How much is a memory worth? Memories of experiences tend to increase in value over time – even if the experience doesn’t last long. Physical “Stuff” tends to last longer, but the value usually decreases over time. You can think of experiences vs. physical goods like appreciating assets vs. depreciating assets.

One piece of this equation of memories growing in value is because our ability to recall is quite poor. As time goes on, we also tend to remember the positive things more and block out the negatives.

If you share an experience, it creates a bond. When it comes to “stuff,” people don’t share, they compare.

______________________________

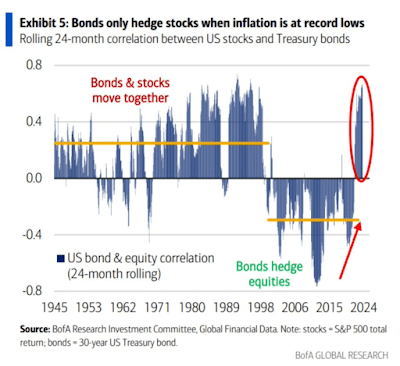

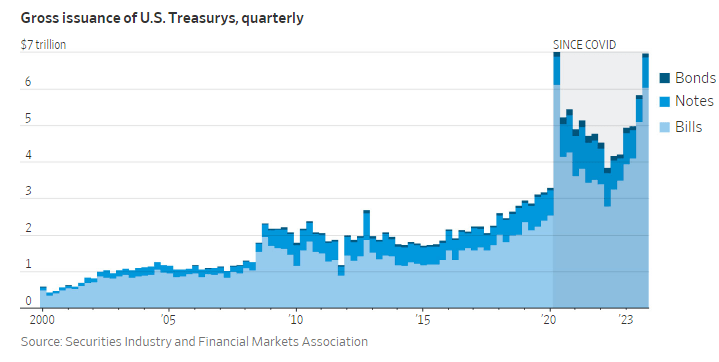

“It’s not the bond market of the 1980s or 1990s or even the 2000s anymore. It’s a big, bloated bond market that requires constant intervention by fiscal policymakers and monetary policymakers. There are pockets of information and pockets of opportunity here and there, but the overall market itself is not what it used to be.

Inflation manifested in recent years without the bond market anticipating it at all, and it can certainly happen again in the future. The same is true for periods of disinflation or economic deceleration. And the bond market can’t really front-run the sheer supply of Treasuries that will be coming to the market over the upcoming years; for the most part it can only respond in real time from the flows.”

______________________________

Over the last 30 years, the number of people who report using marijuana in the past month has risen fivefold from 8 million to 42 million. More than 40 percent of marijuana users consume daily or near daily.

Just 2 percent of 12-17 year-old marijuana users consume daily or near daily. It is becoming something of an old person’s drug. As a group, 35-49-year-olds consume more than 26-34-year-olds, who account for a larger share of the market than 18-25-year-olds.

_______________________________

A quick walk through of how nuclear war would play out should remind us that we worry about the small stuff in life way too much. Too many investors don’t understand that their most precious asset is time and continue to waste it worrying about issues beyond their control.

_________________________

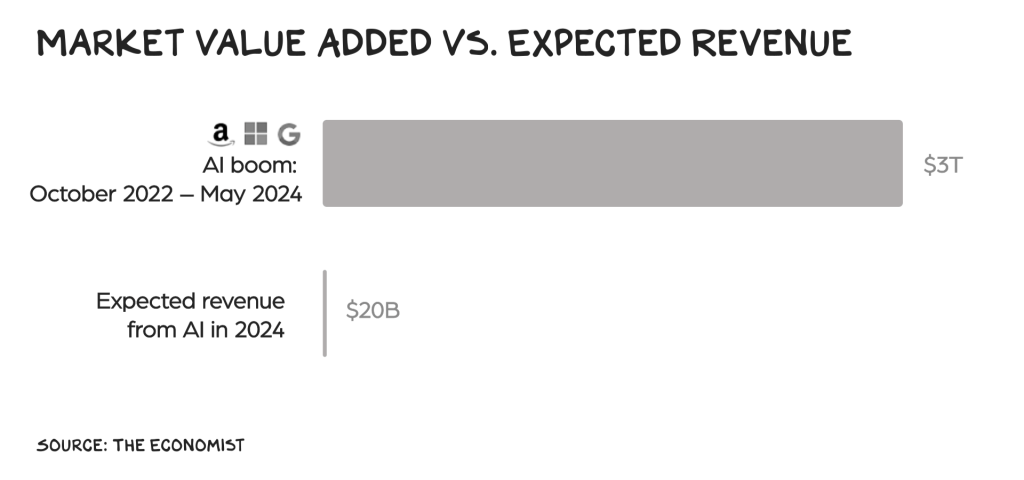

There is near-universal agreement on the AI market’s revolutionary potential, a historic consensus that explains the upward trajectory of AI stocks. In sum, everyone is barking up the same tree … which makes us stupid. It also inspires a question: Are we in a bubble?

__________________________

How to protect your keyless car from theft. Auto technology has evolved and many newer cars use wireless key fobs and push-button starters instead of traditional metal keys. That technology makes things easier for thieves. A simple but effective way to stop auto bandits from purloining your key fob signal is to use a Faraday bag or pouch.

_________________________

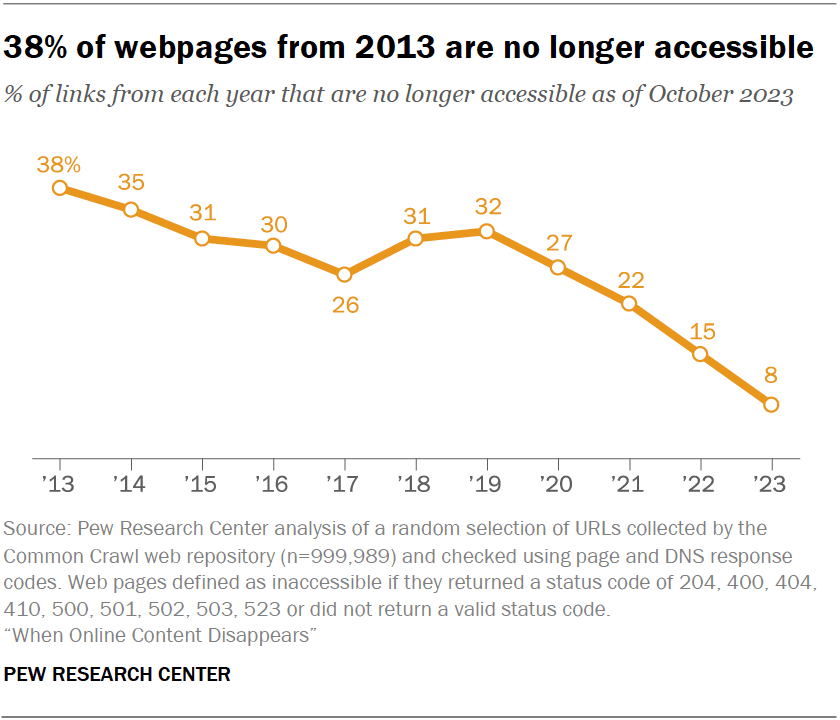

Online content is disappearing.

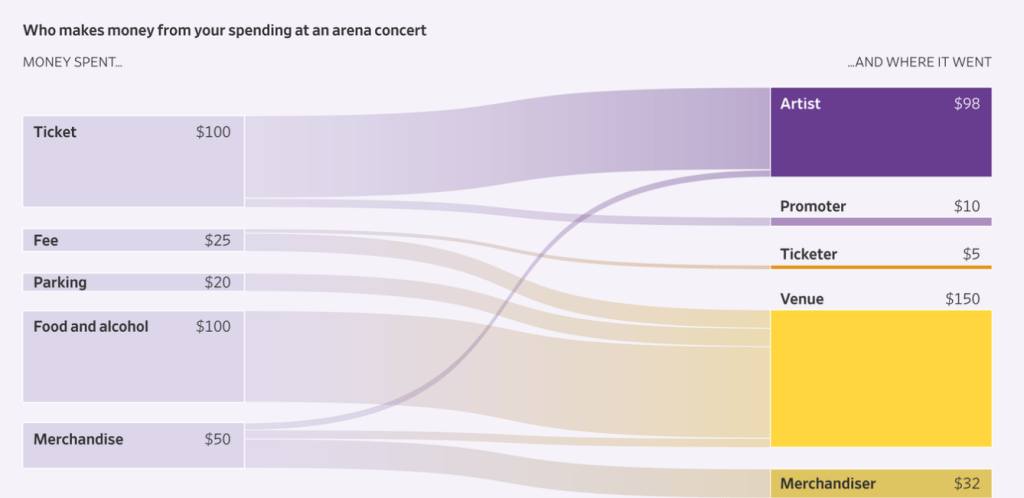

Who makes money when we go to concerts.