10 great lessons learned in 2024 including: walk more, meet in person, things take longer than you realize, and we overweight risk but underweight exponential outcomes (the value of asymmetric bets).

________________________________

When travel is used as a vehicle to break the monotony of life, then don’t be surprised when that sense of monotony finds itself to whatever newfound place you’re visiting. A curious mindset doesn’t ignite just because your surroundings have changed. Travel is no cure for the mind because there is no cure for it to begin with. There is no external vehicle that will take you to prolonged contentment. What truly brings contentment is internal: gratitude for what’s in front of you, openness to all the stories around you, and unwavering curiosity toward the people you see every day.

__________________________________

The Federal Reserve put together a comprehensive 51-page report on marriage trends in the United States. One of the charts that stood out to me was how much the things men and women look for in a partner changed over the last 60 years. Race has collapsed in importance, while income has risen dramatically for both.

In individual sports the best players might have coaches, trainers, agents, and others supporting them, but in matches or tournaments it’s one player versus another, or one player versus the world. The player gets the credit for the win, and the player gets the blame for the loss. It’s why individual sports are agonizing even for the best in the world. Stock picking is an individual sport. You have no place to hide. The outcome is focused on you. It makes the wins intoxicating. Losing is excruciating. When stocks go down, we stop looking in the mirror and start blaming everything and everyone else.

____________________________________

Odometer fraud is shooting up: According to the latest data from CARFAX — 2.14 million cars may have had odometer rollbacks in 2024 — up 82,000 from last year and 18% since 2021. The reasons? Technology has made rolling back an odometer easier than ever — and is often done to dodge lease mileage fees or artificially inflate a car’s value. It takes seconds to do and costs the next buyer an average of $4,000 in lost value. Bottom line — if a “low-mileage” car deal seems too good to be true — it just might be.

_____________________________________

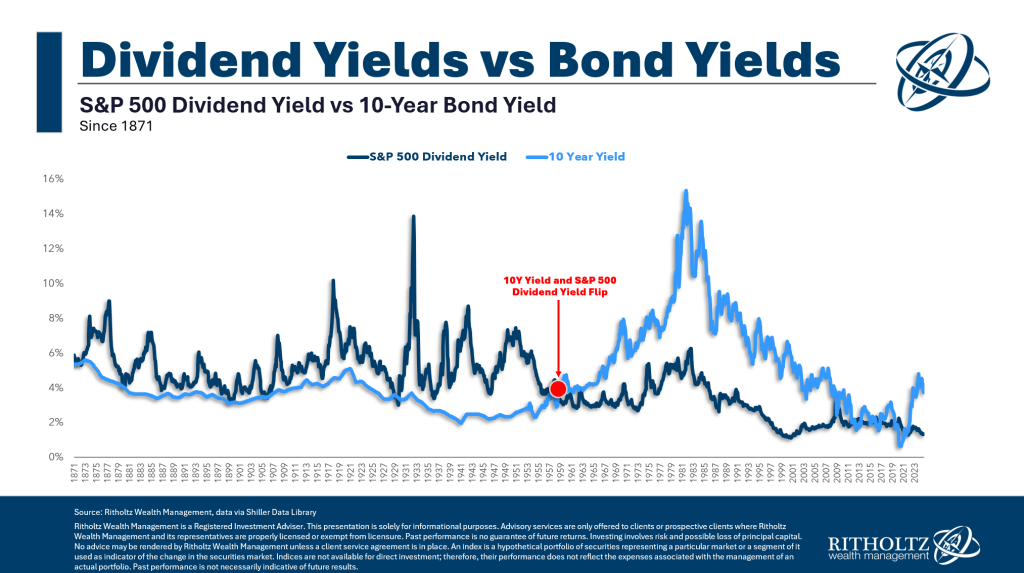

Until the 1950s, investors expected to earn more income from their stocks than bonds. The general idea was that stocks are riskier and thus need higher yields to attract investors. When dividend yields and bond yields converged it was a signal to sell stocks. Stock prices would then fall until dividend yields earned a premium over bonds again. It was a pretty good market signal too. The yields on stocks and bonds flipped for a month or two right before the Great Depression and many of the biggest bear markets of the late 19th century and early 20th century. But then a weird thing happened in the late-1950s…it stopped working. Bonds yields surpassed divided yields and didn’t look back for a very long time. In fact, they remained above stock market yields for 50 years until bond yields finally got low enough during the Great Financial Crisis.

The ratio of emerging market stock performance relative to the United States is now at an all-time low:

Foreign investors have piled into U.S. stocks like never before. Foreign investors now allocate a record 59% of their assets to US equities. The share of US stocks in foreign financial holdings is now ~7 percentage points higher than it was at the 2000 Dot-Com Bubble peak.