These days I’m pretty good at avoiding the trap that’s been called “onedayism” – the tendency to live as if the really important part of life won’t truly begin until you’ve reached some far-off milestone, like finding a long-term partner, or achieving financial security, or until you’ve fixed your problem with procrastination, or once world events don’t seem so apocalyptic. (You have to find meaning, accomplishment and joy in the midst of all that, not solely once it’s all been “sorted out”.)

Yet as I’ve relaxed my grip on that sort of unconscious postponement, I’ve found it’s still easy to make the same error, just on a much shorter timescale: to proceed through the day as if my generally sane and interesting and enjoyable life can resume just as soon as I’ve got this task out of the way, cleared this batch of email, or made it through to this evening. But of course you can miss your whole life in this manner, ceaselessly focused on a point a few hours in the future, no less surely than with the longer-timescale version.

The answer definitely isn’t to beat yourself up for not yet having perfectly mastered the art of being present. (That, you might notice, is just another version of the same mistake.) But you can remind yourself to unclench a bit, to soften, to fall back into what’s really going on, here and now, and to see there’s no reason why you can’t find this very experience juicy and alive. I like how the entrepreneur Shane Melaugh puts it: “Your life plays out over your entire lifetime.” Which always includes now.

None of this is about attaining some kind of pristine, static, passive state of Presence In The Moment, as it sometimes gets presented in spiritual circles. You still get to pursue goals and ambitions and exciting future states; you can still look forward to the end of the day. It’s just that you get to experience all that as something that’s unfolding now, in a present moment that gets to count just as much as any moment that might coming in future.

__________________________

Humility: Given how little of the world we’ve experienced, in most situations we are likely wrong, especially in knowing how other people think and make decisions.

Self-Discipline: Everyone knows the famous marshmallow test, where kids who could delay eating one marshmallow in exchange for two later on ended up better off in life. But the most important part of the test is often overlooked. The kids exercising patience often didn’t do it through sheer will. Most kids will take the first marshmallow if they sit there and stare at it. The patient ones delayed gratification by distracting themselves. They hid under a desk. Or sang a song. Or played with their shoes. Delayed gratification isn’t about surrounding yourself with temptations and hoping to say no to them. No one is good at that. The smart way to handle long-term thinking is enjoying what you’re doing day to day enough that the terminal rewards don’t constantly cross your mind.

Influence: A good storyteller with a decent idea will always have more influence than someone with a great idea who hopes the facts will speak for themselves. People often wonder why so many unthoughtful people end up in government. The answer is easy: Politicians do not win elections to make policies; they make policies to win elections. What’s most persuasive to voters isn’t whether an idea is right, but whether it narrates a story that confirms what they see and believe in the world. It’s hard to overstate this: The main use of facts is their ability to give stories credibility. But the stories are always what persuade.

Balance: Someone with B+ intelligence in several fields likely has a better grasp of how the world works than someone with A+ intelligence in one field. The best thing to do is to quickly learn and accept that your field is no more important or influential to other people’s decisions than dozens of other fields, which pushes you to spend your time connecting the dots between your expertise and other disciplines. Being an expert in economics would help you understand the world if the world were governed purely by economics. But it’s not. It’s governed by economics, psychology, sociology, biology, physics, politics, physiology, ecology, and on and on.

____________________________

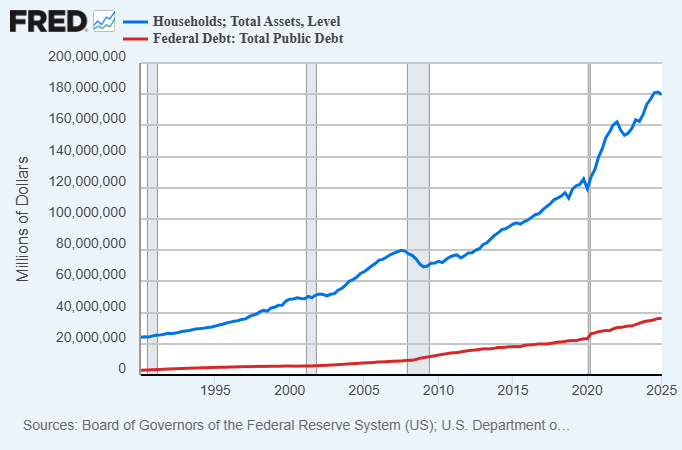

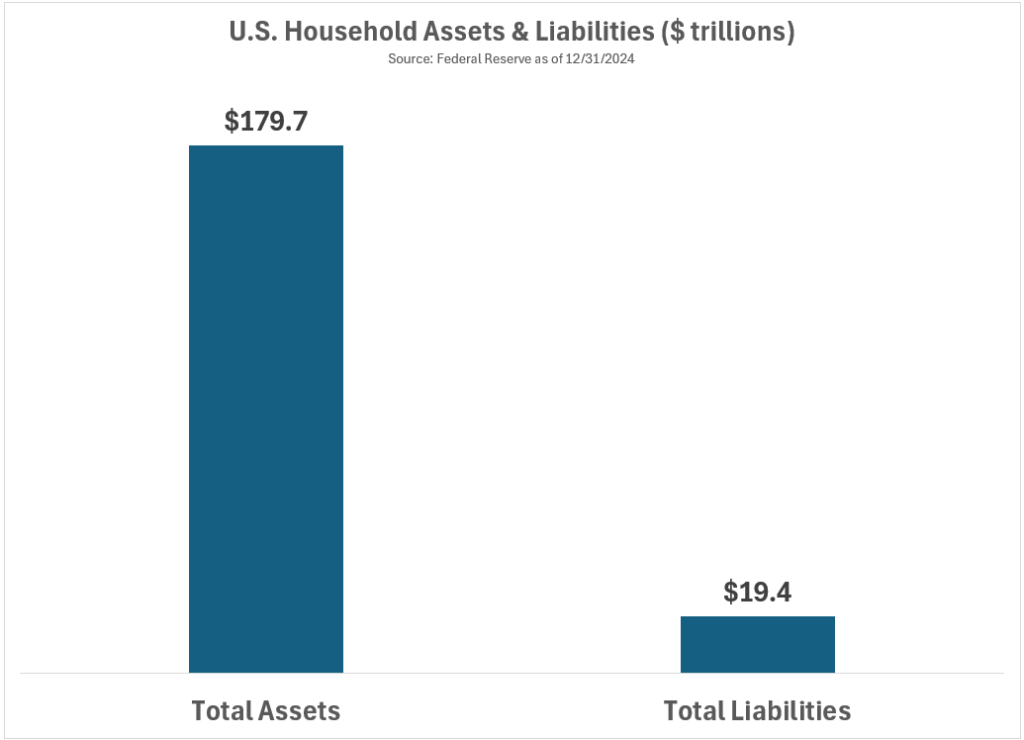

The federal government has a bit over $36 trillion in debt. To put that in context, US households collectively have $180 trillion in assets, or $160 trillion in net worth after liabilities (mostly mortgages) are subtracted.

The US monetary base is about $6 trillion. There is over $120 trillion worth of dollar-denominated loans and bonds outstanding in total (public and private, domestic and international, excluding derivatives). In the foreign sector alone, there is about $18 trillion worth of dollar-denominated debt. What this means is that there is an incredibly large amount of inflexible demand for dollars domestically and throughout the world. Everyone who owes dollars, needs dollars.

When a country like Turkey or Argentina hyper-inflates or nearly-so, it’s in a context where practically nobody outside of their country needs their lira or pesos. There’s no entrenched demand for their currency. And so, if their currency becomes undesirable for any reason (usually due to rapid money supply growth), it’s very easy to just repudiate it and send its value to Hades.

Countless specific entities around the world contractually owe countless other specific entities around the world a certain number of dollars by a certain date in time, and thus need to constantly try to get their hands on dollars. The fact that they collectively owe more dollars than there are base dollars in existence is important. That’s why the monetary base can double, triple, or more, and not be outright hyper-inflationary. It’s still a small increase relative to how much contractual demand there is for dollars. When outstanding debt greatly exceeds the number of base units, it takes a ton of printing of base units to render that base unit worthless.

Suppose that bond yields break out to the point of rendering banks insolvent or the Treasury market acutely illiquid. The Fed can step in with QE or yield suppression. Yes, that comes with the cost of potential price inflation and has implications for asset prices, but no, it’s not hyper-inflationary in this context.

____________________________

Think Twice Before You Click Unsubscribe On An Email:

- Clicking “unsubscribe” in emails can lead to malicious websites testing if your email is active.

- Criminals can build a files on users who click unsubscribe links, hoping to eventually extort money through scams.

- Use list-unsubscribe headers, mark emails as spam or use disposable email addresses for online sign-ups.

____________________________

Cannabis use among seniors surged 46% in the last two years; 7% of adults 65 and older now report recent use. This rise isn’t just in numbers but also in diversity older users today are more likely to be women, college-educated, and higher-income. Researchers suggest legalization and growing social acceptance are contributing factors, especially in states with medical marijuana laws. The trend is especially notable among those with chronic illnesses, raising both opportunities and concerns for medical professionals trying to balance symptom relief with the complexities of aging.

_____________________________

College Baseball Has a Power Problem: Players Keep Hitting the Ball Too Hard: In the big leagues, only superstars like Aaron Judge can routinely crush the ball at speeds in excess of 115 mph. In college baseball these days, everybody’s doing it.

- College baseball is seeing unprecedented exit velocities, rivaling and sometimes exceeding those in Major League Baseball.

- College players are 42% more likely to hit balls at 115 mph or harder than MLB players.

- The reasons for the surge in exit velocity aren’t entirely clear, but it’s creating safety concerns for pitchers, infielders or with fans sitting in the stands

___________________________

Nerds is on track to hit more than $900 million in sales this year, a more than 1,700% increase from the $50 million in sales in 2018. The unprecedented surge is directly attributed to the widely popular Nerds Gummy Clusters, which represented the first meaningful innovation for the once-sleepy brand in years. Nerds Gummy Clusters are now the top sugar confection on the market, overtaking skittles.

_____________________________

Older people will remember the time when there was – for a while – a discussion about how the US stock market had significantly higher returns overnight when the market was closed vs. the actual trading day. Those were the innocent days of an era long gone, aka 2018, when we were all naïve and enthralled by a bull market that couldn’t be derailed by anything. The graph below shows the “overnight effect” through January 2018:

This effect was so promising that it even led to the launch of an ETF in June 2022 that focused on this trade. A product that was so successful that it was liquidated in August 2023.

A new study shows that the effect disappeared after the pandemic. What makes the study interesting, though, is that they seem to find why the effect existed in the US (and not other countries) in the first place: Hype.

They noticed that stocks with large trading volume just after markets opened were the main driver of the overnight effect. For the uninitiated, trading volumes are heavily concentrated during the last hour of the day. Institutional investors typically want to trade when liquidity is highest which means they tend to wait until the end of a trading day to execute their orders. This becomes a self-fulfilling prophecy. Because big institutions focus their trading on the last hour of the day, this is where volume is highest and this is when other institutions want to trade in the future as well.

________________________

The number of paying Tinder users has dwindled to just 9.1 million in its most recent quarter — down 18% from a peak of 11.1 million in late 2022. While Tinder remains Match Group’s biggest brand, Hinge, another dating app under the Match umbrella, saw paying users grow 19% year over year in Q1 2025.

Double Date, a feature that allows pairs of users to match with other pairs, is now available on Tinder in the US, with a global rollout planned for July. So far, the results seem hopeful: after first trialing the feature in a handful of European countries, Tinder reported that women were 3x more likely to “like” a pair than an individual profile, and that nearly 90% of Double Date profiles came from users under 29.