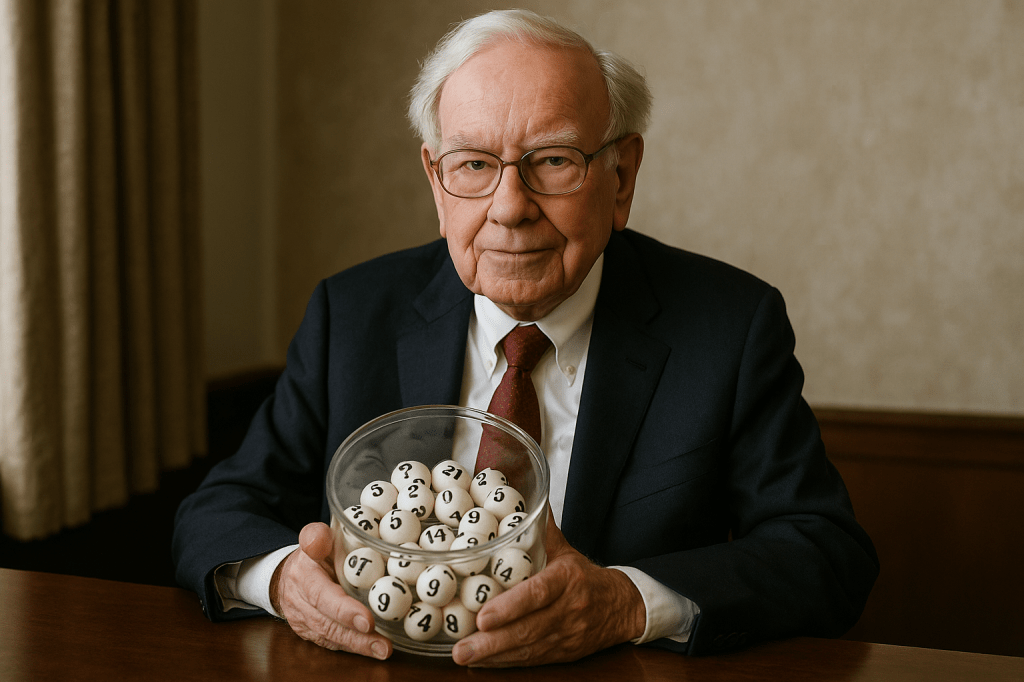

Question To Warren Buffett: What would you do to live a happier life if you could live over again?

I have been extraordinarily lucky. I mean, I use this example and I will take a minute or

two because I think it is worth thinking about a little bit. Let’s just assume it was 24

hours before you were born and a genie came to you and he said, “Herb, you look very

promising and I have a big problem. I got to design the world in which you are going to

live in. I have decided it is too tough; you design it. So you have twenty-four hours, you

figure out what the social rules should be, the economic rules and the governmental rules

and you and your kids and their kids will live under those rules.

You say, “I can design anything? There must be a catch?” The genie says there is a

catch. You don’t know if you are going to be born black or white, rich or poor, male or

female, infirm or able-bodied, bright or retarded. All you know is you are going to take

one ball out of a barrel with 5.8 billion (balls). You are going to participate in the

ovarian lottery. And that is going to be the most important thing in your life, because

that is going to control whether you are born here or in Afghanistan or whether you are

born with an IQ of 130 or an IQ of 70. It is going to determine a whole lot. What type of

world are you going to design?

I think it is a good way to look at social questions, because not knowing which ball you

are going to get, you are going to want to design a system that is going to provide lots of

goods and services because you want people on balance to live well. And you want it to

produce more and more so your kids live better than you do and your grandchildren live

better than their parents. But you also want a system that does produce lots of goods and

services that does not leave behind a person who accidentally got the wrong ball and is

not well wired for this particular system. I am ideally wired for the system I fell into

here. I came out and got into something that enables me to allocate capital.

If all of us were stranded on a desert island somewhere and we

were never going to get off of it, the most valuable person there would be the one who

could raise the most rice over time. I can say, “I can allocate capital!” You wouldn’t be

very excited about that. So I have been born in the right place.

Bill Gates says that if I had been born three million years ago, I would have been some

animal’s lunch. He says, “You can’t run very fast, you can’t climb trees, you can’t do

anything.” You would just be chewed up the first day. You are lucky; you were born

today. And I am. The question getting back, here is this barrel with 6.5 billion balls,

everybody in the world, if you could put your ball back, and they took out at random a

100 balls and you had to pick one of those, would you put your ball back in?

Now those 100 balls you are going to get out, roughly 5 of them will be American, 95/5.

So if you want to be in this country, you will only have 5 balls, half of them will be

women and half men–I will let you decide how you will vote on that one. Half of them

will be below average in intelligence and half above average in intelligence. Do you want to

put your ball in there? Most of you will not want to put your ball back to get 100. So

what you are saying is: I am in the luckiest one percent of the world right now sitting in

this room–the top one percent of the world. Well, that is the way I feel. I am lucky to be

born where I was because it was 50 to 1 in the United States when I was born. I have

been lucky with parents, lucky with all kinds of things and lucky to be wired in a way

that in a market economy, pays off like crazy for me. It doesn’t pay off as well for

someone who is absolutely as good a citizen as I am (by) leading Boy Scout troops,

teaching Sunday School or whatever, raising fine families, but just doesn’t happen to be

wired in the same way that I am. So I have been extremely lucky so I would like to be

lucky again.

Then the way to do it is to play out the game and do something you enjoy all your life

and be associated with people you like. I only work with people I like. If I could make

$100 million dollars with a guy who causes my stomach to churn, I would say no because

in way that is very much like marrying for money which is probably not a very good idea

in any circumstances, but if you are already rich, it is crazy. I am not going to marry for

money. I would really do almost exactly what I have done except I wouldn’t have bought

the US Air.

_____________________________

Some highlights from The Economist’s article on sports betting:

Skilled players are “sharps” and given “stake restrictions” if they play too well (bets are capped). The rest of the players are called “squares.” As important as keeping out “sharps” is hooking “whales”, the deep-pocketed players that are willing to keep playing (and losing) large sums. Some “whales” are actually “sharps” in disguise, though. They’ll lose a bunch of bets to lull the sports book then put down a massive bet when they have an edge. While there is a risk of a “whale” being a “sharp”, the value of a real “whale” is so high that sports book will take the risk.

How sports books profile players:

- Playing on Mobile is a good sign (where majority of people play)

- Playing on PCs is a bad sign (it’s easier to compare odds and run models)

- Women bettors are a red flag (most bettors are men and “sharps” often use women to place bets)

- First wagers are a major tells (typical bettors go after top leagues — NFL, NBA, EPL — and do so near the start of the game).

- Popular bets for “squares”: who will win, scoring margins and how star player will perform (also, they love multi-leg parlays).

- “Sharps” go after less popular leagues and place bets as soon as odds are published, when they are most mispriced. They also go after less popular bets such as “pts in Q3” or stats from a random player (“Sharps” rarely do parlays and don’t withdrawal winnings often).

- ”Sportsbooks look at a player’s ‘closing-line value’ — a measure that compares the odds at which he bets with those available right before a match begins. If it is consistently ahead of the market over his first ten wagers, he is highly likely to beat the book in the long run.”

- E-wallets are a red flag (sports books prefer debit direct deposit that can attach a player to a single account; an e-wallet is more anonymous and players can move cash between sports books more quickly to shop for the best odds)

E-wallet users, women and bets over $100 are flagged. These suspicious bettors are given 30% of maximum bet (and proven sharps only allowed 1%).

By the time a customer places his first bet, [sports books] are 80-90% certain they know the lifetime value of the account. Sports book mathematically monitor players and creates a new risk score every 6-8 hours (risk score = estimate of probability that customers will wind up unprofitable).

High-skilled players will often get a “beard” to bet on their behalf. Most sports books ban this practice but it is widespread. Safest “beards” are close friends and relatives because you can mostly rely on them to pay out any winnings. The “beards” try to look like degens (playing at 3:00 am, bet non-stop and doing ridiculous parlays) before placing a winning bet.

The most effective strategy for “sharps” is “whale-flipping”. Find a losing gambler, then ask to put a (likely) large winning bet among their pool of guaranteed losers. Once “sharps” max out the people they can use as “beards”, they tap professional networks called “movers”. These “movers” employ a bunch of “mules” who can put down bets on the behalf of the network. Low-end movers charge 10-20% while high-end movers charge 50% of winnings.

___________________________________