Through a friend, he heard about a firm called Yield Wealth and the “guaranteed” 15.25% return it was offering to investors on some products. In March, Whitacre withdrew his entire 401(k) from Fidelity—$763,094.21—and rolled it over into an individual retirement account with Yield, which was affiliated with a firm called Next Level Holdings. Now Whitacre, like hundreds of other investors who altogether put at least $50 million into these products, wonders if he’ll ever see his money again. Many of these people may be in desperate tax trouble.

_______________________________

The share of U.S. 12–17-year-olds having experienced depression in the past year has risen from 7.9 percent in 2006 to 18.1 percent in 2023. The share of teens who had reported a major depressive episode was particularly high among Multiracial (24.4 percent) respondents in 2023, followed by white adolescents (19.6), Asian (13.7 percent) and Black teens (13.3 percent).

________________________________

37% of people ages 18 to 29 (and 21% of all adults) get their news from influencers.

- Americans aged 18 to 34 watch less than five hours of live and timeshifted TV per week.

- 50 percent of 18 to 24-year-olds in the U.S. say that they don’t watch any traditional TV!

- At the other end of the scale, those aged 65 and older watch more than 40 hours on average.

________________________________________

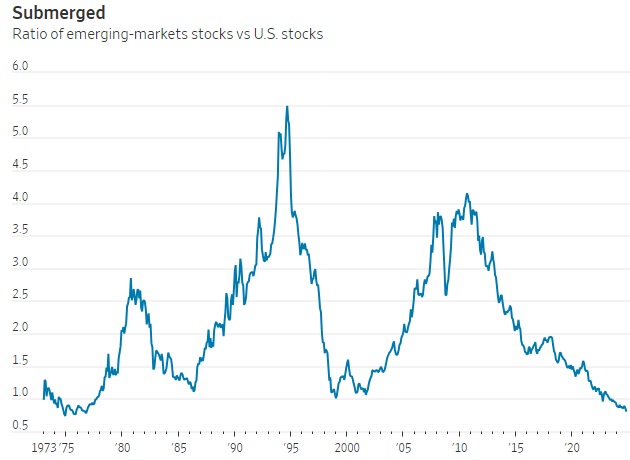

The last time emerging markets were doing this badly the term “emerging markets” hadn’t been coined yet. That spells opportunity, and the greatest spoils might go to those investors who are the boldest and also willing to look past that poorly defined category. Emerging markets outperformed developed market stocks in the century’s first decade as commodity prices boomed and the tech and housing bubbles dented the U.S. market. Today, though, they are much cheaper as a multiple of earnings.

__________________________________________

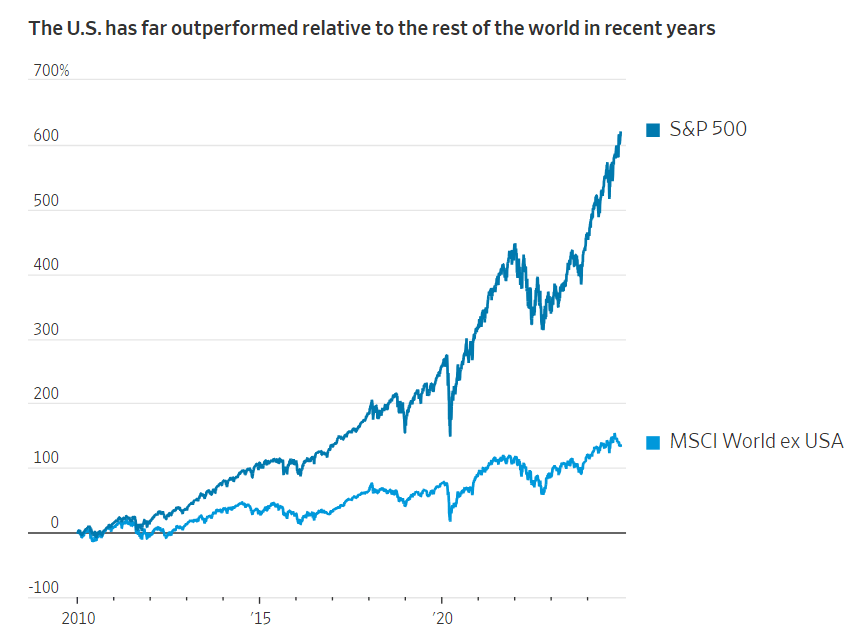

International stocks have performed so poorly that Bank of America analysts think the time is right to buy Chinese and European stocks. They reason that bad sentiment is bound to reverse after getting so extreme. The price performance of U.S. stocks relative to international stocks hit a 75-year high, the bank found. So far there hasn’t been much of a reversal.

__________________________________________

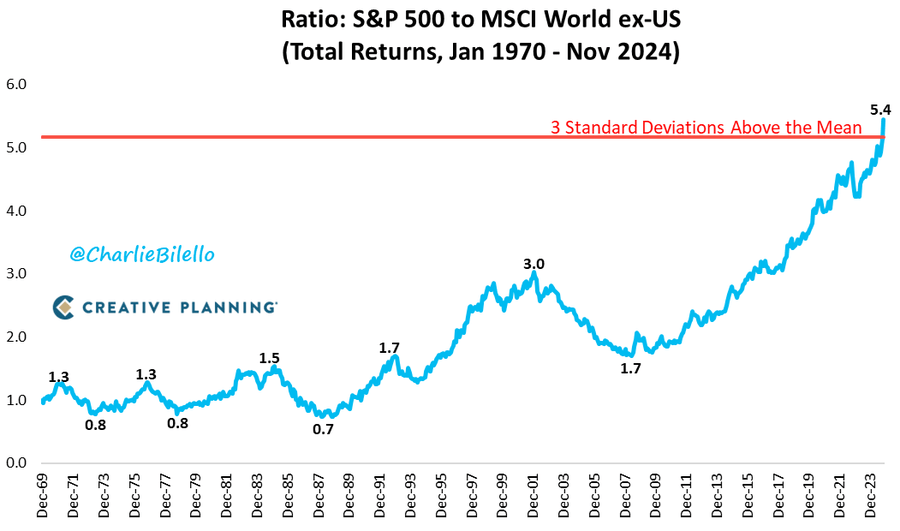

US stocks have been outperforming international stocks for 16 years running, and by a huge margin. The result: we’re now more than 3 standard deviations above the mean in terms of historical US outperformance.

_________________________________________

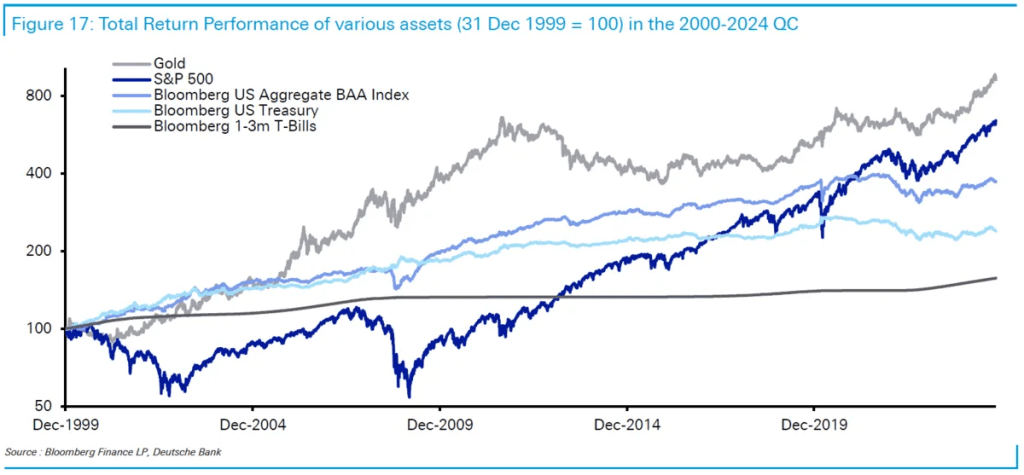

What has performed better than U.S. stocks and bonds this century? Surprisingly, gold has.