Status leads people to assume something about us that we might otherwise have had to prove. It’s a pattern-matching mechanism that allows us to quickly filter and process information in a world defined by incomplete knowledge. We live in a time-constrained world where don’t have the capacity to evaluate everyone on merit alone, and status is our way of expediting that evaluation process. And let’s not kid ourselves, most of us care a lot about status, to the point that we’ll sacrifice money for it. In a survey of 1,500 office workers, seven out of 10 said they would forego a raise for a higher status job title.

___________________________

Probability has no memory. Just because you’ve had a streak of bad days doesn’t mean you’re due for a good one, something known as The Gambler’s Fallacy. However, in real life, many (if not most) events are not, in fact, independent occurrences. In statistical terms, they are governed by the hazard function: what’s the likelihood that something will happen in a given time interval given that it has not happened already? The hundredth railroad car on a passing train portends the caboose with greater likelihood than the third car.

__________________________

Buy this, not that: Buy term life insurance, not whole life insurance. Buy retirement accounts, not annuities. Buy individual disability insurance, not group disability insurance. Buy experiences, not stuff.

__________________________

There are only 4,300 US stocks, down from 7,300 in 1996. Meanwhile, the number of private companies backed by private equity has ballooned to 11,200 from 1,900 during the past two decades. It’s also no longer necessary for many companies. Private equity is awash with cash, making it easier for businesses to raise capital from private sources. So, why go public? It’s time to consider the real possibility that the stock market has become a dumping ground for businesses too weak to attract capital in private markets.

__________________________

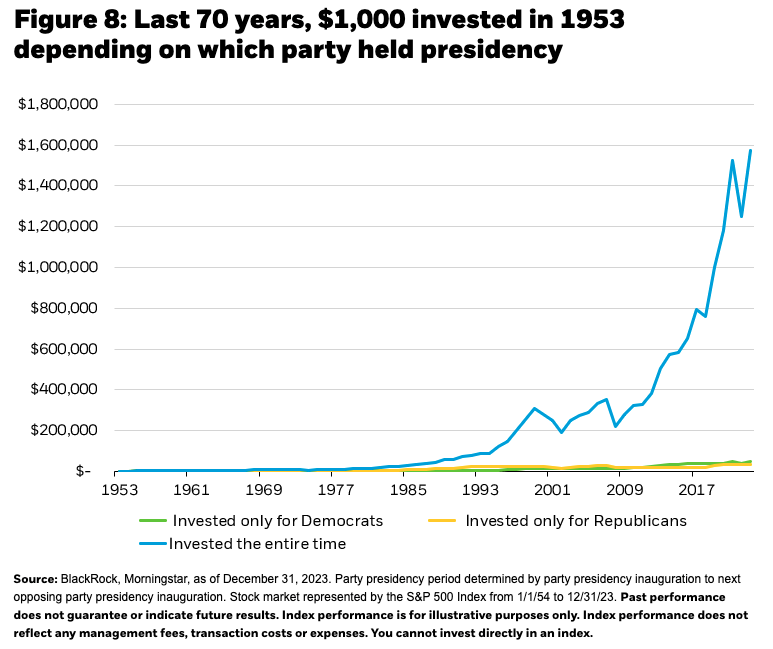

The market doesn’t care who is President: