A study found that A.I. chatbots defeated doctors at diagnosing illnesses, even the test group of doctors that were using a chatbot for assistance. ChatGPT-4, from the company OpenAI, scored an average of 90 percent when diagnosing a medical condition from a case report and explaining its reasoning. Doctors randomly assigned to use the chatbot got an average score of 76 percent. Those randomly assigned not to use it had an average score of 74 percent. The study showed more than just the chatbot’s superior performance. It unveiled doctors’ sometimes unwavering belief in a diagnosis they made, even when a chatbot potentially suggests a better one.

___________________________

The only thing worse than not making life-changing money is losing the life-changing money that you just made. Why is it so hard to hold on to the money we made? Because hitting a home run on an investment is euphoric. And beyond the dopamine rush, it strokes your ego, making you feel smart. Those good feelings cloud your judgement. Financial returns are a seductive feedback mechanism. When something you invest in goes up by a lot, you feel like a genius, and you want to experience that rush again. And because your last bet was correct, you grow more confident, so you decide to double down on another trade.

_____________________________

AI-generated influencers based on stolen images of real-life adult content creators are flooding social media. It is now trivially easy to make these accounts and monetize them using an assortment of off-the-shelf AI tools and apps. What was once a niche problem on the platform has industrialized in scale, and it shows what social media may become in the near future: a space where AI-generated content eclipses that of humans.

_____________________________

$500,000 Pay, Predictable Hours: How Dermatology Became the ‘It’ Job in Medicine. Americans’ newfound obsession with skin care has medical students flocking to this specialty. Medical residency applications for dermatology slots are up 50% over the past five years, with women flooding the zone. Dermatologists earn a median $541,000 a year. Pediatricians, by contrast, earn a median $258,000 annually. Given the infrequency of skin emergencies, far fewer dermatologists are on call at night and on weekends.

______________________________

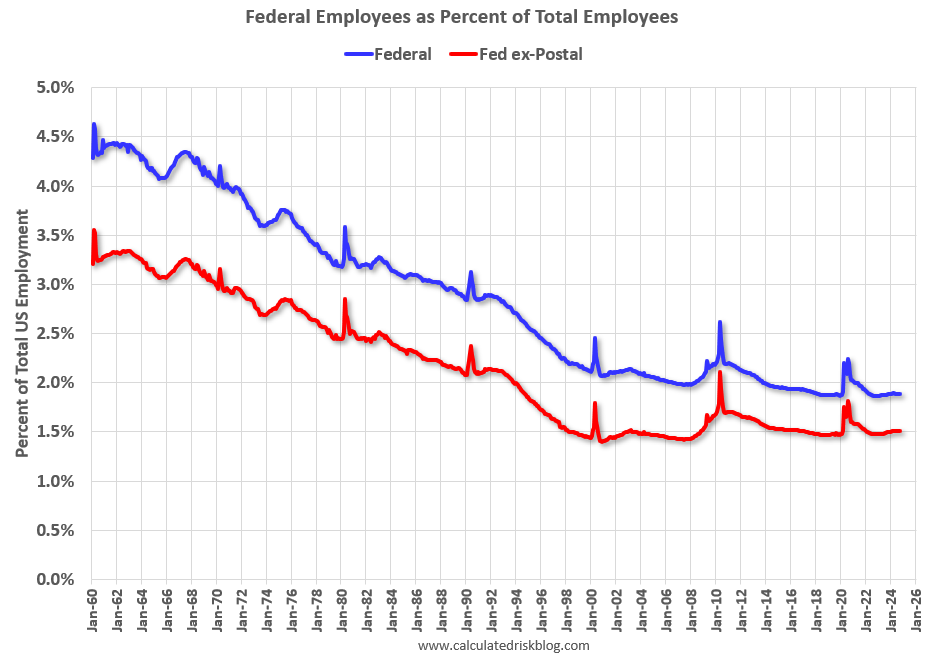

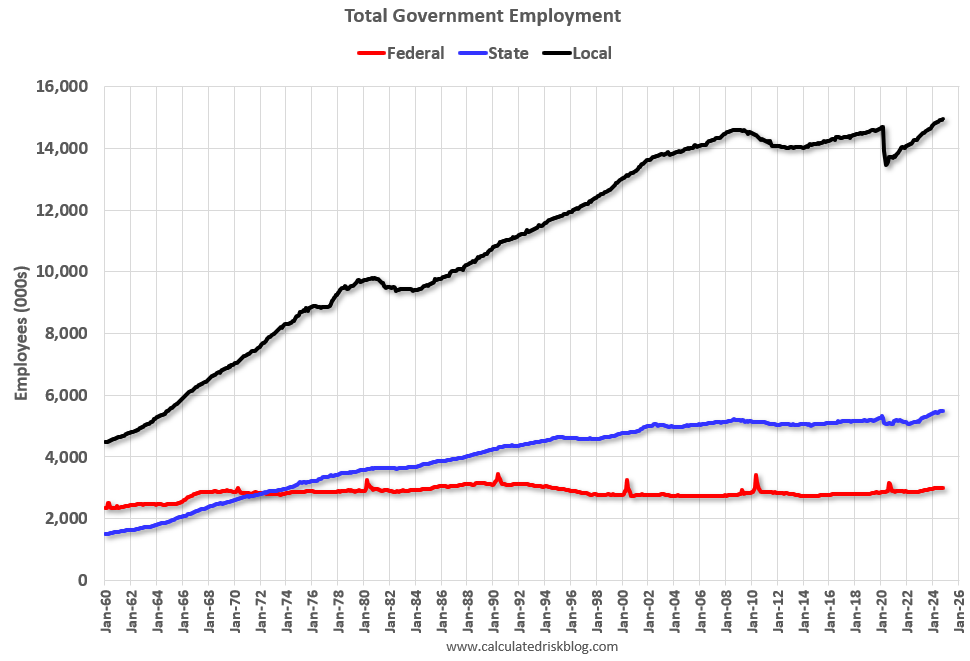

The new administration is talking about cutting the number of federal government employees. Federal employment was around 4.3% of total employment in 1960 and is now down to only 1.9%.

Most government employees are local (police officers, fire department, etc), followed by state employees. Approximately half of the state and local employees work in education (teachers!)

Just some numbers and graphs to keep in mind during the discussion of federal employment cuts.

_________________________________

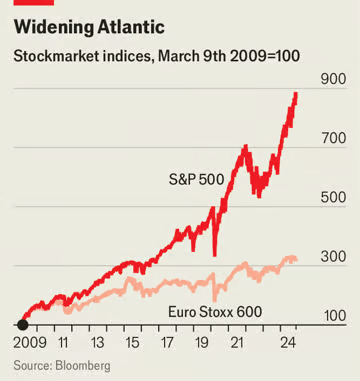

Should investors just give up on stocks outside America? Suppose you had invested in an index of American shares at a trough in 2009 and held on to it until today. Your portfolio would now be getting on for triple the size it would have been if you had instead picked a basket of stocks listed on the old continent (see chart below). Just about whenever American share prices crashed, European ones fell about as far or further; when American prices rocketed, European ones trailed them.

Investors greeted Donald Trump’s re-election by sending American share prices to record highs. European stocks have dropped by 4% since the morning of the result, and by 5% since a peak in September. They are not alone—stocks in much of Asia fell alongside them.

Firms listed in America now constitute nearly two-thirds of the value of MSCI’s broadest index of global stocks. American companies are valued eye-poppingly higher, relative to earnings, than non-American ones. The difference is often justified by their fatter profit margins, better management and stronger growth. Fair enough. However, another way of looking at the valuation gap is that, in order to get from earnings to share prices, the market scales them up by radically different multiples based on whether they are made inside or outside America. This is peculiar, and much harder to justify, suggesting that valuations may have fallen out of whack and may eventually be subject to a correction. With American shares more expensive than at almost any other time in history, that would hardly stretch belief.

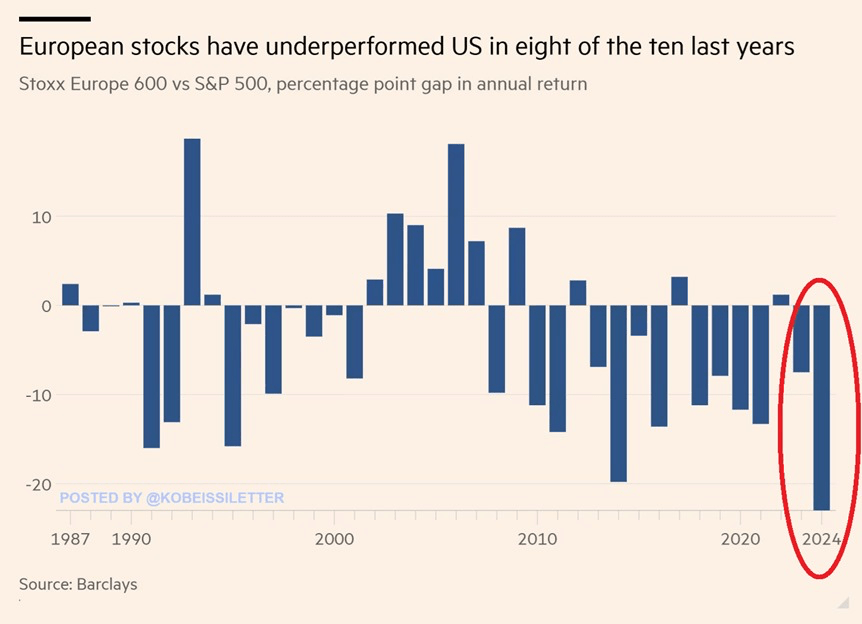

- The Stoxx Europe 600 index has underperformed the S&P 500 by 21% this year, the most on record.

- This comes as European stocks have returned only 3% year-to-date much below the 24% gain of US stocks.

- The Stoxx Europe 600 index is now on track for its 8th year of underperformance out of the last 10.

- Over the last decade, European equities have increased by just 50% much less than the S&P 500 return of 187%. As a consequence, the US stock market is now 4 TIMES larger than Europe.

________________________________________