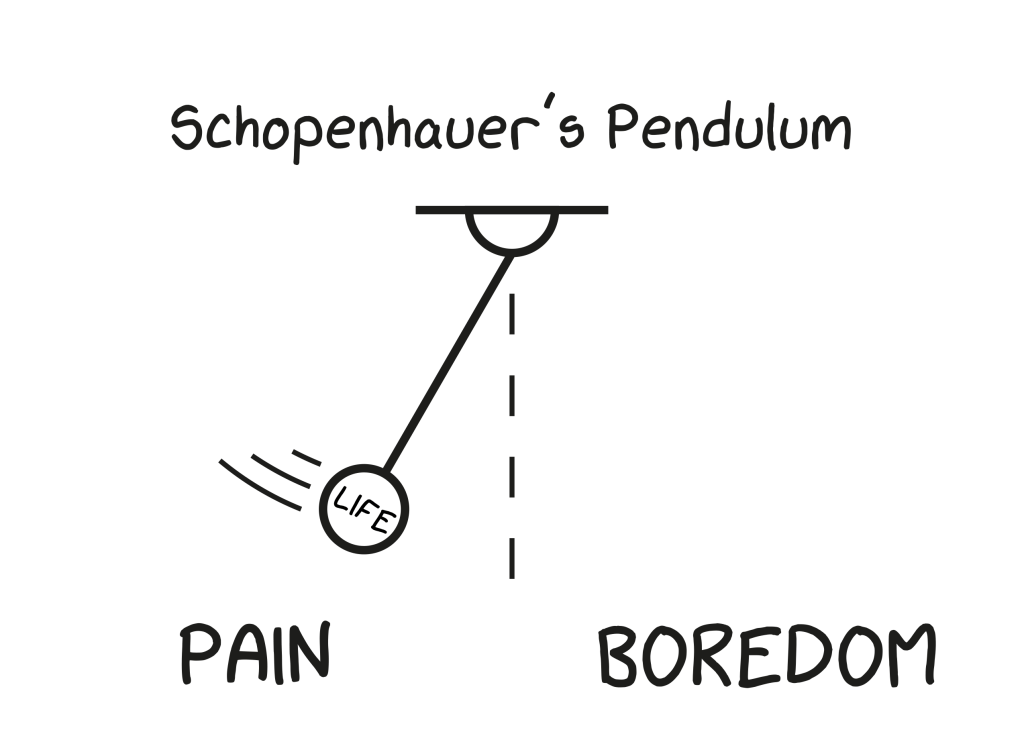

When we dream about being happier in the future, we’re imagining being content with what we have. Maybe we picture a new house or a luxurious lifestyle. But what we’re really imagining is being satisfied with those things. We’re not just picturing wealth, you’re picturing contentment. But often, when reality doesn’t live up to expectations, it’s because the moment we get something new, we immediately start wanting whatever comes next.

The more you desire something you don’t have, the more you’re just focusing on the fact that you’re not happy right now. The person who has everything but wants even more feels poorer than the person who has little but wants nothing else.

______________________

In economics, there is something called the law of diminishing marginal utility. Simply put, it states that for any commodity, you will derive lower levels of utility (or pleasure) with each additional unit you consume. For example, if you’re hungry and you buy a burger, that first one will be amazing. But if you buy another burger, then that one will be less pleasurable than the first. And by the 5th burger, you’ll hate yourself and won’t buy that burger again for the next month (at least).

When it comes to overcoming obstacles, however, I feel that there’s an inverse of this: a law of increasing marginal utility. With each obstacle you overcome, the utility comes in the form of a lesson you can import into the next obstacle you face. And once you overcome that one, the utility gained has a compounding effect that takes all the prior lessons into account as well.

___________________________

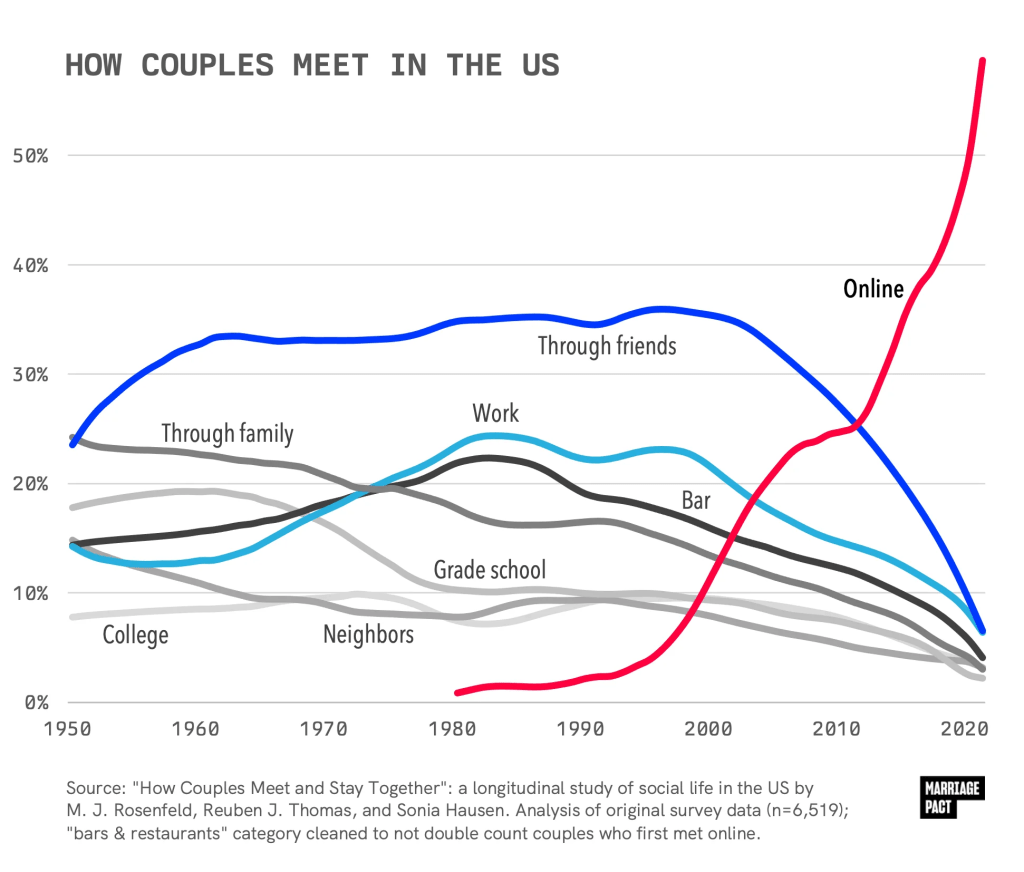

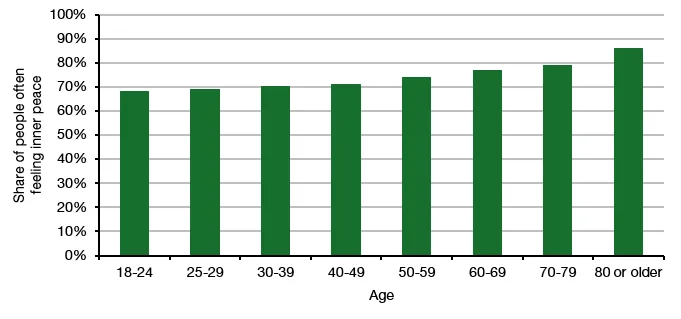

A group of researchers piggybacked on the Global Flourishing Survey, which asked more than 200,000 people in 22 countries over five years to rate how they feel about several aspects of life. One item was the question: “In general. How often do you feel you are at peace with your thoughts and feelings?”

The older people get, the more they feel inner peace. The pattern that emerges is the one that people who no longer compete with other people (whether it is for a job, a salary increase, a spouse, etc.) simply are happier.

_____________________________

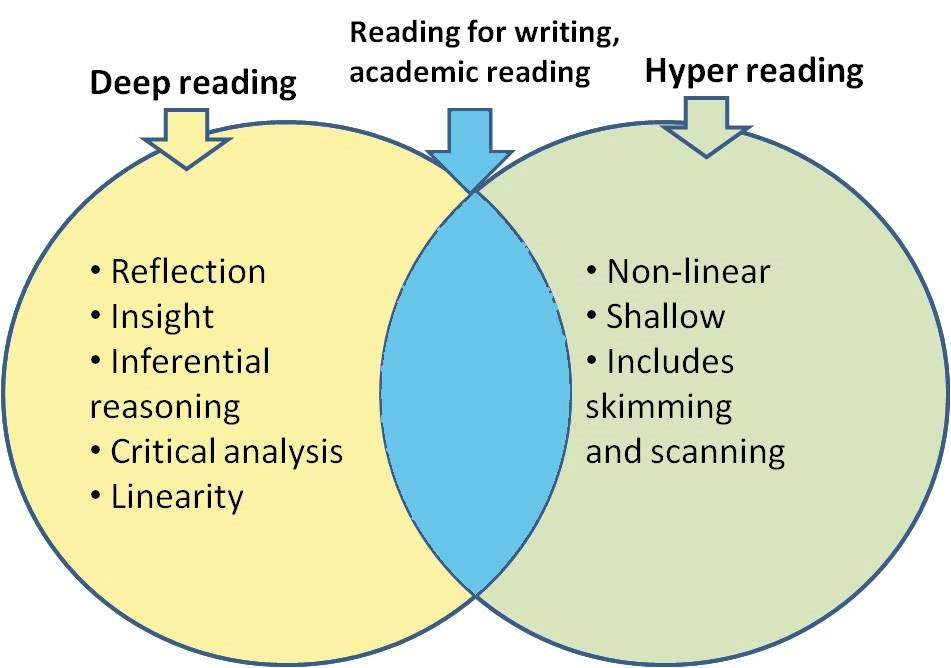

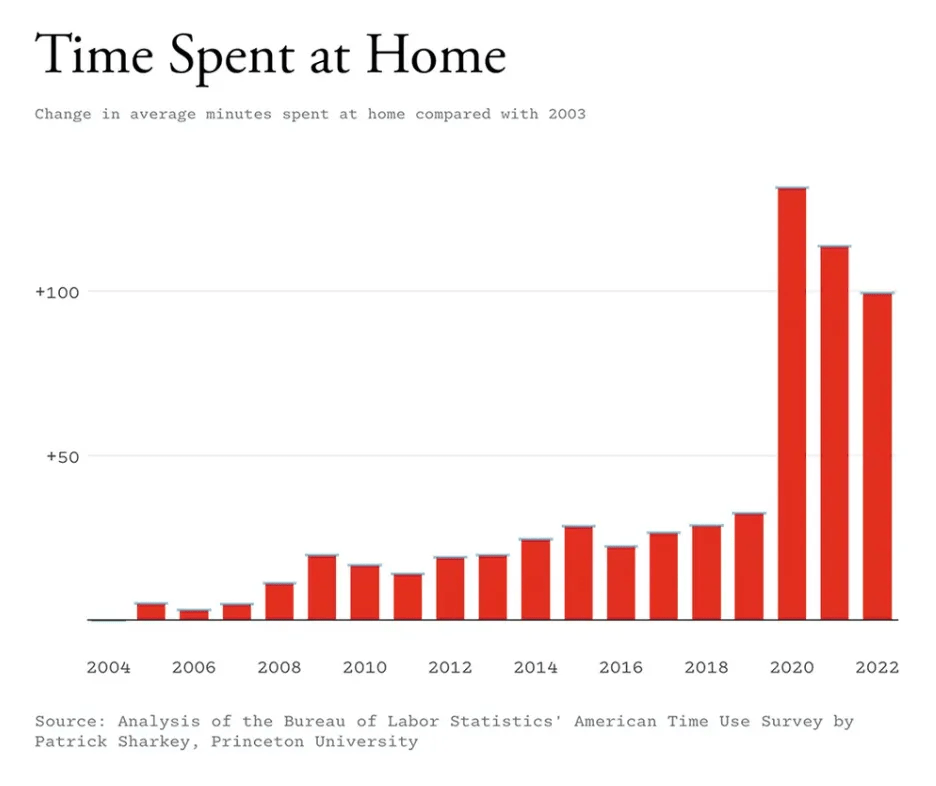

Knowledge of the world (through screens and images) vs. experiencing the world in-person:

“It feels as if the whole world has been transformed into images of the world, and has thus been drawn into the human realm, which now encompasses everything. There is no place, no thing, no person or phenomenon that I cannot obtain as image or information. One might think this adds substance to the world, since one knows more about it, not less, but the opposite is true: it empties the world, it becomes thinner. That’s because knowledge of the world and experience of the world are two fundamentally different things. While knowledge has no particular time or place and can be transmitted, experience is tied to a specific time and place and can never be repeated. For the same reason, it also can’t be predicted. Exactly those two dimensions – the unrepeatable and the unpredictable – are what technology abolishes. The feeling is one of loss of the world.”

Apart from anything else, another good reason to get outside, and soon.

________________________

________________________________

We are told to view winning, in sport and in life as: “success must be earned by an effort of willpower, preferably in a triumph over adversity.”

Natural talent conflicts with the consoling fantasy that we live in a meritocracy where hard work always pays off in the end. But it doesn’t. We simply never hear about the thousands of would-be athletes (or business people, or musicians, or inventors) who put in their 10,000 hours but lack the talent to make significant progress.

If people believe, as more and more of them are encouraged to, that their advancement comes 100% from their own merits . . . they can be insufferably smug. Recognizing luck as a factor in success is inherently civilizing.

It can be difficult to accept that we are all, to some degree, victims and beneficiaries of circumstance, but we are. We are misled by histories of great men and women in which it’s implied that each planned his or her ascent meticulously, homing in on success like a soldier finding a flag in an army training exercise.

The origins of success are usually much more subtle and complex. Successful people, by being open to opportunity and exposing themselves to chance, take new directions that prove more fruitful than anyone could have predicted. We change in many ways as we grow. A missed opportunity represents the failure to evolve into a different, better person.

Believing in luck does not imply fatalism, as many people mistakenly believe. But it does demand openness—and humility. What about effort, skill and planning? All necessary, of course—but never sufficient.

________________________

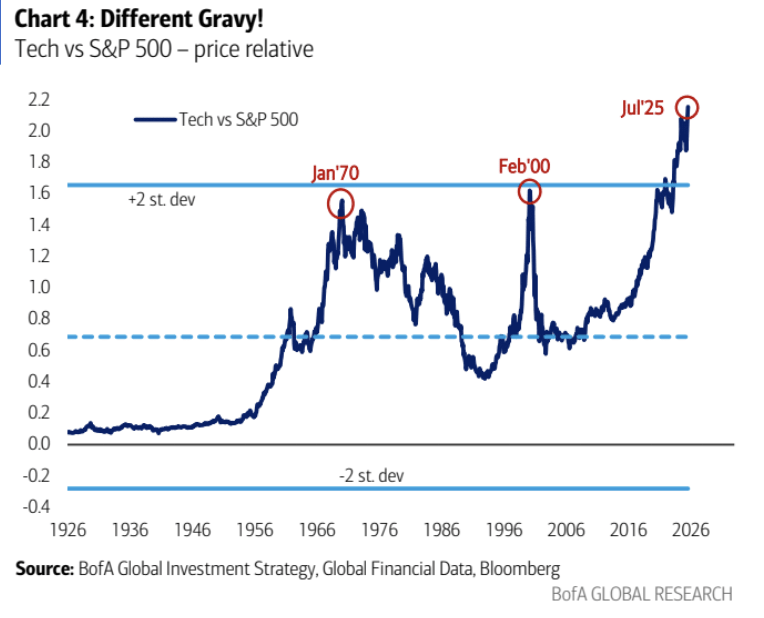

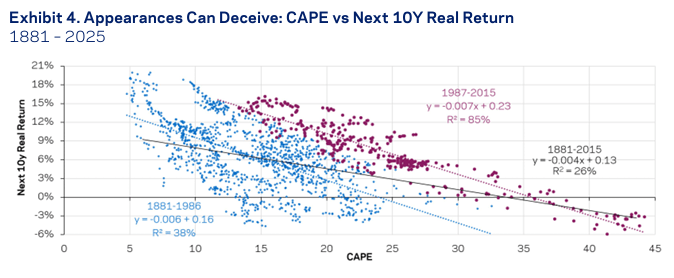

AI may produce faster and more extensive searches and may find correlations that human efforts could not identify in a lifetime, but that’s all still existing information. In short, AI has no creative capacity. It cannot “think” of anything new, unlike humans who create new formulas and works of art routinely. AI is not “intelligent” or creative. It’s just fast.

In a recent experiment, a supercomputer and a group of first grade children were given a ruler, a teapot and a stove and asked to draw a circle. The computer “knew” that the ruler was a draftsman’s tool not unlike a compass and promptly tried to draw a circle with a ruler. It failed. The children glanced at the teapot, saw that the bottom was round and used it to trace perfect circles.

AI will never be superintelligent, expenditures have hit the wall of diminishing returns, AI offers no creativity at all (just fast searches), and children can outperform the fastest machines when the task calls for intuition. Is the frenzy about to hit the wall?

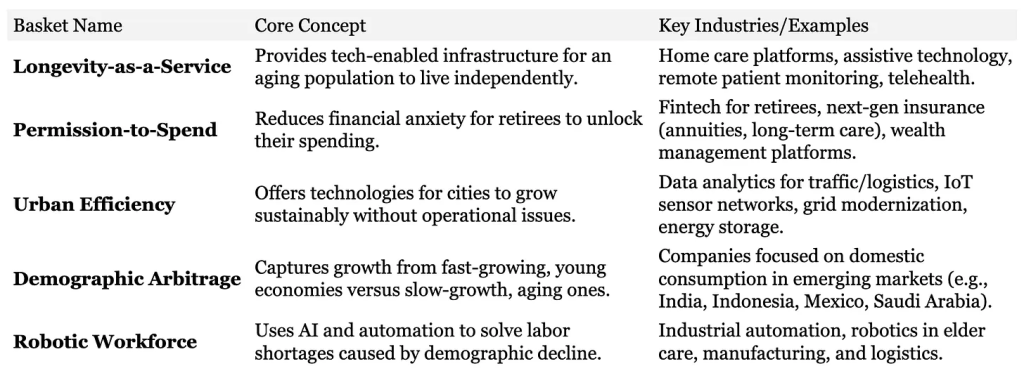

There are some encouraging solutions that may allow AI to add value beyond robotics and fast processing. One of these is the use of small language models (SLMs) instead of LLMs.

Unlike LLMs, which troll the entire internet or large subsets, SLMs contain far less data and are curated by subject matter experts to be tailored to specific tasks. One difference between SLMs and LLMs is the number of parameters that the model is trained on. SLMs can run faster on far less energy. They can also be scaled more easily for smart phones and other applications like self-driving cars and household appliances.

SLMs also have fewer “hallucinations” than LLMs and run on less expensive chips, which may have negative implications for monster chip makers like NVIDIA. SLMs running on smaller cloud systems may make the massive server farms now being constructed, either redundant or obsolete.