The nocebo effect is the opposite of the placebo effect; where people are suffering more than they otherwise would because of their negative expectations. With the placebo effect, someone might gradually feel better after swallowing a pill, getting a therapeutic injection or receiving another medical treatment, even if what they were given is an inert treatment. With the nocebo effect, negative beliefs or expectations about a treatment or experience may elicit symptoms of feeling sick, even when the intervention is a sham.

___________________________

The table below shows the largest multi-decade stock market drawdowns for countries outside the United States. Imagine investing money in Italy and having to wait 50 years to get back to even.

While the U.S. has never experienced a 20-year period of negative real returns, it has gotten close a few times. From February 1966 through December 1982, U.S. stocks lost 0.16% on an annualized basis, when including dividends and adjusting for inflation. That’s a 16-year period of negative real returns. Additionally, from September 1929 through December 1944, U.S. stocks experienced a 15-year period of negative real returns. This coincided with the beginning of the Great Depression through WWII.

_____________________

This article goes through just about any statistic you can think regarding divorce. What about the famous statistic that half of all marriages end in divorce? That’s a bit of an exaggeration when it comes to first marriages, only 43% of which are dissolved. Second and third marriages actually fail at a far higher rate, though, with 60% of second marriages and 73% of third marriages ending in divorce.

_____________________

People around the world are spending billions of dollars talking to who they think are OnlyFans models online. Many times, they are actually talking to a fake “chatter” which can even be another guy (if they think they’re talking to a girl). The word is out and now lawsuits are starting.

_____________________

This paper discusses how less people are moving south due the rising heat: Snow Belt to Sun Belt Migration: End Of An Era? Internal migration has been cited as a key channel by which societies will adapt to climate change. We show in this paper that this process has already been happening in the United States. Over the course of the past 50 years, the tendency of Americans to move from the coldest places (“Snow Belt”), which have become warmer, to the hottest places (“Sun Belt”), which have become hotter, has steadily declined. Given climate change projections for coming decades of increasing extreme heat in the hottest U.S. counties and decreasing extreme cold in the coldest counties, our findings suggest the “pivoting” in the U.S. climate-migration correlation over the past 50 years is likely to continue, leading to a reversal of the 20th century Snow Belt to Sun Belt migration pattern.

_____________________________

More and more home buyers are discovering cheap financing through a once-obscure workaround — assumable mortgages. The first question to ask is whether the seller has an FHA or VA loan. These actually make up a significant share of the market: About 13 percent of all mortgages are FHA loans, while about 11 percent are VA loans. The property must be the seller’s primary residence and the buyer must meet the qualifications set by the FHA and the lender. For VA loans, a regional VA loan office has to approve the transaction, but the borrower doesn’t have to be a veteran, she added. In addition, the seller has to sign off on the buyer assuming the loan and provide authorization to the lender. Once the loan is approved and the sale goes through closing, the loan servicer replaces the original borrower with the new owner on the loan documents.

_____________________

Research by David Autor from MIT shows that 60% of today’s workers are employed in occupations that didn’t exist in 1940, see chart below. This is important when discussing what impact AI may have on the labor market.

____________________________

Japan’s three-day stock market crash this week was their greatest in history. It topped the Fukushima disaster in 2011, the 1987 global crash (when U.S. stocks fell 22% in a single day), the Covid declines, and the massive 2008 drawdowns:

____________________________

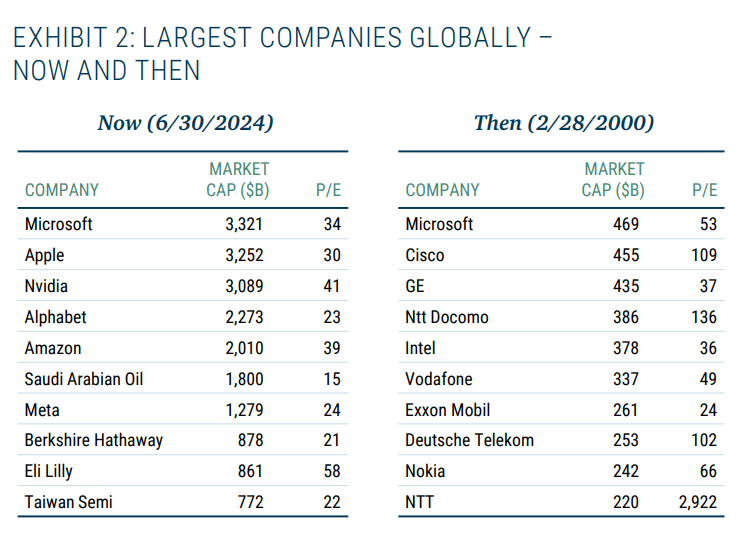

While the price-to-earnings ratios are currently very high for the largest companies in the world, they were at another level of insanity at the peak of the dot com bubble in February 2000: