A look at the Hedonic Treadmill and why our obsession with improvement is making us miserable. The instinct to improve our circumstances is a functional one in a society where resources are scarce. The problem arises when those who objectively already have enough — and ample time and money — are constantly marketed endless goods and opportunities.

_________________________

It is extremely difficult to stay in line with positive behavioral finance strategies because we’re wired to do the opposite. If it was easy it wouldn’t work because everyone would be doing it.

_________________________

The importance of being present and strategies on how to do it better including Forecasting Nostalgia: when this chapter is over, what will we have missed?

_________________________

Of the five major sports, the one with the greatest amount of luck involved in wins and losses is hockey. Luck plays a more important role when there are less chances to score.

_________________________

Car insurance premiums have been skyrocketing due to car and auto parts prices rising, drivers getting worse, and more vehicles being damaged by storms. Even with the increase in premiums, the payouts have been higher for private insurers the last few years.

__________________________

Great interview with Scott Galloway where he lightly discusses some of the topics of his new book, The Algebra Of Wealth, before going into a deeper, introspective conversation about his personal life in his 20s, 30s and 40s. He talks about the mistakes he made and the things that were worth it.

__________________________

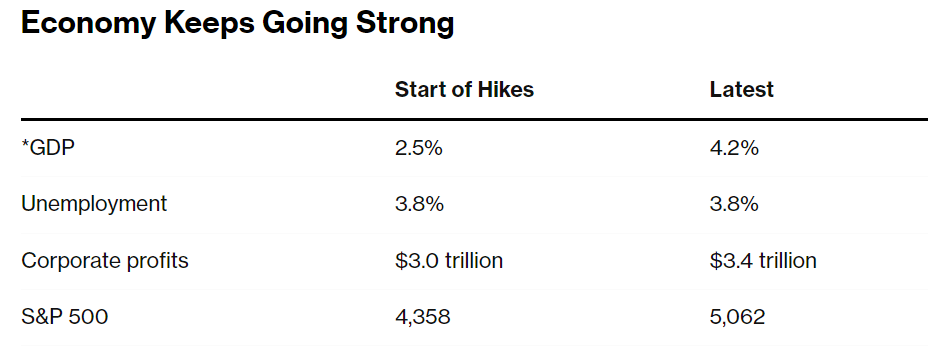

It’s well understood how Fed rate hikes slow areas of the economy (real estate transactions, consumer loans and small business loans), but they also stimulate the economy in other ways. Bloomberg discussed it this week noting: the jump in benchmark rates from 0% to over 5% is providing Americans with a significant stream of income from their bond investments and savings accounts for the first time in two decades.

The government’s debt has ballooned to $35 trillion, double what it was just a decade ago. That means those higher interest rates it’s now paying on the debt translate into an additional $50 billion or so flowing into the pockets of American (and foreign) bond investors each month.

US households receive income on more than $13 trillion of short-term interest-bearing assets, almost triple the $5 trillion in consumer debt, excluding mortgages, that they have to pay interest on. At today’s rates, that translates to a net gain for households of some $400 billion a year.

__________________________________________

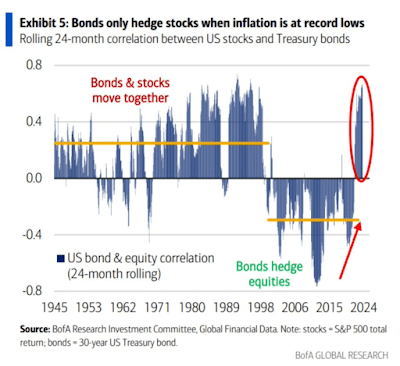

Bonds and stocks started moving together recently (stocks falling in price while bond interest rates rise meaning their underlying value falls). This is a new phenomenon for most investors (including me: I’m only 41). However, the graphic below shows that from 1940 to 2000 stocks and bonds moved together the majority of the time:

____________________________________________