They identified 8,577 who were in the study from the early 1990s until 2017 and who met a variety of other criteria for inclusion. This gave them 25 years of follow up, long enough to ask the question: how does participation in sports affect life expectancy? The results? Playing tennis was the clear winner: extending one’s life expectancy by 9.7 years. The other sports all provided benefits too:

- Tennis: 9.7 years gain in life expectancy

- Badminton: 6.2 years

- Soccer: 4.7 years

- Cycling: 3.7 years

- Swimming: 3.4 years

- Jogging: 3.2 years

- Calisthenics: 3.1 years

- Health club activities: 1.5 years

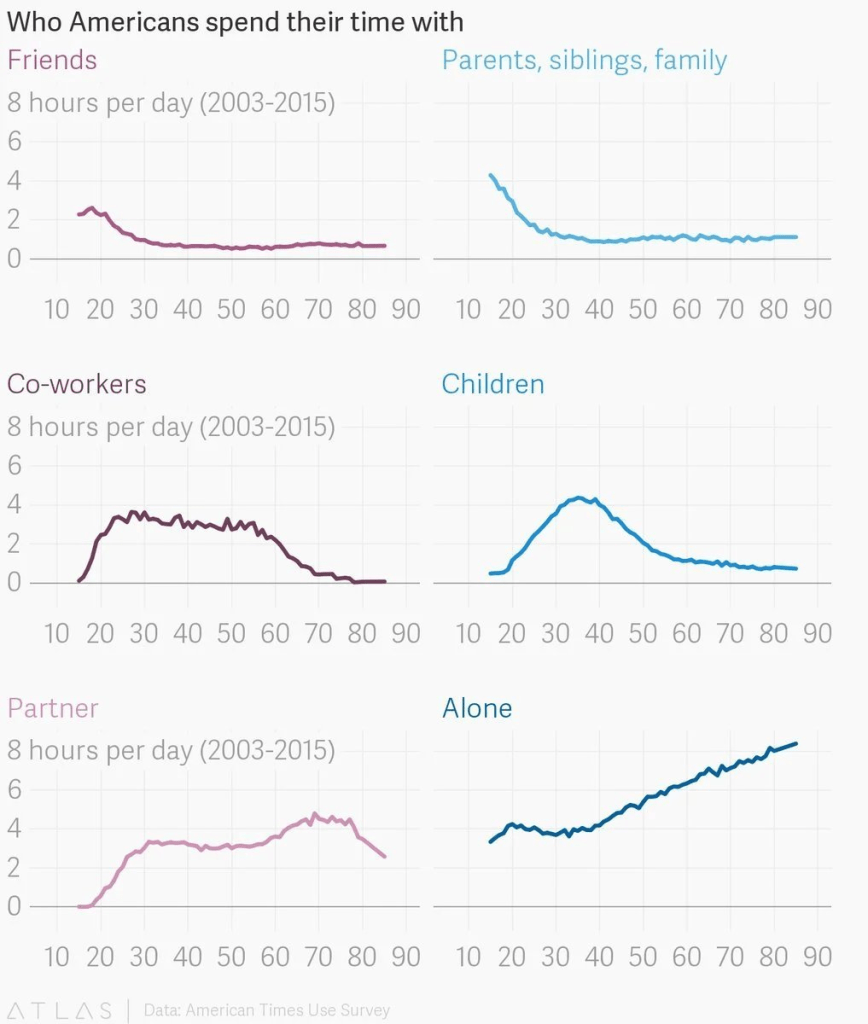

One possible reason for tennis, badminton, and soccer doing so well is that out of the 8 sports studied, these are the ones that require 2 or more people and involve social interaction. As the authors explain, “Belonging to a group that meets regularly promotes a sense of support, trust, and commonality, which has been shown to contribute to a sense of well-being and improved long-term health.”

Or it might be that the type of exercise you get in tennis – short bursts of activity rather than slow, steady plodding exercise – might be better for you. The authors noted that “short repeated intervals of higher intensity exercise appear to be superior to continuous moderate intensity physical activity for improving health outcomes.”

______________________

Here’s the interesting thing about loneliness: it’s a subjective feeling. One person can be alone and feel entirely content. Another can be surrounded by friends and feel very lonely. How lonely we feel depends not only on the objective state of our social life but on how we think our social life should be. Unmet expectations that arise between the two can lead to feelings of loneliness.

Constantly being presented with the idea that their friendships should mirror the deep, intimate, dyadic friendships of women alters men’s expectations in a potentially unhelpful way. Guys see memes about how it’s dysfunctional to spend hours with their buddies without discussing personal issues, or read a reddit post about how sad it is that men don’t have friends they can completely open up to, or listen to a podcast about how they need to be vulnerable with other men if they want to be happy and healthy, and start wondering if their social life is subpar and they’re missing out. “Man, maybe I don’t have good friends after all.”

__________________________

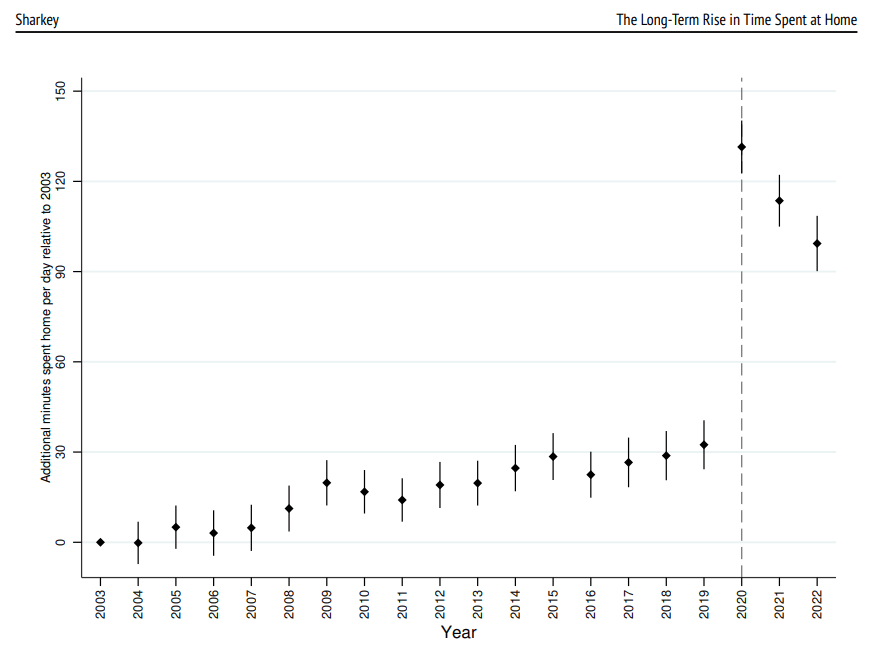

Results show that from 2003 to 2022, average time spent at home among American adults has risen by one hour and 39 minutes in a typical day. Time at home has risen for every subset of the population and for virtually all activities. Preliminary analysis indicates that time at home is associated with lower levels of happiness and less meaning, suggesting the need for enhanced empirical attention to this major shift in the setting of American life.

_______________________________

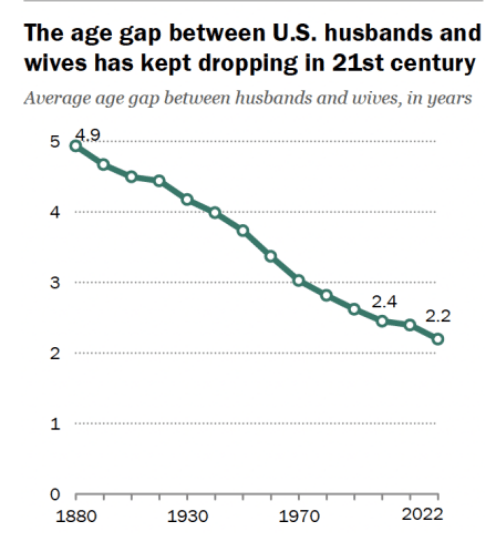

The typical age gap between husbands and wives in the United States has narrowed over the past 20 years, continuing a 20th-century trend. On average, husbands and wives were 2.2 years apart in age in 2022, according to a new Pew Research Center analysis of U.S. Census Bureau data. This is down from 2.4 years in 2000 and 4.9 years in 1880.

_______________________________

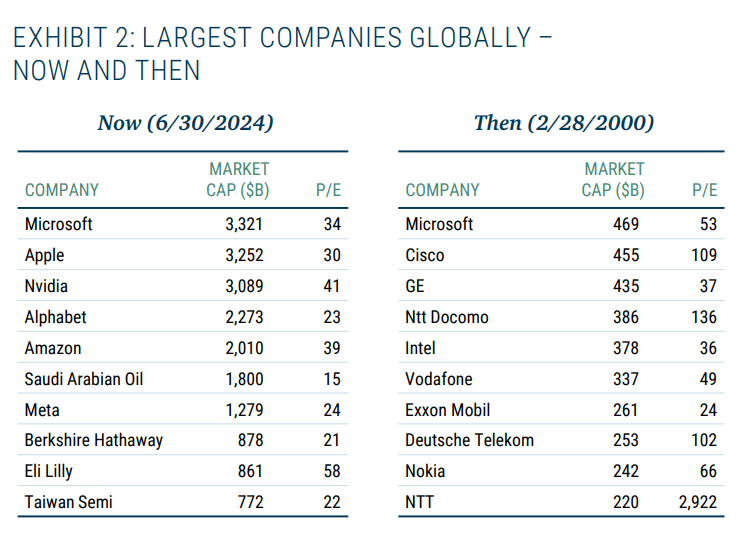

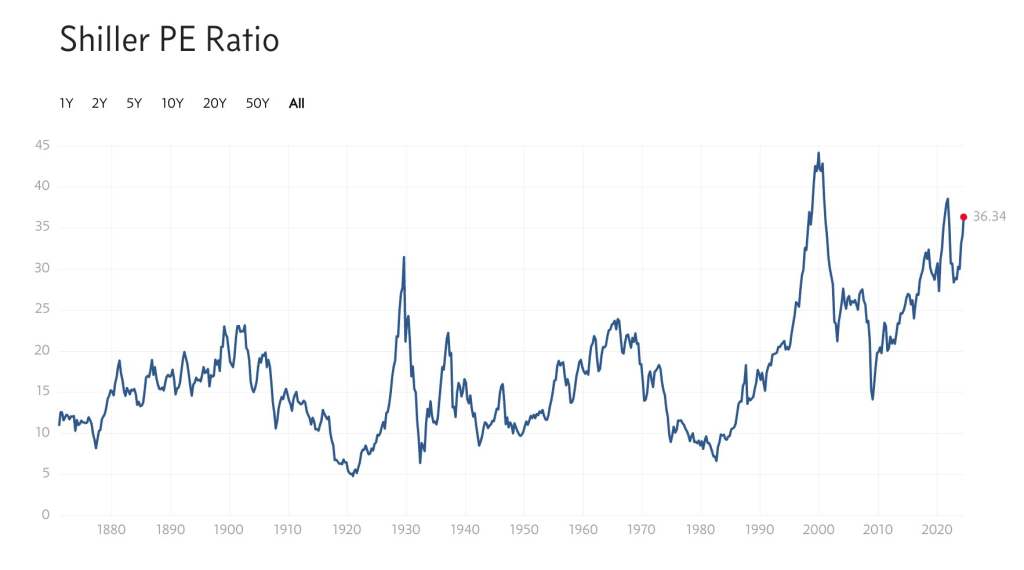

Every forecast takes a number from today and multiplies it by a story about tomorrow. Investment valuations, economic outlooks, political forecasts – they all follow that formula. Something we know multiplied by a story we like.

_______________________

Irving Fisher has one of the most famous quotes in financial history (for being very wrong at the worst possible time), but his full story is even more tragic. Another great lesson on the danger of leverage and overconfidence.

__________________________

Why you don’t need to separate your clothes anymore. There’s no actual threat to your clothes or machines by washing everything together—the life of your clothes may be shortened slightly, but that’s all. Since most of the clothes we wear are now a byproduct of fast fashion, there’s less investment into each piece, and they’re not really built for the long haul the way clothes once were, anyways. Also, the natural fibers and dyes that used to be mainstream have been long replaced by synthetic fibers and better dye processes, which result in much more colorfast garments. These garments also generally stand up to wash processes better. Advancements in detergents also focused on using less of it, stopping colors from fading, keeping whites bright, and washing everything in cold water to save on energy. As a result, laundry in general is a much gentler on clothes.

________________________

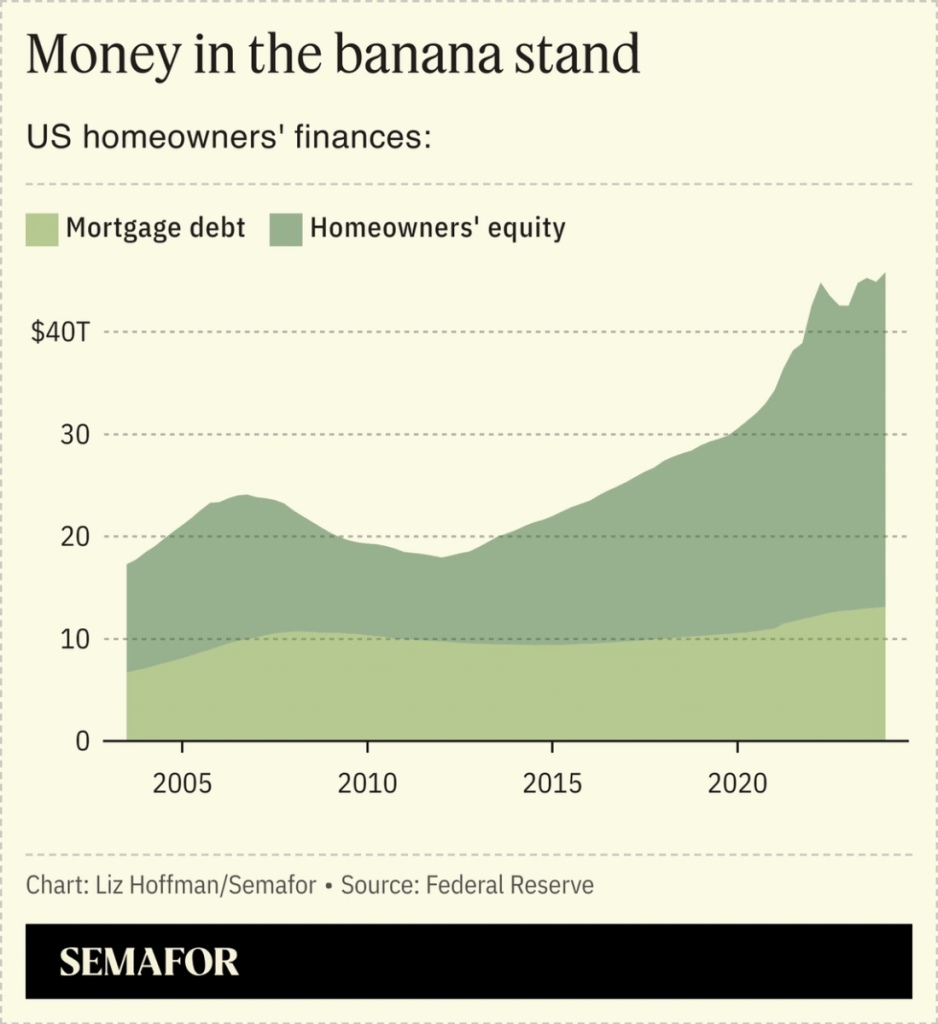

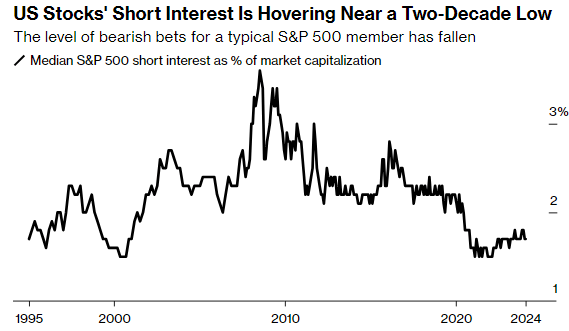

Prices going up feel safe because price increases 1) confirm that we’re right and 2) signal that we’re making money. Prices going down feel dangerous because when you hold a stock that’s declining, you lose money. But cheaper stocks are (at least from a valuation perspective) safer than expensive stocks. Much of the risk is priced in. It’s already happened.

________________________

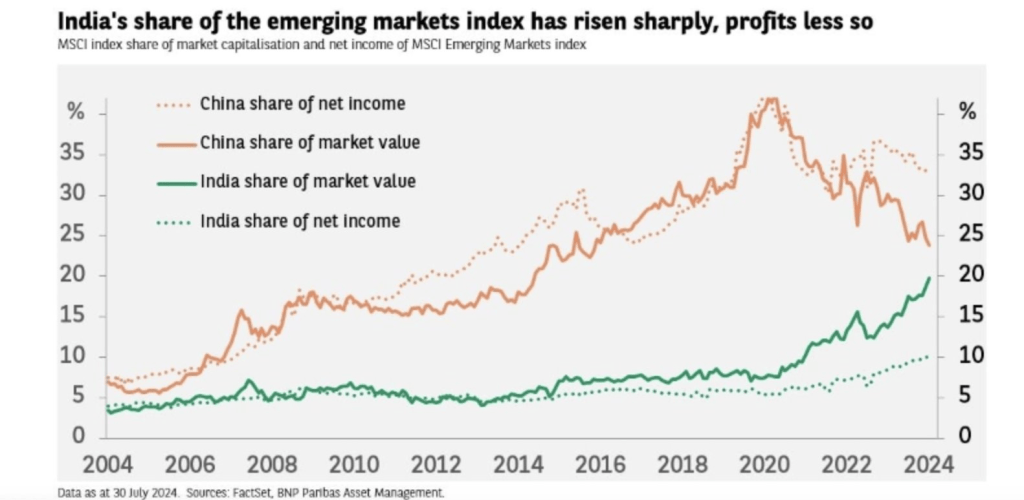

Great podcast this week with Louis-Vincent Gave on financial markets and the global economy from the perspective of someone outside the United States.

________________________