Warren Buffett on Luck:

“When (Charlie Munger and I) were born the odds were over 30-to-1 against being born in the United States. Just winning that portion of the lottery, enormous plus. We wouldn’t be worth a damn in Afghanistan. We won it partially in the era in which we were born by being born male. We won it in another way by being wired in a certain way, which we had nothing to do with, that happens to enable us to be good at valuing businesses. And you know, is that the greatest talent in the world? No. It just happens to be something that pays off like crazy in this system.”

If you had invested from 1960 to 1980 and beaten the market (the S&P 500) by 5% each year, you would have made less money than if you had invested from 1980-2000 and under-performed the market by 5% every year. When you start investing can be more important than anything else.

_______________________________________

For years, 529 accounts were synonymous with college savings plans. But recent updates have given the accounts a makeover. They’ve become education savings accounts, not just college savings accounts. The latest change allows the accounts to be used to help pay for a broader range of post-high school credentials, like certification in specialties like auto mechanics or food safety, and related expenses.

Money saved in the accounts can be used to pay for tuition and supplies for work force training, including certification and licensing programs, often offered at trade or technical schools; to pay for preparation and testing required to “obtain or maintain” a credential; and to pay fees for required continuing education. Some shorter-term credentialing programs were already eligible for tax-free 529 withdrawals, but only if they were offered at community colleges. Now, the range of options is wider.

________________________________________

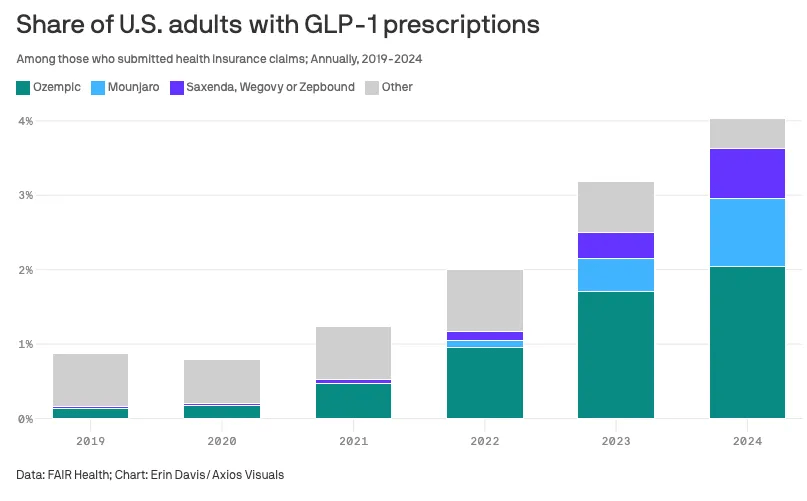

GLP-1s are a medication used for weight loss and diabetes management. In just 6 years after launch, more than 2% of Americans are taking this drug. To put the growth in context: GLP-1 drugs are set to generate nearly double the U.S. revenue of the iPhone’s first 10 years.

_______________________________________

Population ageing and decline is one of the most powerful forces in the world, shaping everything from economics to politics and the environment. It it implies the goal is the same today as it was in the past: finding ways to encourage couples to have more children. A closer look at the data suggests a whole new challenge.

Take the US as an example. Between 1960 and 1980, the average number of children born to a woman halved from almost four to two, even as the share of women in married couples edged only modestly lower. There were still plenty of couples in happy, stable relationships. They were just electing to have smaller families.

But in recent years most of the fall is coming not from the decisions made by couples, but from a marked fall in the number of couples. Had US rates of marriage and cohabitation remained constant over the past decade, America’s total fertility rate would be higher today than it was then. The central demographic story of modern times is not just declining rates of childbearing but rising rates of singledom: a much more fundamental shift in the nature of modern societies.

______________________________

When you ask people, “What builds wealth?” you get a wide variety of answers. Some will tell you it’s mindset. Some will say work ethic. Some will say it’s spending. And a host of other explanations. If you could have just one piece of information on somebody to predict their future wealth, what would it be? Would you ask for their IQ? Whether they went to college? How about their parents’ education level?

The answer is the most obvious and straightforward: For someone of working age, their income is the best leading indicator of wealth. What leads to higher income? Hard work, connections, and luck are important, but high earners tend to follow one of four distinct paths. These paths won’t guarantee success, but they are where high incomes tend to cluster:

- Sales and Persuasion

- Technical/Analytical Skills

- Advanced Degrees/Credentials

- Entrepreneurship and Business Building

______________________________

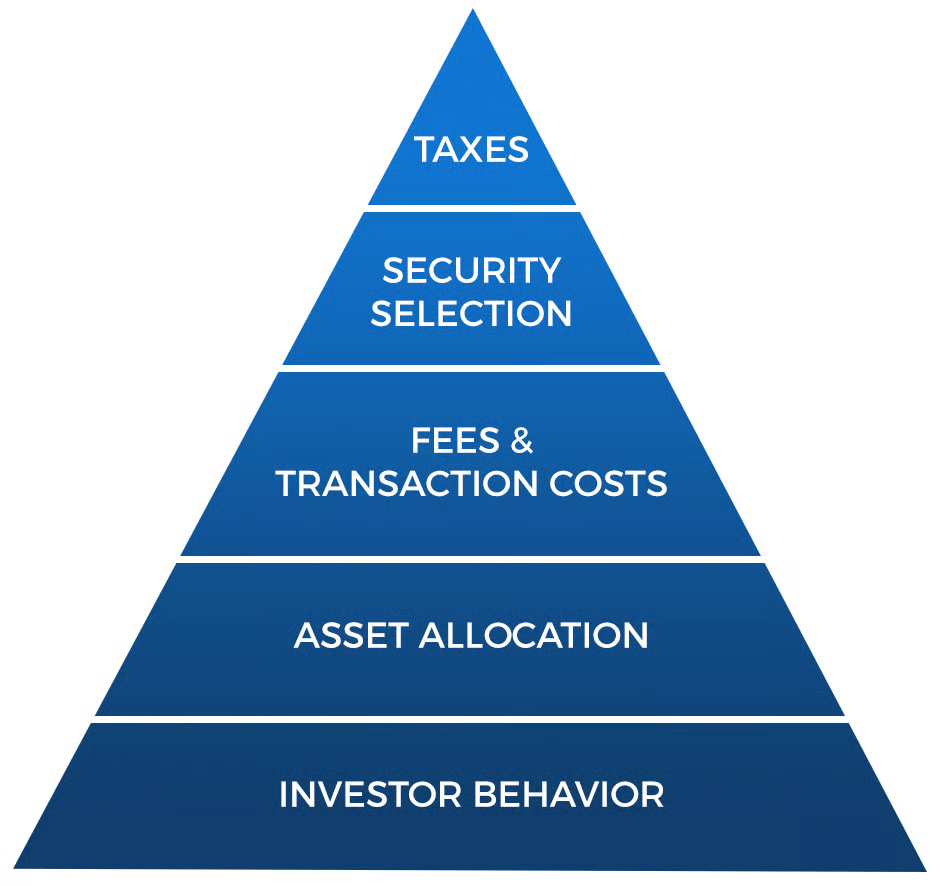

Some investing skills have to be mastered before any other skills matter at all. There is a hierarchy of needs.

At the foundation of this hierarchy are the boring but essential behaviors: living below your means, having an emergency fund, staying invested during downturns, and picking a reasonable asset allocation. These things aren’t exciting. They won’t get you likes. But they will carry you through decades of compounding.

Higher up the hierarchy are things like choosing the right stocks or funds and minimizing fees. These are useful, but only after the foundation is strong. Otherwise, you’re just rearranging furniture in a house with shaky walls.

Now, here’s the irony: the things that matter most often feel the least urgent. And the things that are least important often feel the most urgent. This is especially when social media and peer pressure amplify them. We chase what others are talking about, not what we truly need. If you get the big stuff right, the foundational skills, then the small stuff actually becomes less important.