Once you internalize a simple truth: that all behavior makes sense with sufficient information, the world looks a lot less crazy (although infinitely more complex). The problem is we rarely have access to the full set of variables driving someone’s decisions. Understanding this is not just an intellectual exercise. It’s a model for navigating the social, financial, and professional realms with insight to make sense of the world and get better outcomes from our teams and users, even have better relationships. In social contexts every interaction is imbued with subtext. Many assume others operate under the same rules they do, but each person carries a unique script shaped by their experiences and values. Instead of asking, ‘why are they acting like this’ we can try, ‘what might I not know about their world?

_________________________

Stocks don’t know that you own them. The market is never out to get you. When you personalize the market’s moves, you fall into the trap of trying to be right rather than trying to make money. Constantly worrying about outcomes that are completely out of your control, especially in the short term, is asking for trouble from Mr. Market. It’s bad enough that investors get dinged in their pocketbooks when they take losses. Don’t compound the issue by letting your ego make things far worse. You have to invest in the markets as they are, not as you wish them to be.

__________________________

Poker has a cheating problem. Several recent schemes were uncovered involving poker players at casinos allegedly using miniature cameras, concealed in personal electronics, to spot cards. Should players everywhere be concerned?

____________________________

____________________________

Adrian Wojnarowski on retirement and what’s important in life:

____________________________

____________________________

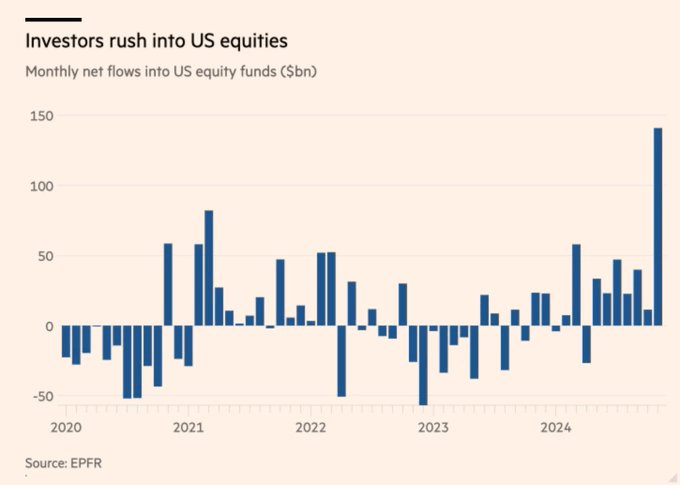

The monthly inflows into U.S. stocks in November were the highest since the peak of the tech bubble in 2000.

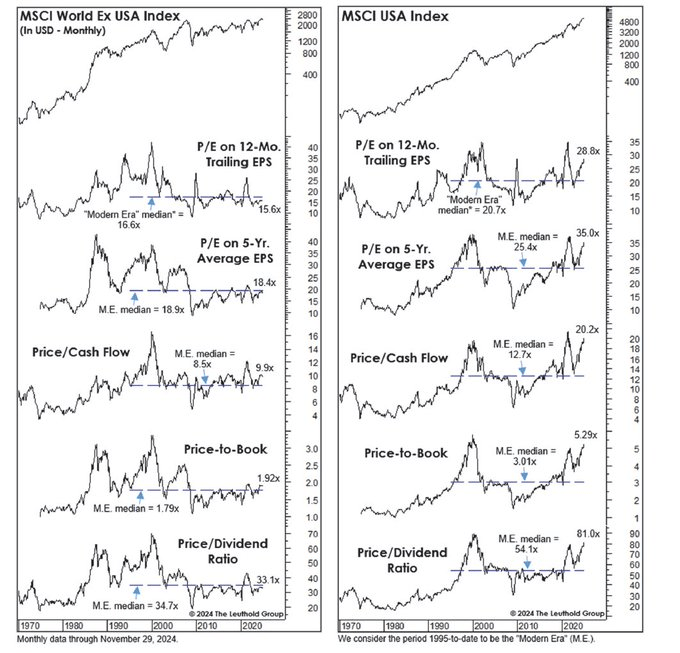

12-month forward P/E ratios relative to the last 20 years. The U.S. is off the chart expensive, even when including Wall Street analysis aggressive “forward” (estimates) of earnings over the coming year.

No matter how you measure it, foreign stocks trade at half the valuation of US stocks:

It’s not just multiple expansion that created the outperformance. The U.S. also experienced much stronger earnings vs. the rest of the world over the last 15 years (the denominator in the P/E ratio):

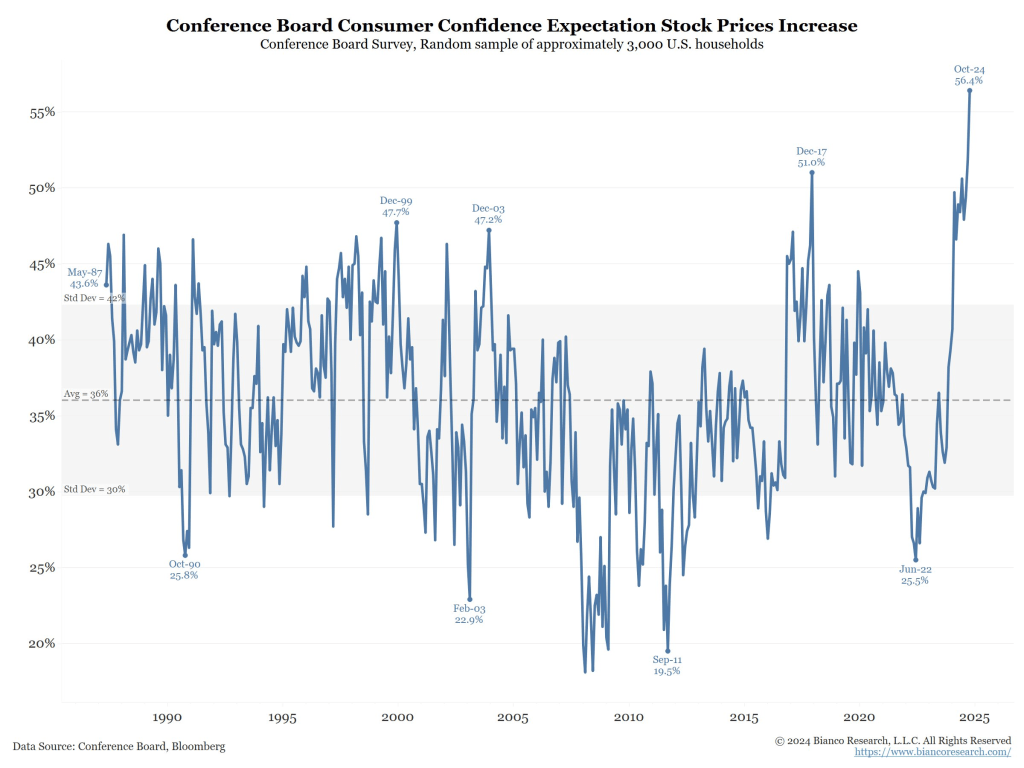

The percentage of respondents that expect U.S. stocks to rise over the next 12 months. New record-shattering levels of bullish excitement:

The market cap (price investors are paying to own the U.S. stock market) is rising much faster than the profits relative to the rest of the world: