Six years ago, Kevin Kelly celebrated his 68th birthday by gifting his children 68 bits of advice he wished he had gotten when he was their age. Every birthday after that he added more bits of advice for them until he had a whole book of bits. In a few days he’ll will turn 73, so again on his birthday, he offers an additional set of 101 bits of advice he wished he had known earlier:

- Forget trying to decide what your life’s destiny is. That’s too grand. Instead, just figure out what you should do in the next 2 years.

- Interview your parents while they are still alive. Keep asking questions while you record. You’ll learn amazing things. Or hire someone to make their story into an oral history, or documentary, or book. This will be a tremendous gift to them and to your family.

- Asking “what-if?” about your past is a waste of time; asking “what-if?” about your future is tremendously productive.

- When you are stuck or overwhelmed, focus on the smallest possible thing that moves your project forward.

- Discover people whom you love doing “nothing” with, and do nothing with them on a regular basis. The longer you can maintain those relationships, the longer you will live.

- Write your own obituary, the one you’d like to have, and then everyday work towards making it true.

- The highest form of wealth is deciding you have enough.

- Very small things accumulate until they define your larger life. Carefully choose your everyday things.

- Humility is mostly about being very honest about how much you owe to luck.

________________________________

I’m reminded of the scandal at Ford Motor—when they knew that the fuel tank in the Pinto could erupt into flames after a collision. They could fix it at a cost of ten dollars per car. But they did nothing. Ford calculated that 180 drivers would burn to death, and each would result in a $200,000 payout. It was cheaper just paying that money to victims’ families than recalling all eleven million Pintos and installing a safer fuel tank.

This is the same kind of math they’re doing at the big web platforms right now. The money they make from addiction more than offsets their cost from dead teens and ruined lives. In 1995, teens were alone 3.5 hours per day. But nowadays teens spend up to nine hours daily staring into screens.

We live in a materialistic society, but all the evidence tells us that happiness doesn’t come from what we own. The single best predictor of people’s happiness is the depth and breadth of their social connections.

_______________________________

Spotify is paying hundreds of millions on an annualized basis to audiobook publishers, according to internal figures obtained by Axios. The company has also doubled the number of titles available to premium members in the past few months from 150,000 to 300,000. The figures, confirmed by a Spotify spokesperson, suggest Spotify’s entry into the audiobook market is helping to significantly grow the pie for audiobook publishers at large. Without Spotify, the audiobook industry in the U.S. grew 14% in unit sales between Q4 2022 and Q4 2023, according to Bookstat. With Spotify, it grew 28%.

________________________________

Research suggests that unearned income is at best inferior as a happiness multiplier and at worst a Faustian bargain. People constantly ask me what they should help their adult kids pay for, if they themselves have been lucky enough to do well in life. The dilemma they have is that they’re proud of having earned their way and feel that their self-reliance, not a handout, is the gift they want to pass on; yet they also feel that it’s stingy to hold out on their nearest and dearest, rather than share their good fortune. Here’s a rule of thumb to help resolve that dilemma: If you can afford to help your adult kids, pay for investment, not consumption. In practice, that means: Education? Absolutely. Vacation? No way. Staking a business? Yes, if it seems a viable proposition (as opposed to mere whim or lifestyle choice). Wine cellar? Don’t be ridiculous. A down payment on a house? Judgment call. In this way, you are giving generously—to help them earn their own success.

________________________________

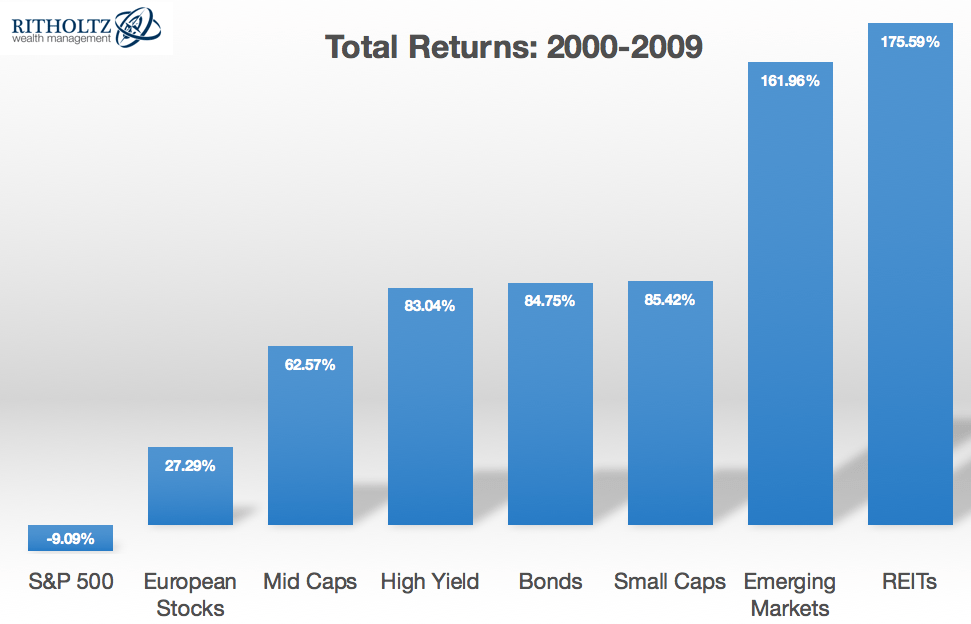

If it feels like the S&P 500 has always outperformed everything else in the world (and always will), you only need to go back to the 2000 – 2009 decade to see that cycles always change:

How expensive stocks are when you buy them (price to earnings ratio) has a direct correlation to the future returns.

_______________________________________