When you’re independent you feel less desire to impress strangers, which can be an enormous financial and psychological cost. Speaking of hidden forms of debts: How much of what takes place in our modern economy is done purely for signaling reasons? It’s impossible to quantify, but you know it when you see it. And taking an action to impress other people is a direct form of dependence.

___________________________

After shuffling the cards in a standard 52-card deck, Alex Mullen, a three-time world memory champion, can memorize their order in under 20 seconds. As he flips though the cards, he takes a mental walk through a house. At each point in his journey — the mailbox, front door, staircase and so on — he attaches a card. To recall the cards, he relives the trip. This technique, called “method of loci” or “memory palace,” is effective because it mirrors the way the brain naturally constructs narrative memories: Mullen’s memory for the card order is built on the scaffold of a familiar journey.

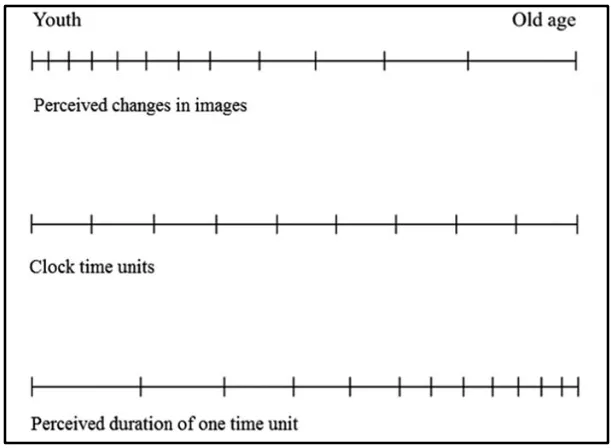

Analyses have generated a new understanding of how the human brain constructs narrative memories. Nearly the entire brain is involved, contradicting earlier ideas that placed memory in specific brain regions. And memories are built in temporal pieces, each of which ranges from a second to a minute in length. The brain places those pieces onto the scaffolds of event scripts. It’s all a construction. It’s not like you have this video camera of exactly what happened, exactly as it happened. You have to reconstruct, based on pieces of the experience, what you think happened.

The brain doesn’t simply record what it perceives. Instead, much if not most of the brain’s reaction to an event or story originates in memories of how that type of event usually plays out. In other words, we process the present through the past.

There are two critical steps to constructing memories. As we go about our day, we record the new experiences in pieces of varying size and complexity, from simple perceptions to stunning plot twists. Meanwhile, our brains access templates for these new events based on knowledge of similar ones, and place the pieces of the evolving memory in that context. Memories, it turns out, are more like paint-by-number than rendered from scratch on a blank canvas. The way we experience and remember events arises largely from our mental state, as opposed to properties of the events themselves.

_____________________________

We report eleven studies that show declines in life satisfaction and happiness among young adults in the last decade or so, with less uniform trends among older adults. In the U. S. life satisfaction rises with age. This is broadly confirmed in several other datasets including four from the European Commission across five other English-speaking countries: Australia, Canada, Ireland New Zealand and the UK. There is broad evidence across all of these English-speaking countries that happiness and life satisfaction since 2020 rise with age. In several of these surveys we also find that ill-being declines in age. The U-shape in well-being by age that used to exist in these countries is now gone, replaced by a crisis in well-being among the young.

_____________________________

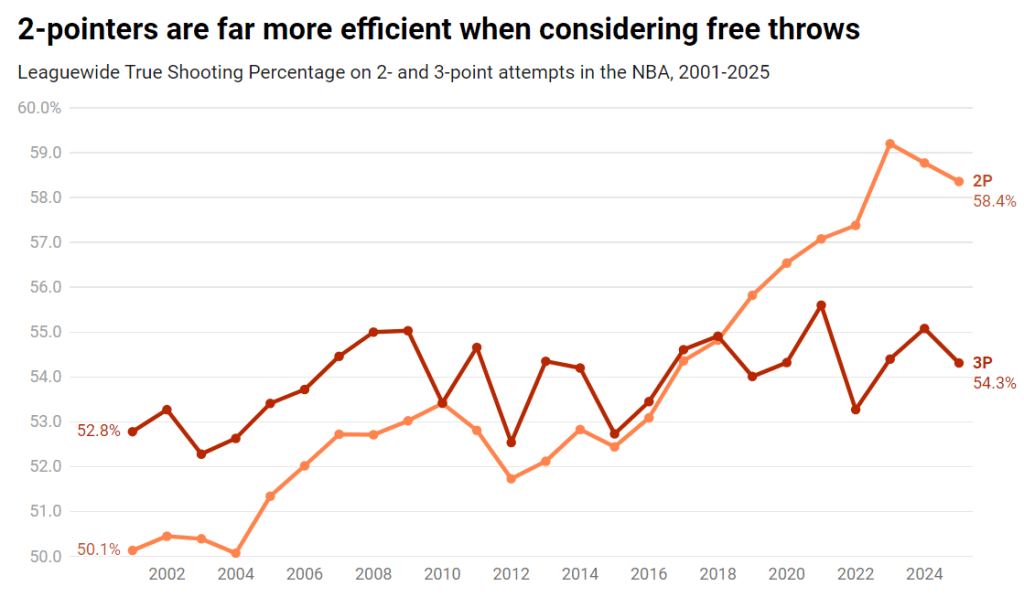

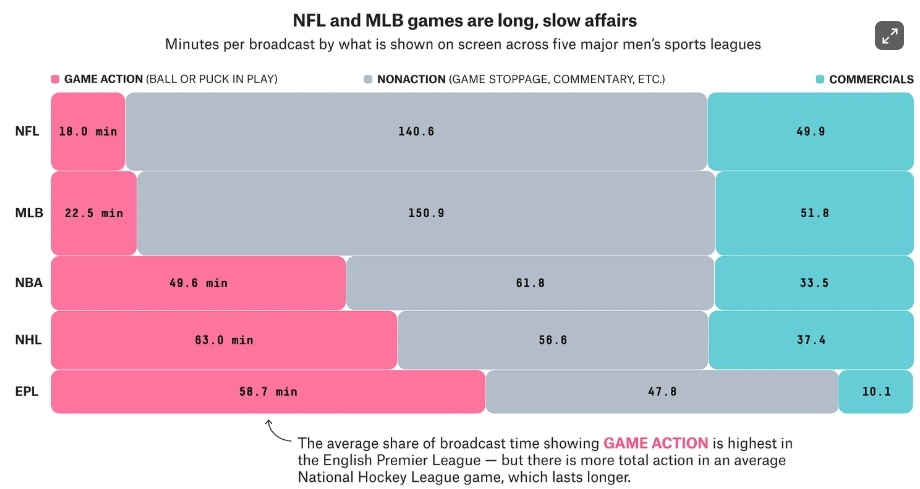

Which Sports Provide the Best Return on Your Time Investment? Football has the greatest amount of “false advertising” in terms of how much time the game actually takes versus how long it lasts on the clock. Hockey, by contrast, is the most honest American sport — with a ratio of 2.5 “real” minutes per minute on the scoreboard — with NBA games checking in right behind at 2.8 “real” minutes per clock minute.

_________________________________

The U.S. has become much less Christian, driven in large part by Gen Z and younger Millennials, according to a new Pew study. “We’ve had rising shares of people who don’t identify with any religion — so-called ‘nones’ — and declining shares who identify as Christian, in all parts of the country, in all parts of the population, by ethnicity and race, among both men and women, and among people at all levels of the educational spectrum,” he says about the survey findings. A significant portion of U.S. adults (35%) have switched from the religion of their childhood.

________________________________

Lessons From This Year’s Berkshire Hathaway Letter. Sixty years ago, Warren Buffett bought control of Berkshire Hathaway. He’s highlighted that mistake on and off ever since. He did so once again in this year’s annual letter, which came out over the weekend.

_______________________________

India is best thought of as a country of 1.4 billion people of whom about 300 million are leading a relatively comfortable life in major cities like Bombay and New Delhi while 1.1 billion are in rural or urban poverty. India is poor but 300 million middle-class citizens is a population almost the size of the United States. Again, that’s the point. A U.S.-sized middle-class population already exists in India with 1.1 billion more people waiting to join the ranks. The growth potential is almost beyond comprehension.

___________________________

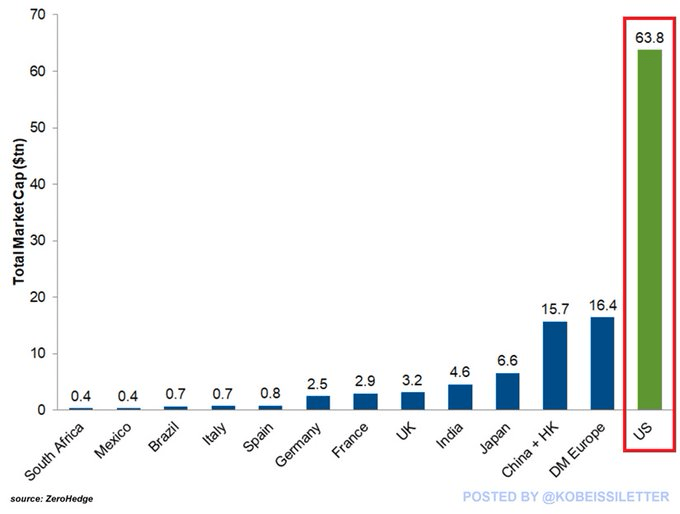

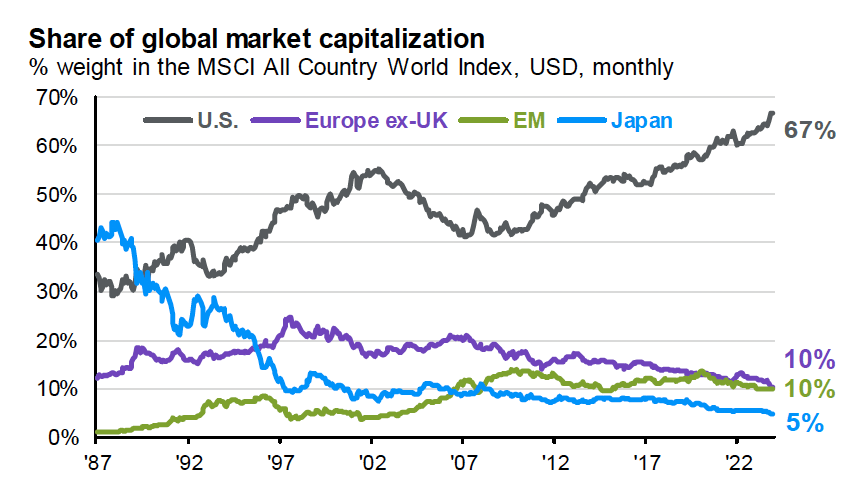

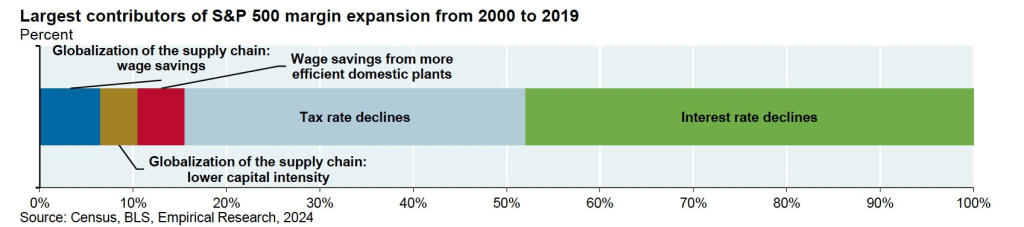

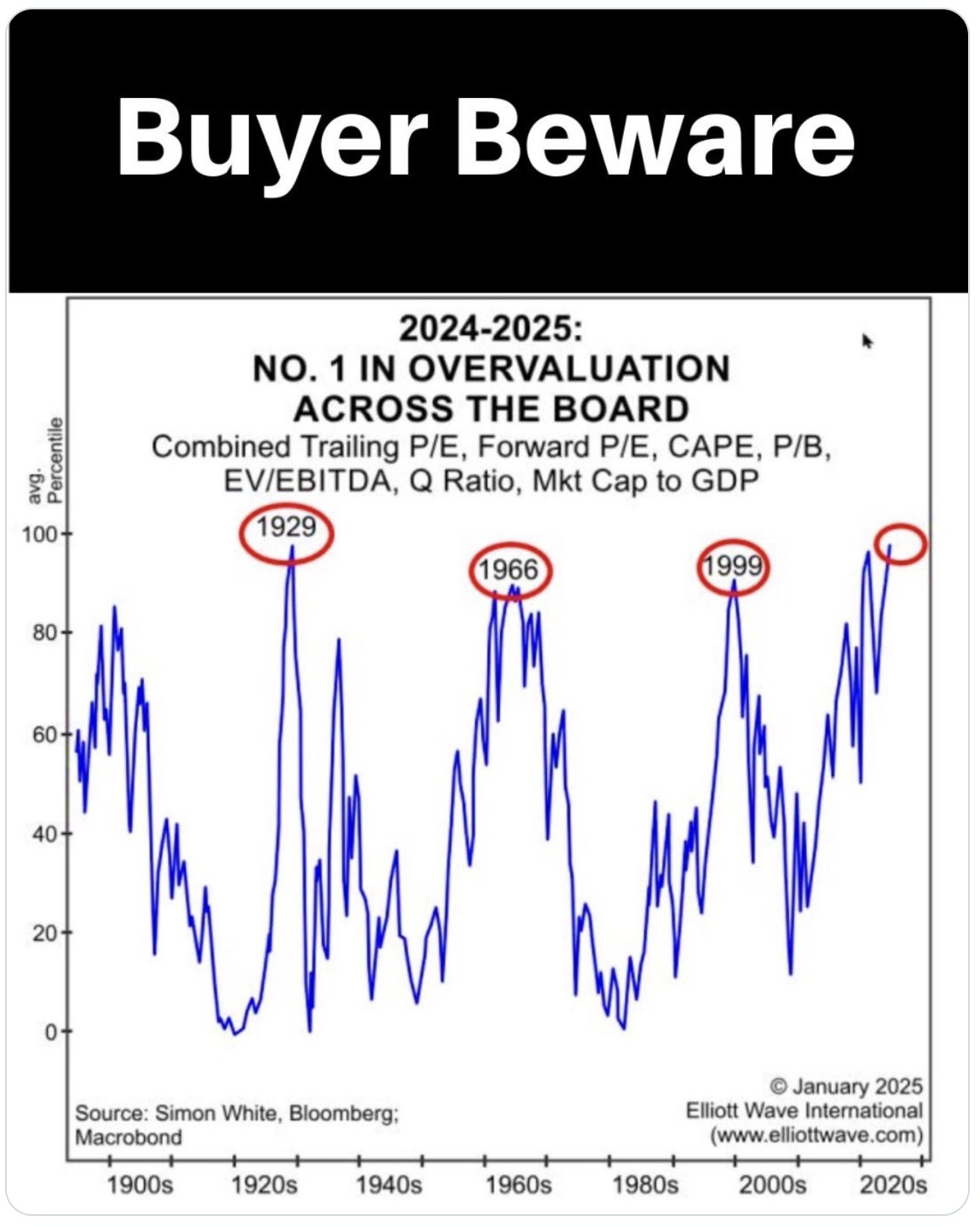

My quest for cheap stocks has led me to South America. Specifically, Brazil. The largest Brazil ETF, EWZ, currently trades at around 8x earnings with an 8% dividend yield. An entire country ETF offering an 8% yield. Meanwhile, the dividend yield on the S&P 500 is 1.27%. EWZ trades at 1.5x book value, while the S&P 500 currently sits at 5.01x (a higher multiple means stocks are more expensive). The chart combines seven metrics to show just how expensive the U.S. stock market has become.

___________________________

The U.S. stock market as a whole is the most expensive in the world, but when you pull out just the technology stocks, they are on another planet in terms of how they’re priced relative to their earnings.

___________________________

Jim Chanos spoke with Paul Krugman this week on market sentiment, A.I. and data centers:

How about the capital being employed? There better be something new. I mean, we’re talking now for the just a top handful of companies doing $300 to $500 billion in capex [capital expenditures] annually. I mean, AI isn’t like the internet, which made things more capital efficient and raised returns on capital. So far, AI is doing the opposite. It is a massively capital-intensive business. Someone joked that the top tech companies are now looking like the oil frackers did in 2014, 2015, where more and more capital is chasing arguably a variable return.

Fracking technology has revived the U.S. oil and gas industries, and along with renewables, has made America energy-independent for the first time in generations. But the fracking companies themselves turned out to be far less profitable than they led investors to believe.