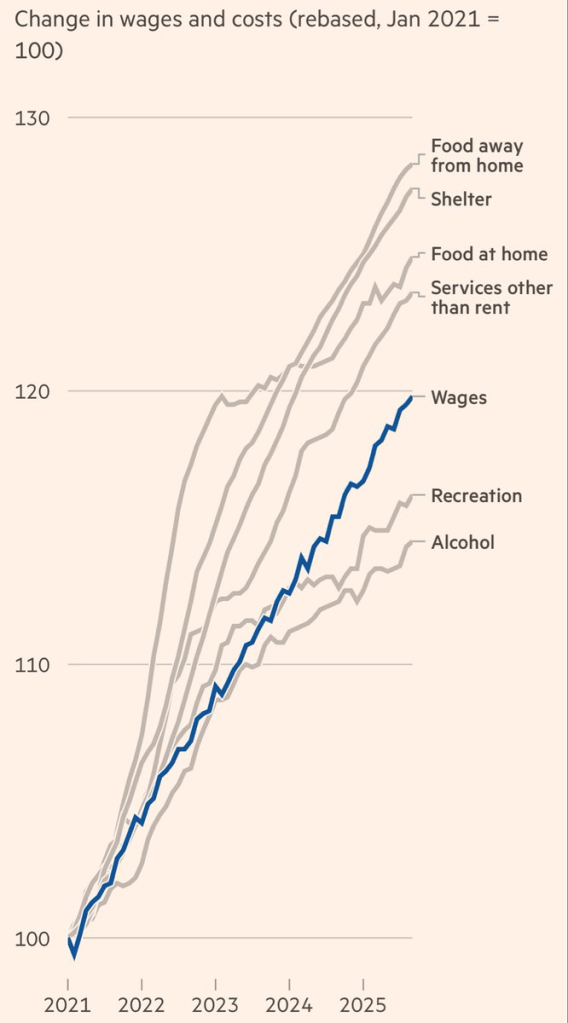

I wanted to see what would happen if I ignored the official stats and simply calculated the cost of existing. I built a Basic Needs budget for a family of four (two earners, two kids). No vacations, no Netflix, no luxury. Just the “Participation Tickets” required to hold a job and raise kids in 2024. Using conservative, national-average data:

- Childcare: $32,773

- Housing: $23,267

- Food: $14,717

- Transportation: $14,828

- Healthcare: $10,567

- Other essentials: $21,857

Required net income to live: $118,009. Add federal, state, and FICA taxes of roughly $18,500, and you arrive at a required gross income of $136,500.

I then ran the numbers on what happens to a family climbing the ladder toward that break-even number. What I found explains the “vibes” of the economy better than any CPI print.

Our entire safety net is designed to catch people at the very bottom, but it sets a trap for anyone trying to climb out. As income rises from $40,000 to $100,000, benefits disappear faster than wages increase. I call this The Valley of Death. Let’s look at the transition for a family in New Jersey:

1. The View from $35,000 (The “Official” Poor)

At this income, the family is struggling, but the state provides a floor. They qualify for Medicaid (free healthcare). They receive SNAP (food stamps). They receive heavy childcare subsidies. Their deficits are real, but capped.

2. The Cliff at $45,000 (The Healthcare Trap)

The family earns a $10,000 raise. Good news? No. At this level, the parents lose Medicaid eligibility. Suddenly, they must pay premiums and deductibles.

- Income Gain: +$10,000

- Expense Increase: +$10,567

- Net Result: They are poorer than before. The effective tax on this mobility is over 100%.

3. The Cliff at $65,000 (The Childcare Trap)

This is the breaker. The family works harder. They get promoted to $65,000. They are now solidly “Working Class.” But at roughly this level, childcare subsidies vanish. They must now pay the full market rate for daycare.

- Income Gain: +$20,000 (from $45k)

- Expense Increase: +$28,000 (jumping from co-pays to full tuition)

- Net Result: Total collapse.

When you run the net-income numbers, a family earning $100,000 is effectively in a worse monthly financial position than a family earning $40,000. At $40,000, you are drowning, but the state gives you a life vest. At $100,000, you are drowning, but the state says you are a “high earner” and ties an anchor to your ankle called “Market Price.”

In option terms, the government has sold a call option to the poor, but they’ve rigged the gamma. As you move “closer to the money” (self-sufficiency), the delta collapses. For every dollar of effort you put in, the system confiscates 70 to 100 cents.

___________________________

Bitcoin was never the future of money. It was a battering ram in a regulatory war. Now that war is wrapping up, and the capital that built it is quietly leaving. For 17 years we convinced ourselves that Magic Internet Money was the final state of finance. It was not. Bitcoin was a regulatory battering ram, a one purpose siege engine built to smash a specific wall: the state’s refusal to tolerate digital bearer assets.

That job is basically done. Tokenized US stocks are already being issued. Tokenized gold is legal and growing. Tokenized USD has a market cap of several hundred billion dollars. In wartime, a battering ram is priceless. In peacetime, it is a heavy, expensive antique.

_________________________

There is genuine and widespread despair in the U.S., but the primary reason isn’t economic, rather it is because human fulfillment requires more than material wealth, which in our quest for more stuff, we have forgotten. People need physical communities, and while the US excels at material wealth, it’s achieved it, especially in the last forty years, at the expense of the aesthetic, communal, stable, and personal, and so the bad vibes are justified.

Societies come with strong forces that shape expectations and even shape people’s understanding of a ‘good life.’ That is, society provides citizens playbooks that they are urged to follow which are supposed to end in happily ever after, and ours is that you can become a millionaire on your own terms as long as you hustle hustle hustle — and when that doesn’t happen, it’s very lonely and humiliating, because we as a culture have put all our eggs in that one particular basket. At the expense of community, friendships, and even family.

When you give your citizens a cultural script, built on the material, that promises hard work will lead to success, and then your policy design ensures it doesn’t, people will end up both economically frustrated, as well as spiritually empty, sitting in their living room streaming the latest movie wondering what exactly is the point of life. Or, they will feel they have failed at the material, while also having little else to give them meaning.

_____________________________

In his investment classic Winning the Loser’s Game, Charley Ellis tells a great story about healthcare and simplicity:

“Two of my best friends, who are at the peak of their distinguished careers in medicine and medical research, agree that the two most important discoveries in medical history are penicillin and washing hands (which stopped the spread of infection from one mother to another by the midwives who delivered most babies before 1900). What’s more, my friends counsel, there’s no better advice on how to live longer than to quit smoking and buckle up when driving. “

The Lesson: Advice doesn’t always have to be complicated to be good.