A few of my favorites from an excellent best things learned in 2025 list:

- All things being equal, the liquid inside a glass bottle contains more microplastics than the liquid inside a plastic bottle—up to 50X more! This is because plastic-coated metal caps found on glass bottles shed more particles than plastic caps found on plastic bottles.

- If you have a son, the chances of your next child being a boy are not 50%, they are actually 57%.

- Noise-canceling headphones are causing hearing problems in young people, not because they’re listening with the volume too high, but because blocking ambient noise prevents the brain from learning to filter and process everyday background sound in the real world.

- In team sports, women are 13.69 times more likely to be attacked by a fellow teammate than men.

- Until very recently, networks didn’t save live television footage because storage costs were too high. The only reason we have access to footage that aired between 1979 and 2012 is because a woman from Philadelphia recorded it and saved it on over 40,000 VHS tapes.

- The screens of all laptops in Apple stores are set at an angle of exactly 76 degrees, which is just awkward enough to invite people to tilt them back a bit more, thereby taking the first step toward interacting with the product.

- No NFL game has ever ended with a score of 36–23. Across the approximately 17,000 games that have been played in NFL history, this score should have happened 2.68 times by now.

- Women are more likely to believe ghosts are real; men are more likely to believe aliens are real.

- Coal-burning plants release 100 times as much radiation as nuclear plants per megawatt of power produced.

- In 2024, the word “delve” appeared in journal abstracts 28X more frequently than in 2022 because ChatGPT likes the word delve.

- The average West Virginian eats more than one hot dog per day.

- In Mexico, extending the school day by 3.5 hours led to a 12.6% increase in divorce rates. The extra time made it more likely for women to participate in the labor market, thus increasing their economic independence.

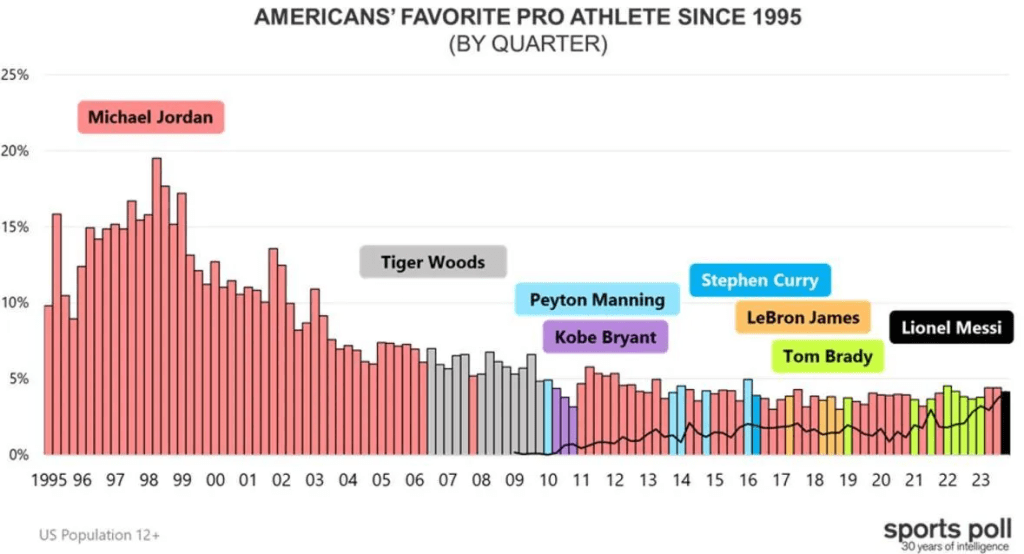

- Before 2000, it was common for 10% of Americans to have the same favorite athlete. The 10% threshold was last crossed in 2003, and since 2014, no more than 5% of Americans have had the same favorite athlete. This trend reflects a broader shift away from monocultural sports consumption, where everyone watches the same sports on a few channels, and a shift toward the fragmentation of sports media, where audiences are split across digital platforms and niche interests, preventing any single athlete from dominating the national consciousness.

_____________________________

I conducted dozens of bot challenges based on real things people do with AI, including writing breakup texts and work emails, decoding legal contracts and scientific research, answering tricky research questions, and editing photos and making “art.” Human experts including best-selling authors, reference librarians, a renowned scientist and even a Pulitzer Prize-winning photographer judged the results:

- For writing and editing – use Claude

- For research and quick answers – use Google’s AI Mode

- For working with documents – use Claude

- For images – use Google’s Gemini

If I could change one thing about today’s AI tools, I’d make them better at asking follow-up questions that could completely change the answer.

When I asked the chair of the department of medicine at the University of California to judge ChatGPT’s responses to real medical questions he said the difference between a bot with access to infinite knowledge and a good human doctor is that the doctor knows how to answer a question with more questions. That’s how you actually solve someone’s problem.

He suggested an AI strategy I now use regularly: Front-load your queries to a chatbot with as many details as you can think of, knowing that the AI might not stop to ask for some of them before trying to answer. Instead of “summarize this lease,” try “summarize this lease for a renter in D.C., flagging clauses about fees, renewal and early termination.”

___________________________

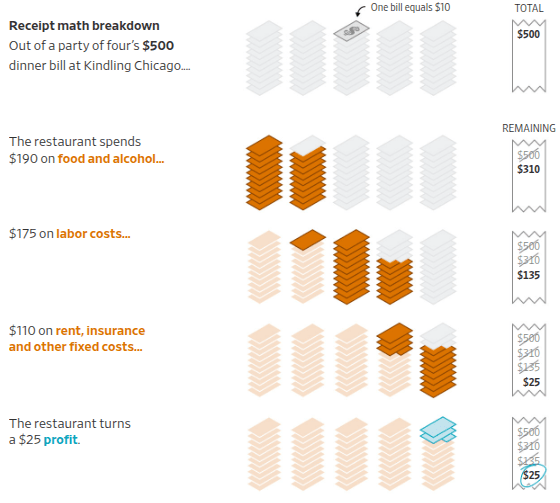

The bill on a steak dinner for four can easily climb to $500. But after accounting for the restaurant’s costs—from the steak to rent—profits from the meal amount to around $25.

___________________________

_____________________________

Warren Buffett always had lunch at the Stage Deli on Seventh Avenue. A friend pointed out there were many good eateries in New York — why not try someplace new? Buffett replied, “If I like the Stage, why eat somewhere else?” The fear of missing out — responsible for a high percentage of foolish speculations — was unknown to him. This character quirk flowed from a subtle insight: People get in trouble far more often from doing and changing too much rather than doing too little.

____________________________

__________________________

Podcasts have devastated my relationship to music, but that is not to say I’ve embraced silence. Whereas I used to listen to music all the time, now I fill every available moment with the sound of people talking.

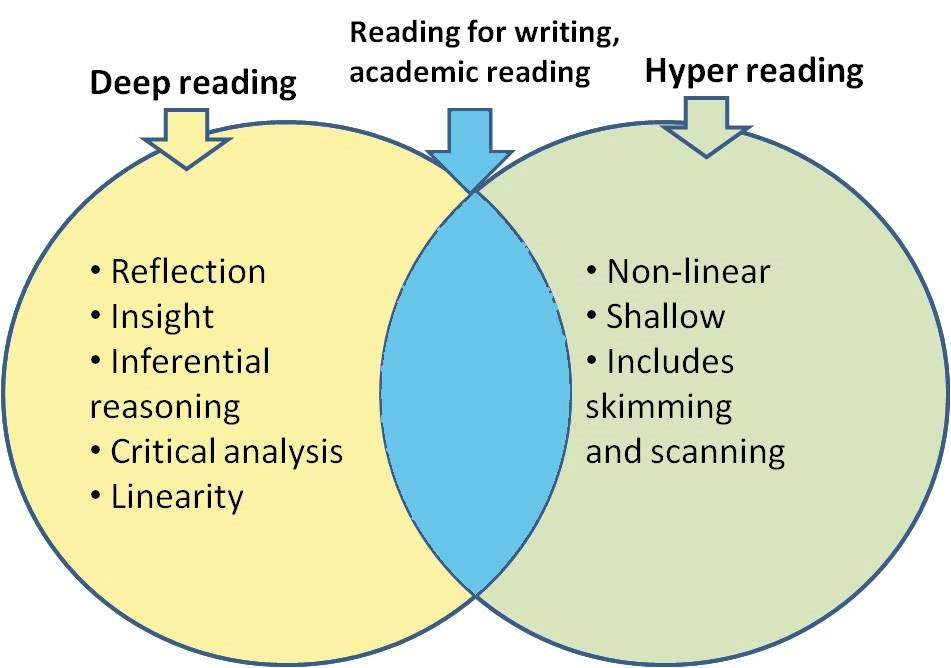

My change in listening habits comes from a compulsion that many people in my life share: to make every minute of the day as “productive” as possible. By that blinkered calculus, an informative podcast will always trump music. But listening incessantly to podcasts has actually narrowed my interests and shown me just how limiting too much information can be.

I’ve found that trying to make every listening minute count inevitably becomes counterproductive. The internal pressure to optimize free time and always multitask is ultimately exhausting, not enlightening.

___________________________

There were incredible 2025 medicine breakthroughs in:

- Metabolic Medicine

- Infectious Diseases

- Transplant Medicine Firsts

- Gene Therapies

- Neurological Diseases

- Cell Therapies

- Cancer Vaccines and Treatments