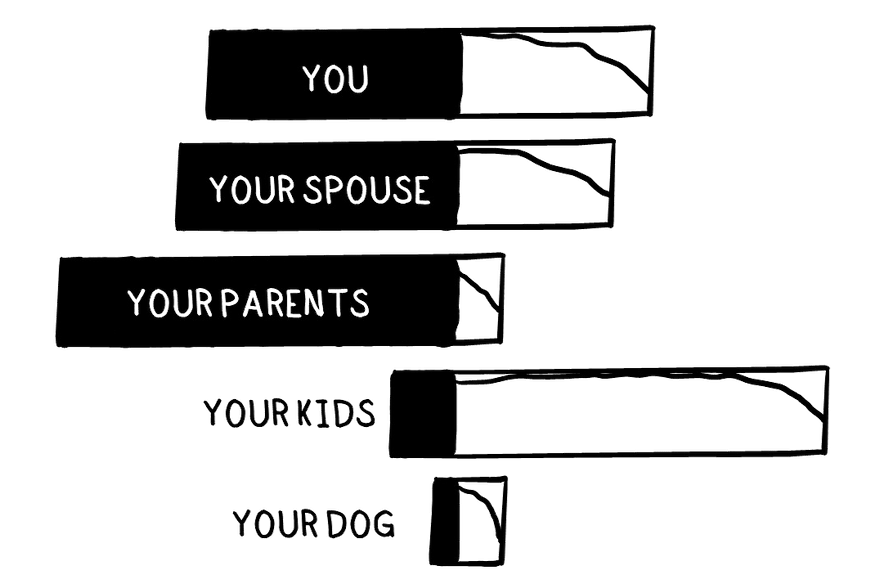

Understanding the finality of everything brings a clarity that only a wiser version of ourselves sees. If we know that one day we’ll long for the very things we routinely gloss over, how can we consciously neglect those moments again? Perhaps the best way to give every moment a fresh start is not to redo it, but to be aware of the finish line that awaits each one.

___________________________

While technology has materially decreased the time it takes do many things (i.e., book reservations, send messages, check the weather, get directions, etc.), it has also increased peoples’ desire for immediate results. As a result, this has significantly altered the incentives that drive the economy, and society at large. Look no further than people on social media clamoring for “likes”, politicians catering to their bases instead of “crossing the aisle” to appeal to voters in the middle, the media thriving on soundbites and scandals as opposed to simply reporting the news, and investors making extremely confident forecasts instead of acknowledging an uncertain future.

___________________________

New studies are showing that more money provides higher levels of happiness, even for the ultra-wealthy. A famous 2010 paper by Kahneman and economist Angus Deaton that said happiness tends to go up with incomes until about $60,000 to $90,000 a year, at which point it flattens. Kahneman and Killingworth reanalyzed that work and found the correlation between money and happiness extended to people with salaries up to at least $500,000 a year. The new research, which is being self-published by Killingsworth, found people with a net worth in the millions or billions reported an average life satisfaction rating between 5.5 and 6 out of 7, compared to a rating of about 4.6 for those earning around $100,000 a year and just above 4 for those earning about $15,000 to $30,000 a year. That makes the difference in happiness between the richest and middle-income groups almost three times larger than the difference between middle- and low-income groups.

__________________________

They are called zombies, companies so laden with debt that they are just stumbling by on the brink of survival, barely able to pay even the interest on their loans and often just a bad business hit away from dying off for good. An Associated Press analysis found their numbers have soared to nearly 7,000 publicly traded companies around the world — 2,000 in the United States alone — whiplashed by years of piling up cheap debt followed by stubborn inflation that has pushed borrowing costs to decade highs. And now many of these mostly small and mid-sized walking wounded could soon be facing their day of reckoning, with due dates looming on hundreds of billions of dollars of loans they may not be able to pay back.

__________________________

Great podcasts this week: