Researchers Find That Exercising Is Twice As Effective As Anti-Depressants

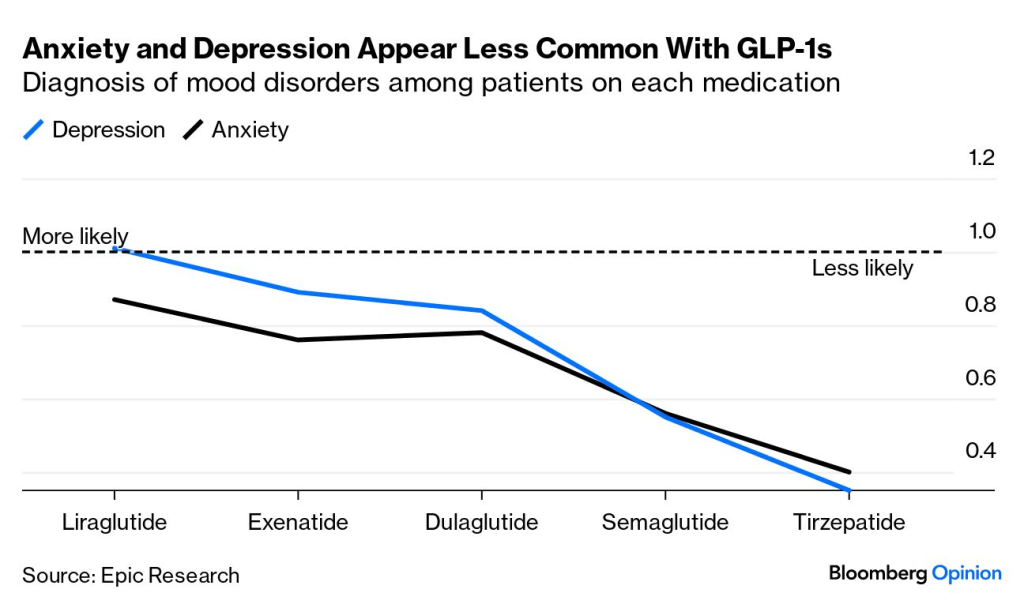

Ozempic and other GLP-1 medications are having a positive effect on depression.

Interview with Jim Bianco who has been in the (recently lonely) camp that the last mile to get inflation down to 2% will be very difficult, and interest rates will be higher and for longer than we expect. This podcast/interview came right before this week’s higher than expected CPI inflation print.

David Einhorn discusses why the financial markets are fundamentally broken and the traditional way to invest in value companies is dead. This is one of the best podcasts I’ve heard in a long time. He walks through how he changed his investing tactics after years of underperformance trying to continue to do the correct thing in a broken market.

The Dark Side of the Internet’s Obsession with Anxiety (Podcast) – Derek Thompson asks if we have “overcorrected” from an era when mental health was shameful to talk about, to an era where people talk about anxiety so much online that it’s now possibly worsening mental health?

Mark Manson brought up the same topic this week on his podcast talking with Lori Gottlieb; the prevalence inflation hypothesis: when awareness can paradoxically contribute the increase mental health problems.

Anger Leaves A Lasting Mark – After unleashing a critical barrage on your child, you seek to justify it, mitigate it, by saying how overworked and stressed out you’ve been. But your child doesn’t register this context at the time, and ten, twenty, thirty years later, it will still very much be forgotten, while the sting of your words indelibly remains.

Americans continue to focus on how large the top 10 companies in the S&P 500 have grown as a percentage of the total market:

However, the concentration is even greater in other stock markets around the world:

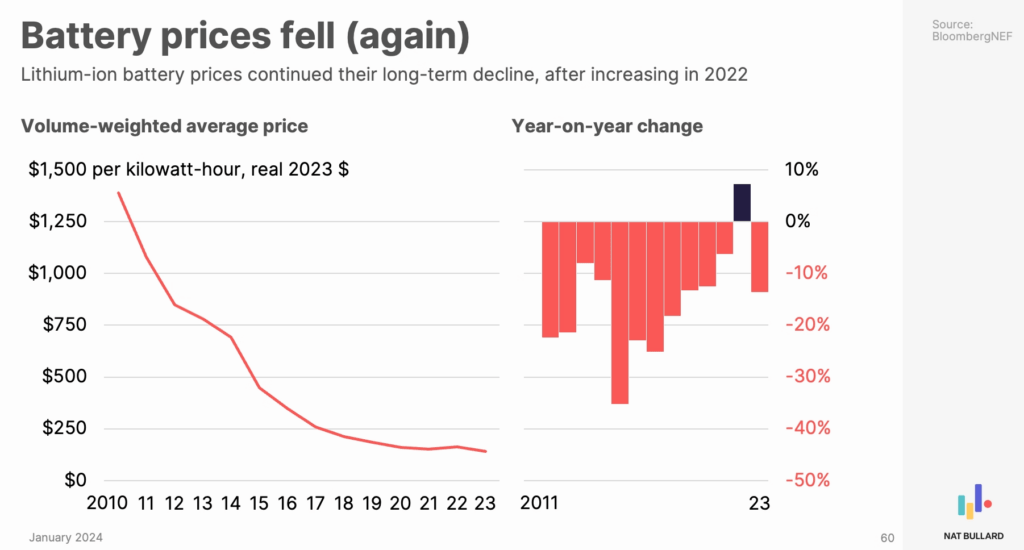

Lithium battery prices continue to get cheaper:

A scathing review of Tony Robbins new book on investing in private investments. The article was written by someone who makes a living keeping his clients in public investments. Not saying there’s anything wrong with that, but if you ask a realtor what someone should invest in, I think you can guess what their answer will be.