The “disease of more” was a phrase coined by National Basketball Association (NBA) coach Pat Riley to describe how, following a successful season, players can become entitled and want more of everything, including money, playing time, and media attention, which starts the onset of the team’s demise.

Needless to say, it’s not just NBA players that are affected by wanting more. Everyone wants more of everything, more so than ever before. Never in human history has there been such an overwhelming abundance of food, clothing, and material goods. Beyond necessities, consumer goods of all kinds—electronics, furniture, and household items are more accessible and affordable than ever, filling stores and warehouses to the brim.

In addition to the explosion of physical goods, the world now overflows with the non-physical. The digital age has brought an endless supply of information, entertainment and convenience.

Suppose you invented an incredible new passenger plane that reduced aviation fuel consumption by 50%, and every airliner worldwide adopted your aircraft. In that scenario, it’s a natural assumption to think that aviation fuel across the globe would reduce dramatically and be good for the environment. However, the opposite is true, and fuel consumption would increase because flying has become more efficient, which means more flights, lower prices and more demand for flying. This is known as the Jevons paradox.

Instead of digital communication making our lives easier with how we communicate with friends and family in a similar way to the workplace, the reduction of friction has made us do more of it than ever before to the point where it has become all-consuming. As things become easier — we just do more of it, and in spades. It’s been an evolution of deliberate and reflective communication to text speak, forwarding cat videos and memes.

News has become like a drug. We hear what is going on instantly all of the time. It becomes impossible to avoid. Every hour on the hour, the radio stations give us our fix. Social media was originally meant for discovering what your friends and family were doing, and now it’s just another news outlet keeping us transfixed.

In a roundabout way, we all fall into the chronic busyness category. Even if we’re not running around with packed diaries and overflowing work schedules, we’re all swamped with communication, news, things to buy, pings, breaking news alerts, and vibrations. We’re overloading our nervous system, which means we don’t have time to think, reflect, and consider. Being bored is invaluable thinking time to ponder what to do or change about your life.

One of our deepest evolutionary instincts—believing that more is always better—no longer serves us. Our ancestors struggled with scarcity; we struggle with excess. The way forward isn’t more, it’s less. Less news, less noise, less busyness, less mindless communication, fewer endless choices. More slowness, more presence, more clarity.

I love the title of a book by a financial market analyst named Walter Deemer: “When the Time Comes to Buy, You Won’t Want To.” The negative developments that make for the greatest price declines are terrifying, and they discourage buying. But, when unfavorable developments are raining down, that’s often the best time to step up.

To paraphrase Mark Twain, there are themes that rhyme throughout history. For that reason, just as I recycled the title of my post-Lehman (Sept 2008) bankruptcy memo for this one, I’ll also borrow its closing paragraph: Everyone was happy to buy 18-24-36 months ago, when the horizon was cloudless and asset prices were sky-high. Now, with heretofore unimaginable risks on the table and priced in, it’s appropriate to sniff around for bargains: the babies that are being thrown out with the bath water.

_______________________

Measures of retirement preparedness often suggest a substantial share of U.S. households are not on track to maintain their standard of living in retirement (financially). And many retirees report regret for not saving enough. Yet, when asked about their life satisfaction, the overwhelming majority (92%) of retired households say that they are “very satisfied” or “moderately satisfied.” In fact, gerontologists and psychologists have found a weak correlation between older Americans’ financial circumstances and retirement satisfaction.

_________________________

I think the thing that doesn’t get talked about is that no one wants to admit they’re a short-term thinker. We fool ourselves into believing we’re committed to something for the long haul, but we’ve been trained since childhood to be tactical, to chase the short-term win, to have a short attention span.

We emphasize who just scored a goal in soccer instead of asking, Does this kid have perseverance? Do they have good sportsmanship? Those qualities are much more useful for who they will become. But instead, we reward the kid who cheated or played dirty to score a goal. And that sticks with us.

I don’t judge people based on job interviews. That’s a false proxy — unless I’m hiring a talk show host, being good at a job interview doesn’t matter. Shielding ourselves from false proxies is really hard. Some people just can’t do it. They need immediate feedback, they need to know what’s happening right now.

__________________________

Despite the existence of an arsenal of medications that target the neurotransmitters in the brain thought to be responsible for mood disorders, about 30% of individuals with major depressive disorder remain treatment-resistant. This points to other possible factors that may contribute to the condition.

Research to date has implicated impaired energy metabolism as a potential culprit, as the brain requires enormous amounts of energy to function normally. This, in turn, would suggest that interventions known to boost cellular energy production might offer some relief for those suffering from depression, and attention has turned to one such supplement in particular: creatine. Well known for its role in muscular energetics, might creatine have additional benefits in the treatment of depression?

__________________________

Where people are happiest in the Americas, from the 2025 World Happiness Report.

Where people are happiest in Europe, from the 2025 World Happiness Report.

_____________________________

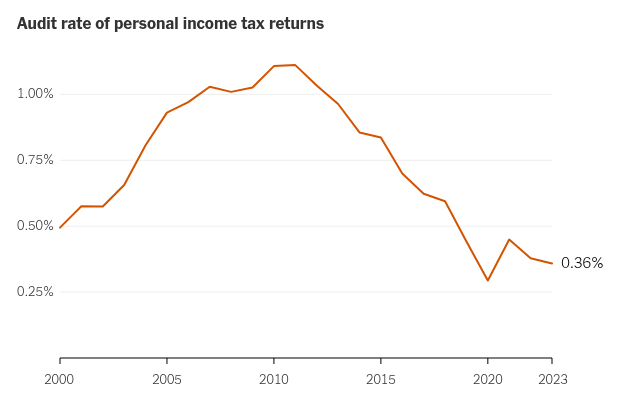

The odds of getting audited by the IRS are low:

_________________________

America Has Never Been Wealthier. Why Doesn’t Feel That Way? A 10 percent boost to the middle and especially higher incomes is money that feels real, like you can do something with it. For someone making $100,000, that means a $10,000 raise. But a 10 percent increase at the bottom, perhaps to an hourly wage of $16.50 from $15, means you’re still living hand-to-mouth. If we define someone as living paycheck to paycheck if they either say they do not have three months of emergency savings or say they cannot afford a $2,000 emergency expense, then 59 percent of American adults are “living paycheck to paycheck.

___________________________

| 1 | Hawaii | 13.9% |

| 2 | New York | 13.6% |

| 3 | Vermont | 11.5% |

| 4 | California | 11.0% |

| 5 | Maine | 10.6% |

| 6 | New Jersey | 10.3% |

| 7 | Illinois | 10.2% |

| 8 | Rhode Island | 10.1% |

| 9 | Maryland | 10.0% |

| 10 | Connecticut | 9.9% |

| 11 | Minnesota | 9.7% |

| 12 | New Mexico | 9.6% |

| 13 | Massachusetts | 9.6% |

| 14 | Utah | 9.5% |

| 15 | Ohio | 9.4% |

| 16 | Kansas | 9.3% |

| 17 | Iowa | 9.2% |

| 18 | Indiana | 9.1% |

| 19 | Mississippi | 9.1% |

| 20 | Oregon | 9.1% |

| 21 | Louisiana | 8.9% |

| 22 | Kentucky | 8.9% |

| 23 | Virginia | 8.9% |

| 24 | West Virginia | 8.9% |

| 25 | Nebraska | 8.8% |

| 26 | Colorado | 8.7% |

| 27 | Nevada | 8.6% |

| 28 | Washington | 8.6% |

| 29 | Arkansas | 8.6% |

| 30 | Pennsylvania | 8.6% |

| 31 | Georgia | 8.5% |

| 32 | Wisconsin | 8.3% |

| 33 | Michigan | 8.3% |

| 34 | Arizona | 8.2% |

| 35 | North Carolina | 8.2% |

| 36 | South Carolina | 8.2% |

| 37 | Alabama | 8.0% |

| 38 | Montana | 7.9% |

| 39 | Missouri | 7.8% |

| 40 | Texas | 7.8% |

| 41 | Idaho | 7.5% |

| 42 | Oklahoma | 7.0% |

| 43 | North Dakota | 6.6% |

| 44 | Delaware | 6.5% |

| 45 | Florida | 6.5% |

| 46 | South Dakota | 6.5% |

| 47 | Tennessee | 6.4% |

| 48 | New Hampshire | 5.9% |

| 49 | Wyoming | 5.8% |

| 50 | Alaska | 4.9% |